- Highs: Free for one user. Integrated payments. Online booking page included. Choice of payment methods.

- Lows: Scheduling software and online booking page could have more features. Only works with Square Payments.

- Best for: Individual professionals and teams of professionals in need of an easy booking system with convenient payment tools.

What is Square Appointments?

Square Appointments is a complete client scheduling system with an app for the point of sale (POS), online booking website and payment system included.

It is easy and free to sign up for Square and download the Square Appointments app on iPhone, iPad or Android tablet or smartphone. Clients can pay for their bookings online or in person through a Square card machine, with payouts settled in your bank account within 1-2 working days.

The Appointments software has a lot of useful features like no-show protection, team management, an online booking process, customer library and in-store payment options directly from the booking calendar in the app.

As with all Square features, the Appointments system is linked to a wide range of free tools such as a virtual terminal for telephone payments, sales analytics, payment links and contract templates. You can also integrate the software with many external software tools for marketing, ecommerce and much more.

Pricing

Individual users can use Square Appointments indefinitely for free. There is only a tiered monthly fee when you add more users. This allows colleagues to have their own calendars in the system.

The monthly cost is £29 + VAT for 2-5 users or £69 + VAT for 6-10 users. Larger teams can get custom pricing by contacting Square directly.

No contractual commitment is required for any of the plans or features. A free 30-day trial is available for the subscriptions, if you want to try the staff settings.

| Square Appointments cost | |

|---|---|

| Software subscription | 1 staff: £0/mo 2-5 staff: £29 + VAT/mo 6-10 staff: £69 + VAT/mo 11+ staff: Custom quote |

| Chip, contactless transaction fee | 1 staff: 1.75% 2-10 staff: 1.6% 11+ staff: Custom rate |

| Online booking transaction fee | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

| Virtual terminal, invoice, keyed rate, card on file | 2.5% |

| Payouts | Standard (1-2 days): Free Instant: 1% added to transaction fee |

| Refunds | Free |

| Chargebacks | Free |

| Square Appointments cost |

|

|---|---|

| Software subscription | 1 staff: £0/mo 2-5 staff: £29 + VAT/mo 6-10 staff: £69 + VAT/mo 11+ staff: Custom quote |

| Chip, contactless transaction fee | 1 staff: 1.75% 2-10 staff: 1.6% 11+ staff: Custom rate |

| Online booking transaction fee | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

| Virtual terminal, invoice, keyed rate, card on file | 2.5% |

| Payouts | Standard (1-2 days): Free Instant: 1% added to transaction fee |

| Refunds | Free |

| Chargebacks | Free |

Other than that, there is only a transaction fee per successful payment accepted through Square.

This transaction fee is 1.75% for chip or contactless payments on a one-user (free) plan. The rate goes down to 1.6% per card reader payment as soon as you pay a subscription for at least 2 users, and lower rates are negotiable on plans for over 10 users.

Online transactions through your booking site incur a 1.4% + 25p charge for European cards or 2.5% + 25p for non-European cards. If you take telephone bookings through the virtual terminal, invoice payments, keyed transactions through the app or a cancellation charge with a card on file, the fee is 2.5%.

Standard payouts reaching your bank account within 1-2 working days are free, whereas Instant Transfers (payouts within 2 hours) have a 1% charge added on top of the transaction fee.

Chargebacks are free and so are refunds.

