Tyro has long been known to merchants when it comes to EFTPOS solutions in Australia, but a newer entry on the market, Zeller, offers a strong alternative to small businesses.

The all-in-one Zeller package with a terminal, Mastercard and business account makes it easy to get started with payments quickly. More established merchants may prefer Tyro’s point of sale integrations and bank account (as opposed to online account).

Comparing the two, which is the better EFTPOS solution in Australia? What are their shortcomings and strengths?

|

|

|

|---|---|---|

| Credit card machines | EFTPOS machines: $29*/mo to rent or $59* to buy |

Zeller Terminal: $259* to buy |

| POS apps | Integrates with POS systems | Integrates with POS systems |

| Remote payments | Invoicing, ecommerce integrations, keyed payments | Invoicing, payment links, keyed payments |

| Account and card | Free bank account, no business card | Free online account and business card |

| Deposits | Same day in Tyro account, 1-2 business days in other bank account | Next day in Zeller account, next business day in bank account |

| Accepted cards | Optional/extra cost: |

Buy now, pay later: Afterpay, Zip |

*Including GST.

|

|

|---|---|

| EFTPOS machines: $29*/mo to rent or $59* to buy |

Zeller Terminal: $259* to buy |

| POS apps | |

| Integrates with POS systems | Integrates with POS systems |

| Remote payments | |

| Invoicing, ecommerce integrations, keyed payments | Invoicing, payment links, keyed payments |

| Account and card | |

| Free bank account, no business card | Free online account and business card |

| Deposits | |

| Same day in Tyro account, 1-2 business days in other bank account | Next day in Zeller account, next business day in bank account |

| Accepted cards | |

Optional/extra cost: |

Buy now, pay later: Afterpay, Zip |

*Including GST.

Card machines

Zeller and Tyro offer quite different card machine packages.

Until recently, Tyro used to have two old-school EFTPOS machines with occasional technical problems: a countertop model and a mobile terminal for portable use. These two have been replaced with one wireless touchscreen terminal that does it all: the Tyro Pro. It can be integrated with a wide range (330+) of POS and industry software for a fixed countertop or portable use, or used on the go with its mobile SIM card.

Tyro Pro is a high-end Ingenico DX8000 terminal model, which we were impressed with when testing it. The screen is crisp-clear with various accessibility settings, it has a built-in receipt printer, and the speed of transactions is fast.

Photo: Emily Sorensen, MobileTransaction

Tyro Pro is a powerful EFTPOS machine manufactured by Ingenico.

Alternatively, you can buy the small card reader Tyro Go that works with the Tyro Go app downloaded on your smartphone. This looks very much like Square Reader and is purchased upfront with no monthly fees to follow.

Photo: Tyro

Tyro Go card reader accepts cards when connected with an app.

The previous Tyro EFTPOS machines were subject to a serious outage in January 2021, rendering many small businesses in Australia unable to take cards for that time. We think it was due to the outdated hardware, since they were old Worldline models that looked quite dated. Thankfully, they are replaced with the new models above.

Zeller only has one card machine: the Zeller Terminal with a touchscreen interface. It can be used as a portable terminal or placed in a charging cradle on a countertop. As with Tyro Pro, it accepts chip, tap and swipe cards as well as mobile wallets.

Photo: Zeller

Zeller Terminal in black and white.

The Zeller terminal has a receipt printer built in and a battery that lasts up to 24 hours (250-300 transactions) from a full charge. It automatically works with WiFi and also GPRS, 3G or 4G if you get a SIM card (extra cost).

The software on Zeller Terminal allows you to enter a payment total and add a surcharge and tip if required. Apart from printing receipts, you can send receipts via SMS or email following each transaction. A selection of POS systems can be integrated for more in-depth features at the checkout.

Another option: accept contactless payments on your phone

Australia now has several tap-to-phone options, i.e. the ability to accept contactless cards and mobile wallets on the merchant’s NFC-enabled smartphone without a dedicated card reader.

In line with this, Tyro and Zeller have both introduced Tap to Pay on iPhone. None of them charge a monthly fee for this feature. All you do is download the relevant app (you must be a signed-up user), enter a transaction amount in the app and ask the customer to hover their card or mobile wallet over your phone.

