- Highs: Accepts more card brands than most competitors. Windows Phone support.

- Lows: Contactless option costs extra. Year’s contract with monthly fees required. Hefty cancellation fee, even after initial contract period is up.

- Choose if: You like to deal with a service provider who designs and manufactures its hardware locally.

This review

What is it?

How it works

Fees & costs

Advantages

Disadvantages

Verdict

What is Quest Pocket Pay?

Quest Pocket Pay is an mPOS (mobile point of sale) service that enables small businesses to accept credit and debit card payments from anywhere.

The service was launched in April 2014 and provided by Quest, an Australian technology company that designs and manufactures card terminal hardware locally.

The app can be downloaded on iPhone, iPad, Android smartphones or tablets, and even Windows mobile devices (which is rare to see in a mobile card reader).

Quest Pocket Pay accepts chip & PIN and swipe cards. Contactless payments can only be accepted for an extra monthly fee(!), which we haven’t seen anywhere else, as it is now the norm for new card readers to accept this.

The range of accepted cards is good – it includes Visa, Mastercard, Diners Club, American Express, JCB, stored value gift cards and eftpos (Cheque and Savings) debit and credit cards.

The card reader is extremely compact and weighs just 0.1 kg, making it easy to carry around with you while you go about your daily business.

How much does it cost?

Pocket Pay charges a monthly rental fee of $23 + GST per terminal over a contract term of 12 months. If you want to accept contactless cards as well, that costs an additional $5 + GST monthly. A charging dock for the card reader can be purchased for $35 + GST.

The transaction costs for card payments are 2% (including GST) for Visa and Mastercard and 31¢ (incl. GST) for eftpos debit cards. Expect to pay a higher rate for foreign card brands such as JCB – how much is not displayed publicly.

As for the setup fee, it is normally $65 + GST but appears to be waived by virtue of an ongoing special offer. This may depend on timing, so it is best to contact Quest directly to confirm availability.

Overall, though, these fees make Pocket Pay one of the more expensive Australian mPOS solutions that we have reviewed.

Pocket Pay contactless reader.

The card reader itself is light and compact, which is convenient on the go.

Another advantage of Pocket Pay is its Windows Phone support. Most services only seem to offer iOS and Android apps, so this is a distinct positive of Pocket Pay.

Since Quest is an OEM (original equipment manufacturer), it is fairly safe to say that you should be well covered when experiencing any technical or hardware issues, as you are dealing directly with the manufacturer rather than a third party. This peace of mind could go some way towards justifying the higher costs involved.

Cons

A major downside of this service lies in its expensive fees. With the monthly fee and added cost of a contactless function, Pocket Pay isn’t cheap.

What’s more, there is a rather hefty charge for leaving the service. The fee for cancellation before the end of the contract term is a whopping $160 + GST. If your EFTPOS reader gets damaged, you also pay $140 + GST for repairs, or $479 + GST for a full replacement (or $578 + GST for the contactless reader).

This is quite ridiculous compared to Square’s and PayPal Here’s card readers that cost way less without monthly fees or contract – and then you own the terminal.

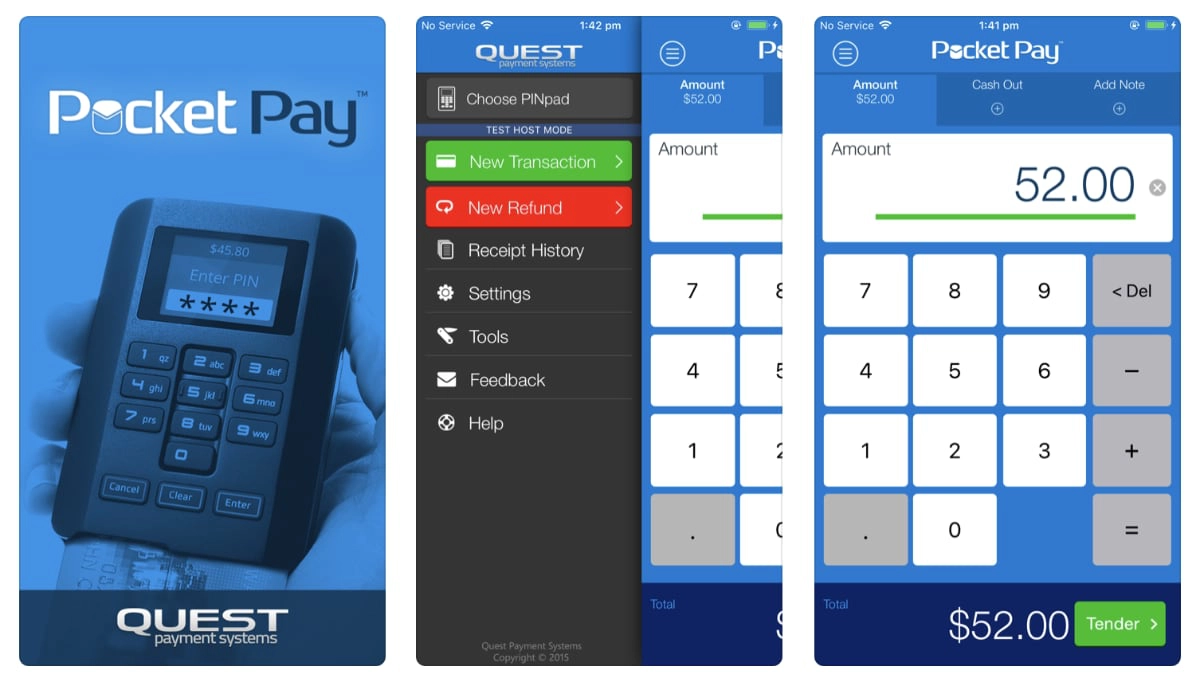

Credit: App Store

The Pocket Pay app only has basic payment features.

But that’s not all! There is also a “Closure Fee” for any cancellations after the initial 1-year term. While this is only $95 + GST, it seems quite an unreasonable charge considering Quest is already charging you a monthly amount and high transaction fees.

Overall, we can safely say the costs are the biggest downfall of this service.

Our verdict: expensive for what you get

If you already use Quest terminals, then this may be a natural choice for your business. Moreover, if you like the idea of supporting Australian manufacturing and enjoying the benefits of dealing directly with the OEM for technical support issues, then Quest Pocket Pay might be for you.

However, for many Australian merchants, there are better services out there. We recommend looking at other options such as Square, PayPal Here and Mint Payments.