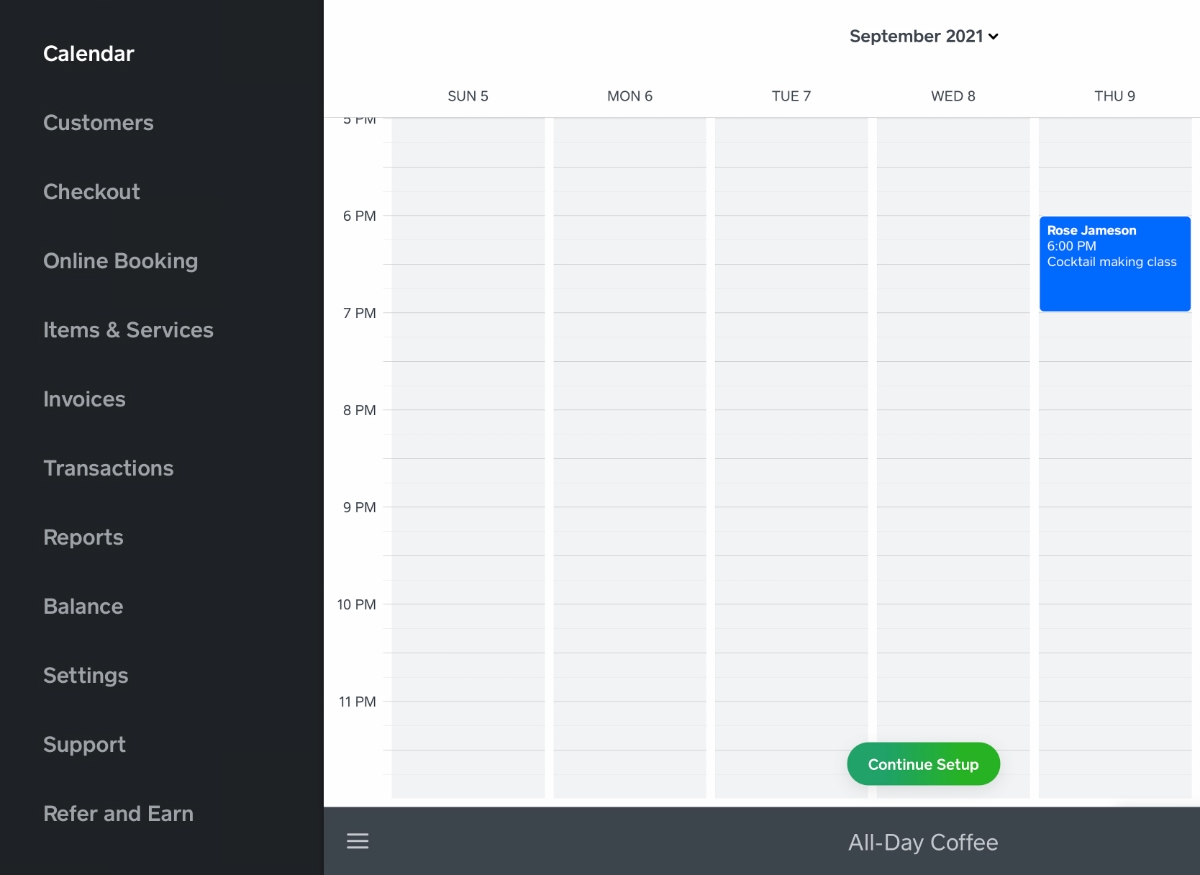

Image: Mobile Transaction

An open side menu in the Square Appointments app.

To create a booking in the Appointments app, you must:

- Pick a time slot in the calendar

- Add the customer who is booking

- Add the service that is being booked

You can select whether it is a whole-day booking or timed slot, and optionally add physical products (e.g. if you’re selling a shampoo for your hairdresser client), set a discount or write a custom note applicable to the booking.

After confirming this information, you can select if the client should receive a booking notification by text, email or both – and then the booking is added to the calendar.