Pricing: same fixed EFTPOS rate

Neither Tyro nor Zeller have fees for account creation, and there are no lock-in contracts. The similarities more or less end there.

Zeller focuses on simple, transparent fees that apply to everyone: 1.4% per chip, and swipe transaction. The Zeller Terminal costs $259 upfront including GST and a 12-month guarantee, and then you own it.

With Zeller, you do have to pay for a SIM card if you want mobile connectivity. Zeller’s own SIM card costs $15 incl. GST monthly for unlimited data, but you can use another SIM card from a different provider.

Tyro offers a rental contract for its Pro terminal, so you cannot buy it upfront and avoid monthly charges. It costs $29 including GST per month. If you want to add health fund claiming, an additional $10 + GST per terminal applies.

The Tyro Go card reader costs $59 to purchase, after which there are no monthly fees. That’s because it’s a cheaper piece of hardware that depends on Tyro App to function altogether.

|

|

|

|---|---|---|

| Contract lock-in | None | None |

| Setup fee | None | None |

| Purchase price | Tyro Go card reader: $59 | Terminal: $259 Charging dock: $39 |

| Monthly fees | Tyro Pro EFTPOS rental: $29/mo No fee/mo for Tyro Go |

No monthly fee, unless you use Zeller SIM card ($15/mo) |

| Swipe, chip, tap rate | 1.4% | 1.4% |

| Keyed, online rate | +0.15% | Keyed on Zeller Terminal: 1.7% Virtual Terminal/Pay by Link: 1.75% + $0.25 Invoice: 1.7% + $0.25 (AU cards), 2.9% + $0.25 (non-AU cards) |

| Foreign card fee | +0.4% | None |

| Currency conversion | +0.4% | None |

| Settlement | Free | Free |

| Refunds | Free | Free |

| Chargebacks | Free | Free |

*Above costs all include GST.

|

|

|

|---|---|---|

| Contract lock-in | None | None |

| Setup fee | None | None |

| Purchase price | Tyro Go card reader: $59 | Terminal: $259 Charging dock: $39 |

| Monthly fees | Tyro Pro EFTPOS rental: $29/mo No fee/mo for Tyro Go |

No monthly fee, unless you use Zeller SIM card ($15/mo) |

| Swipe, chip, tap rate | 1.4% | 1.4% |

| Keyed, online rate | +0.15% | Keyed on Zeller Terminal: 1.7% Virtual Terminal/Pay by Link: 1.75% + $0.25 Invoice: 1.7% + $0.25 (AU cards), 2.9% + $0.25 (non-AU cards) |

| Foreign card fee | +0.4% | None |

| Currency conversion | +0.4% | None |

| Settlement | Free | Free |

| Refunds | Free | Free |

| Chargebacks | Free | Free |

*Above costs all include GST.

Transaction fees have recently become more simplified with Tyro: card payments now cost a fixed rate of 1.4% regardless of the EFTPOS machine – the same rate as Zeller. It’s only if your card sales exceed $20,000 per month that you can negotiate lower, variable rates.

Certain transactions have an additional fee with Tyro, though: keyed and online transactions incur $0.15 extra, and foreign cards add 0.4% plus an additional 0.4% if a currency conversion took place. Zeller adds a fixed fee of $0.25 to Virtual Terminal, payment link and invoice transactions and charges a high rate for international cards via invoicing.

Can you avoid transaction fees? Yes

The practice of surcharging, i.e. passing on transaction fees to customers to avoid the cost in the business, is possible with both Tyro and Zeller. Whether you should opt for it is another matter, as some customers avoid businesses applying a “penalty” fee for using a card.

You can automatically accept Visa, Mastercard, UnionPay and eftpos cards with Tyro. American Express, JCB and Diners Club require separate agreements with those card schemes directly, incurring extra costs. Zeller does not require any additional costs to accept Amex and JCB in addition to eftpos, Visa, Mastercard and UnionPay.

Neither Zeller nor Tyro requires a minimum monthly turnover, so you are free to use the card machines as little or much as needed without paying extra. Payouts, chargebacks and refunds are free to process in both cases as well.

Photo: Tyro

Tyro’s bank account and app are free to use.