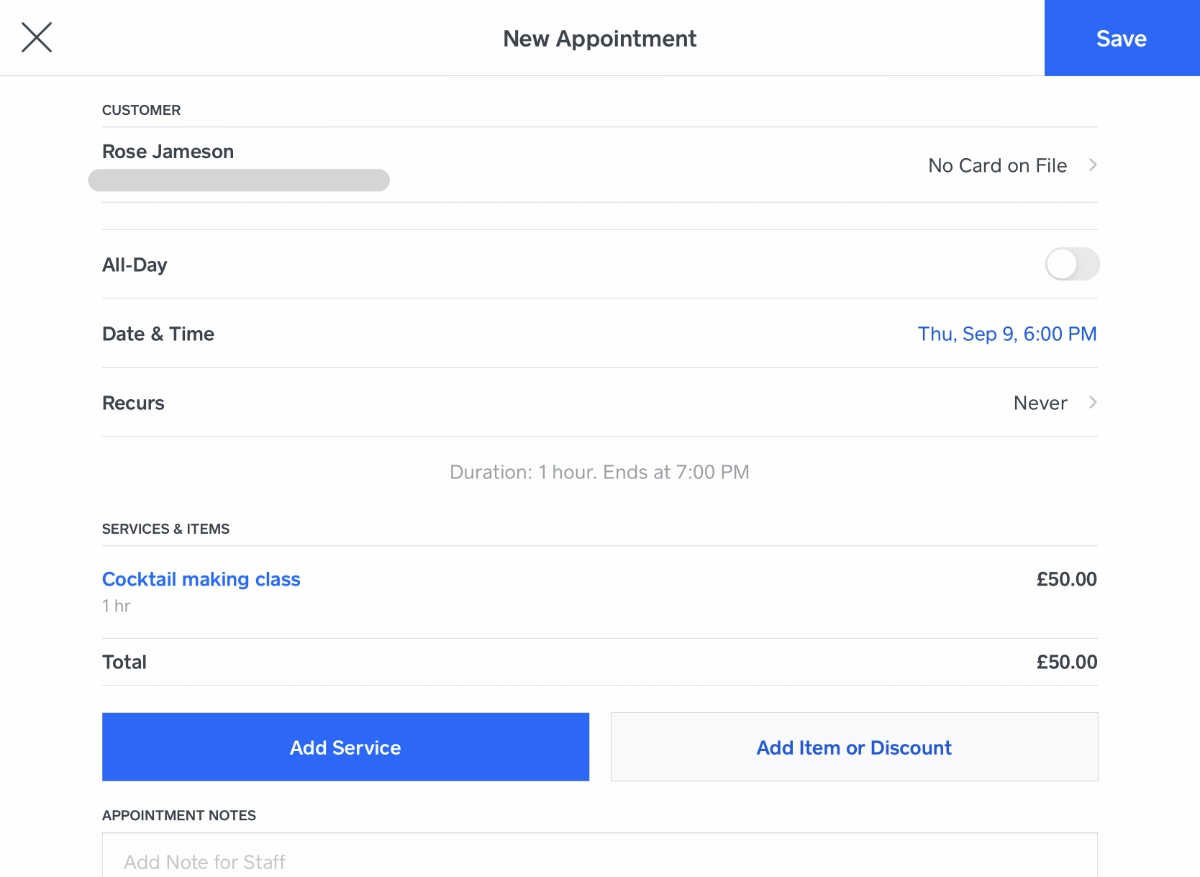

Image: Mobile Transaction

Booking form in the Square Appointments app.

You could then tap the confirmed booking in the calendar to edit it or process the payment from the till.

The customer can reschedule the booking through a link in the confirmation message or add the appointment to their Google, Apple, Outlook or Yahoo calendar. There is also a Twitter share button if they’re really excited about your service.

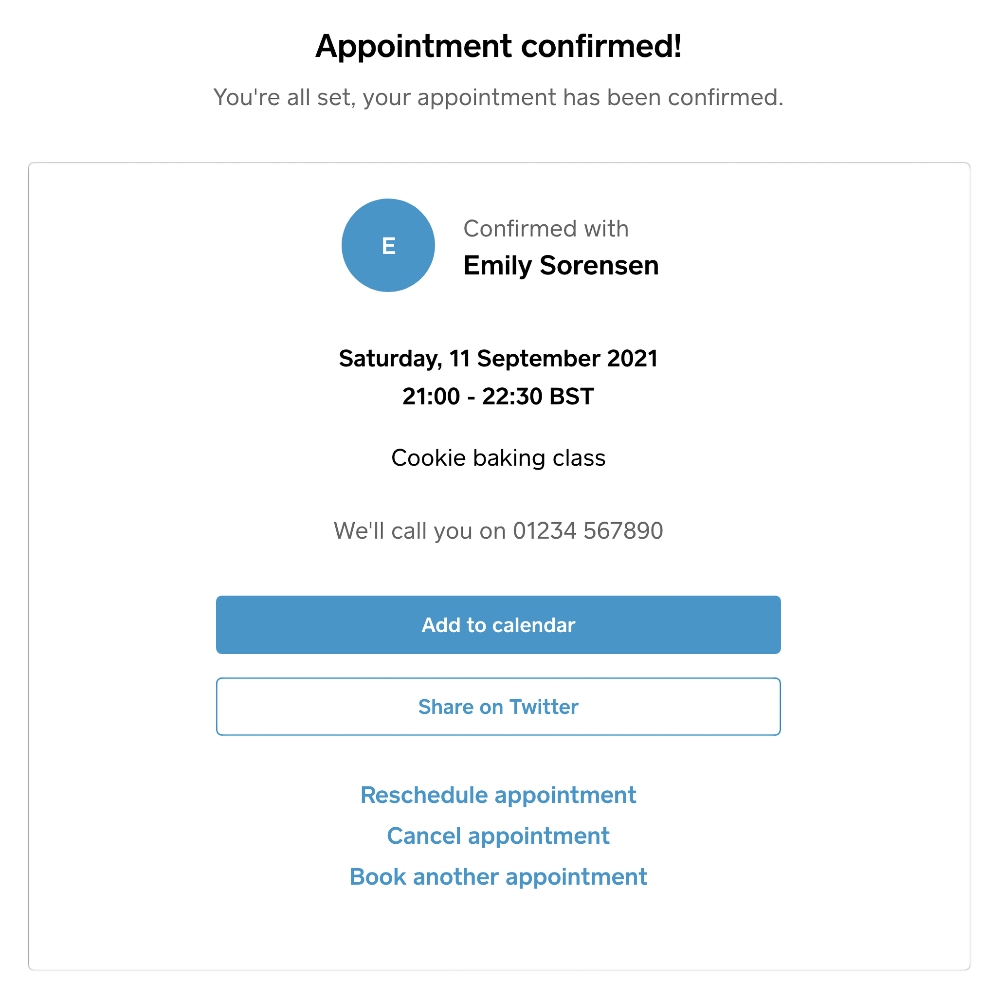

Image: Mobile Transaction

Customer’s booking confirmation.

Most importantly, the customer can choose to reschedule, cancel or book another appointment from their booking page – subject to your terms and cancellation policy, of course.

Speaking of terms, Square Contracts is a complimentary feature that lets you create contracts, terms and conditions included with your client appointment emails through Square. It has preexisting templates for a service agreement, confirmation of delivery, credit card authorisation, sale of goods and completion of services, but you can create any kind of contract.

Other booking options can be set up by the business owner to suit their processes. For example, bookings can be automatically accepted when the client books, or you could manually accept each one if you want more control. You could also add a tipping option at checkout, customised email notifications and booking rules.

If you’re dealing with regular customers, the customer directory helps you save time. When you add a customer to an appointment, the app automatically adds this person to your customer library along with any contact details added to the profile.

By adding card details to the customer’s profile (card on file), you can charge the person’s card when necessary. This means that if you do have a no-show or last-minute cancellation, you can still charge the card belonging to your customer (if the customer has agreed to this policy at the time of booking).

However, the cardholder can at any time retract their card information remotely, which has been a problem for some merchants who get customers booking, then retracting their card information and not turning up for a booking that could’ve gone to a paying customer.

There is also an items library where you can add all your services and products. When making an appointment, a service is selected for a time slot. Each service can have a duration, processing time and extra time added to keep the calendar availability accurate.