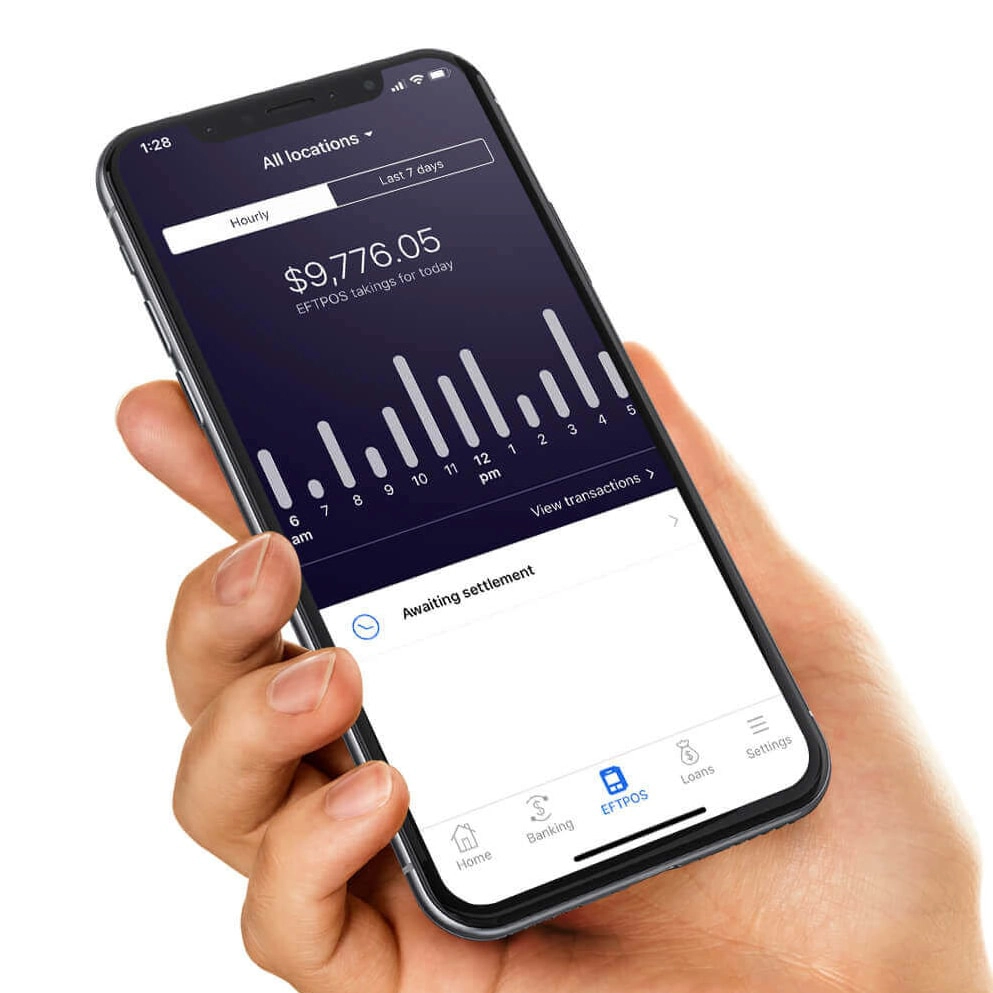

Photo: Zeller

Zeller includes an e-account and Mastercard.

Payouts, account and debit card

Both Tyro and Zeller can settle transactions in a free business account, bypassing the need to connect with an existing bank account.

In Tyro’s case, you can apply for a full-fledged bank account managed in the Tyro App. This does not come with a physical bank card, so you can’t use it for buying things in person, but it is suitable for bank transfers, BPAY and direct debits.

EFTPOS transactions settle the same evening in the Tyro account any day of the week, or within 1-2 business days in any Australian bank account linked to your business.

Zeller Terminal comes with a Mastercard in the box, linked to your own Transaction Account accessed in a web browser. This can be used for in-person and online payments, money transfers and paying invoices. Transactions clear in this online account at midnight the same evening, or you can opt for settlement in an Australian bank account the following business day.