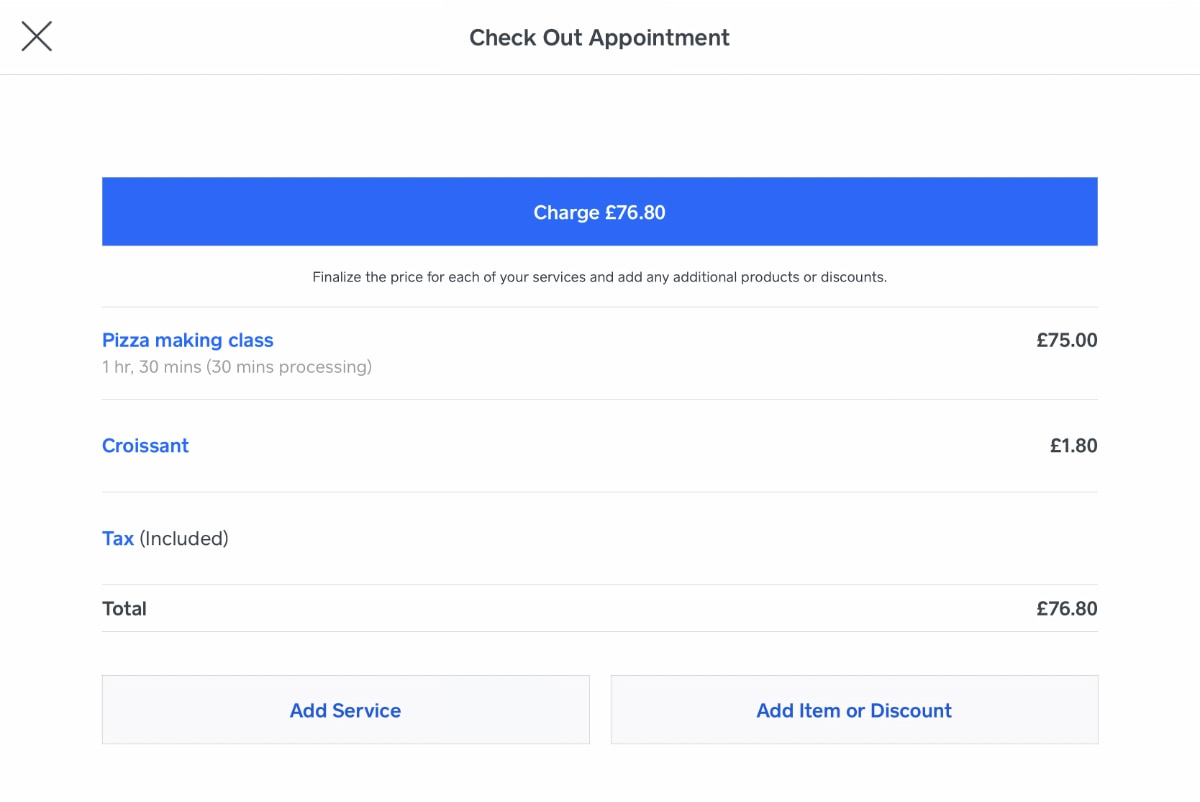

Image: Mobile Transaction

When taking a booking payment, you can add a product, service or discount.

If you’re selling add-ons such as styling products alongside hairdressing appointments, these can easily be added to the appointment transaction at checkout.

You can also allocate resources to a service, for example rooms or chairs. When a service is booked where a certain resource is required, the resource will then be booked automatically. Similarly, specific staff members can be added to a service.

To keep the booking calendar free conflicts, you can book in personal events that apply to your business only. For example, lunch and time off can be booked so that customers won’t be able to opt for a service during these times when a team member is unavailable.

A paid Appointments subscription (2+ users) includes advanced staff permissions, called Team Plus (normally £20/month). This lets you create custom permissions and roles for different employees about what features they can access in the app. The free plan for one user has a decent range of team settings already, including timecards, shifts and staff analytics, but only one set of permissions.

A new feature is staff commissions, where you can add tiered or flat-rate commissions that apply when certain services or products are sold.