Both Zeller and Tyro (its bank account, at least) can integrate with Xero accounting software. Eligible Tyro merchants may also apply for a business loan – this is not available with Zeller, but there is a Zeller savings account.

POS integrations: pretty good ranges

Zeller Terminal integrates with several external point of sale (POS) systems, such as Impos, Erply, Lightspeed, H&L and OrderMate.

The on-screen Zeller Terminal software allows you to accept cards and process refunds, and that’s it. The web dashboard does allow you to manage your terminal fleet, so you can have a group of EFTPOS machines at different locations.

Photo: Tyro

Tyro connects with many different POS systems.

Tyro is built to fit in with nearly any point of sale. Their EFTPOS terminals integrate with over 330 different POS or practice management system (PMS) platforms. This includes Bepoz, Timely, Pracsoft, Lightspeed and many others geared towards a wide range of industries.

There is no charge extra for integrating Tyro with a POS system, but costs do apply to your chosen software solution.

Online selling: not so extensive

The remote selling options available for Zeller merchants are email invoices, payment links and keyed payments.

The keyed payments intended for mail order and telephone (MOTO) payments. This is where you manually enter an amount and card details on the card terminal or browser-based Virtual Terminal to accept a transaction where the customer is not present. Payment links (‘Pay by Link’) are sent from the Virtual Terminal.

As of yet, Zeller cannot integrate with ecommerce, but plans to add it soon.

| Remote payment method |  |

|

|---|---|---|

| Telephone/keyed payments | ||

| Email invoices | ||

| Payment links | ||

| Recurring payments | ||

| Online store integration |

| Remote payment |

||

|---|---|---|

| Telephone/keyed payments | ||

| Email invoices | ||

| Payment links | ||

| Recurring payments | ||

| Online store integration |

Tyro has slightly different options for remote payments. You can accept MOTO payments on their EFTPOS terminals or in a web browser, set up recurring payments and send email invoices from an online web portal.

Although Tyro hints at an ecommerce setup, the company is not transparent on which ecommerce platforms it can connect with for online store features. To find out, you need to speak to Tyro for a tailored solution.

Customer service and reviews

Whereas Tyro offers round-the-clock support over telephone and email, Zeller limits the phone and email support hours to 9am-1am AET every day of the week (i.e. there’s no support between 1am-9am). For a service without monthly fees, though, Zeller really goes the extra mile compared with Square that only has weekday support.

Tyro’s onboarding can take two weeks from the initial quote to having the EFTPOS machine set up and ready to use – if all the required paperwork is submitted and you are accepted smoothly.

Photo: Zeller

The pocketable Zeller Terminal is handy for table-service.

In contrast, Zeller’s online sign-up form only takes 5 minutes to complete, and then you’re accepted straight away in most cases, or within a day for more complex businesses. Shipping of the terminal takes anything from 1-11 business days depending on the delivery option chosen. You can also buy the terminal at Officeworks, in which case you can accept payments right after your account is accepted.

We’ve seen many bad reviews of Tyro in 2021 due to their terminal outage early in the year and lacking customer service when help is needed. It seems to be a good service when it works – but when it doesn’t, the consensus on how Tyro handles it is bad.

The Zeller reviews so far are mostly positive about its ease of use and reasonable fees with some reports about customer service issues.

Our verdict: pros and cons with each

The least complicated EFTPOS solution is Zeller hands down. The initial cost of the terminal may seem like much, but then you have a complete, affordable pay-as-you-go payment solution that includes an online account and Mastercard.

Once you need more than just a card terminal, though, Zeller falls a bit short. No ecommerce integrations are available yet, but we’re told Zeller will expand with more features soon. The EFTPOS machines of Tyro connect with more POS systems than Zeller and are quite good quality compared with their older models.

Tyro includes somewhat more remote payment options and a full-fledged bank account, but fails to be transparent about online store capabilities and hidden fees. The monthly cost of Pro may also be a deal-breaker for a small business, but the Tyro Go reader presents a cheaper alternative that Zeller doesn’t have.

As a service, Tyro has a lot to prove after its recent terminal outage, but the company has caught up somewhat with new EFTPOS terminals and tap-on-phone option. That said, the faster sign-up and better all-in-one package from Zeller will appeal to many small businesses.