Image: Mobile Transaction

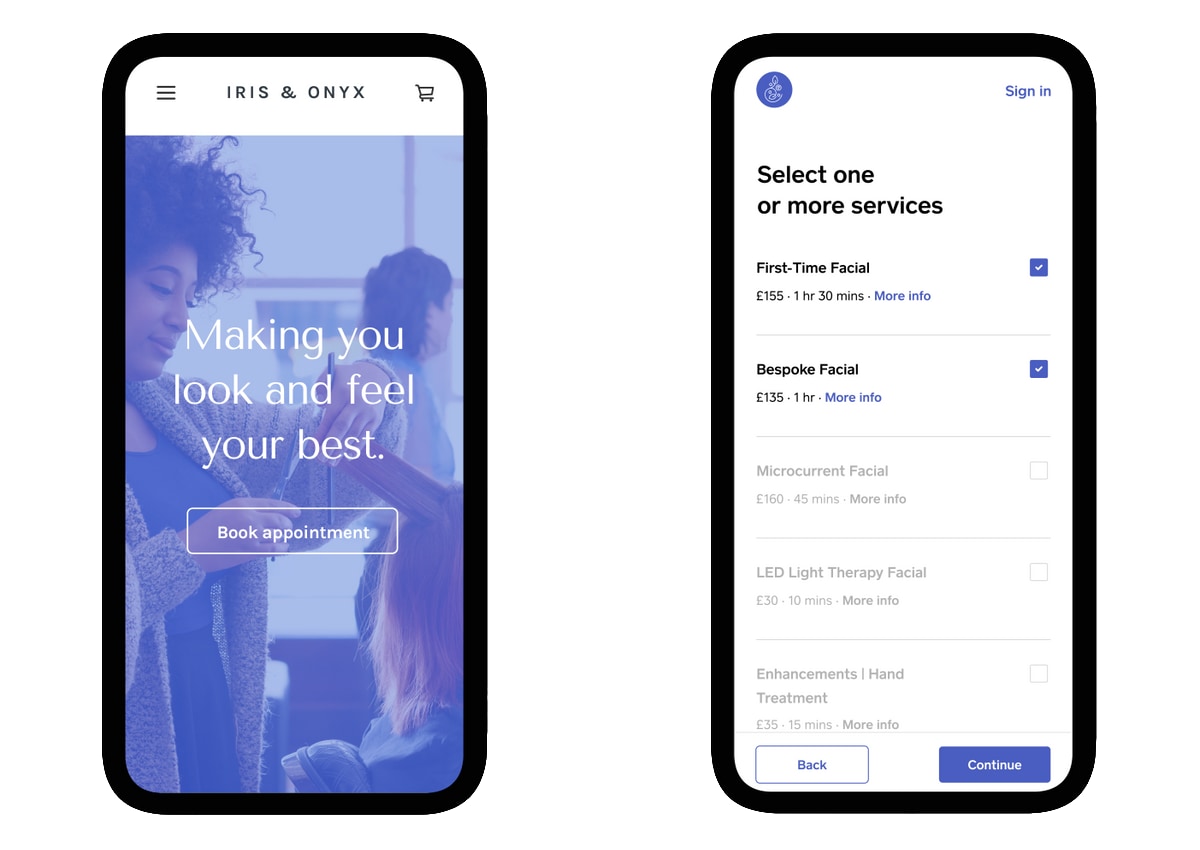

The online booking flow as it appears to a client.

Online bookings

On both the free and paid Appointments plans, you get a free online booking website so clients can book remotely. This is a complete website with an embedded booking page connected to Square Appointments and the payment system.

The website runs on Square Online, a website builder with basic editing options that make it easy for anyone to create a modern site for ecommerce. There are no website templates to pick from – instead, you are carried through different steps to pick e.g. a colour scheme, pages and images.

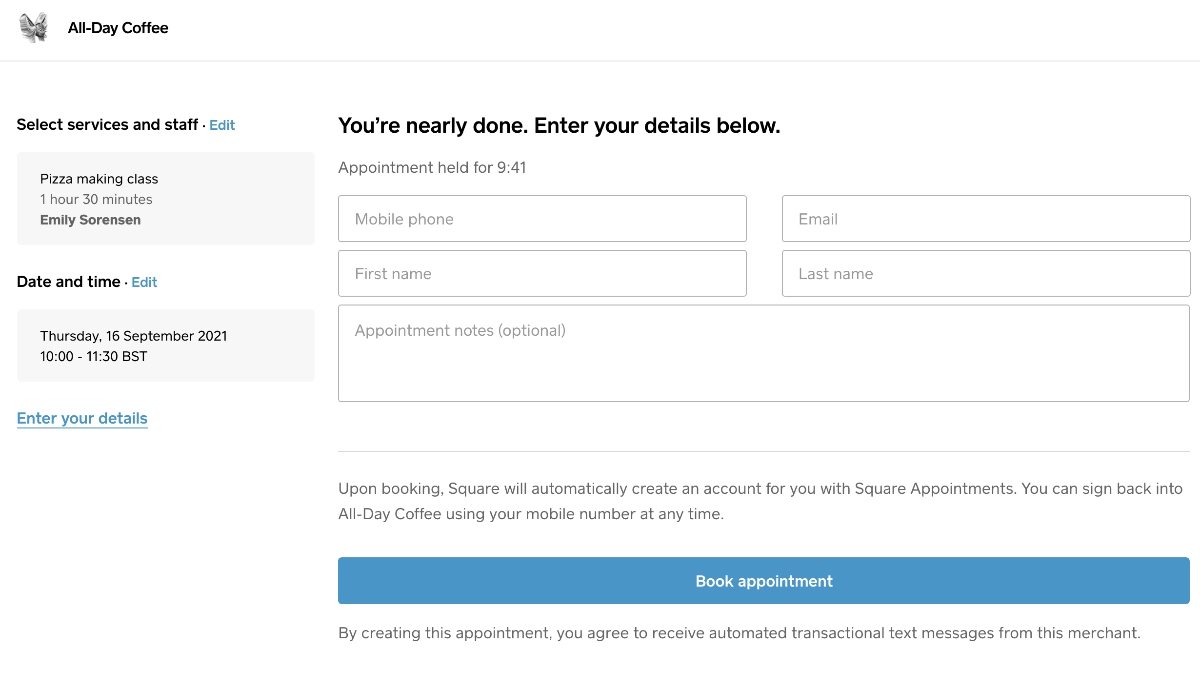

Image: Square

Example of an online booking through a site built with Square Appointments.

The website can be integrated with Instagram so followers can book through a “Book” button on your Instagram Business profile. The ‘Reserve with Google’ integration furthermore allows you to connect your calendar with a business profile in Google search results for a more direct way for people to secure a booking.

If you already have a website, it’s possible to integrate the Square Appointments booking flow into this as long as your website platform is compatible (WordPress, Wix or Squarespace would work).

You can enable cash management and connect a cash drawer that is tracked in the app. External vouchers, cheques and other payment forms can also be registered at checkout.

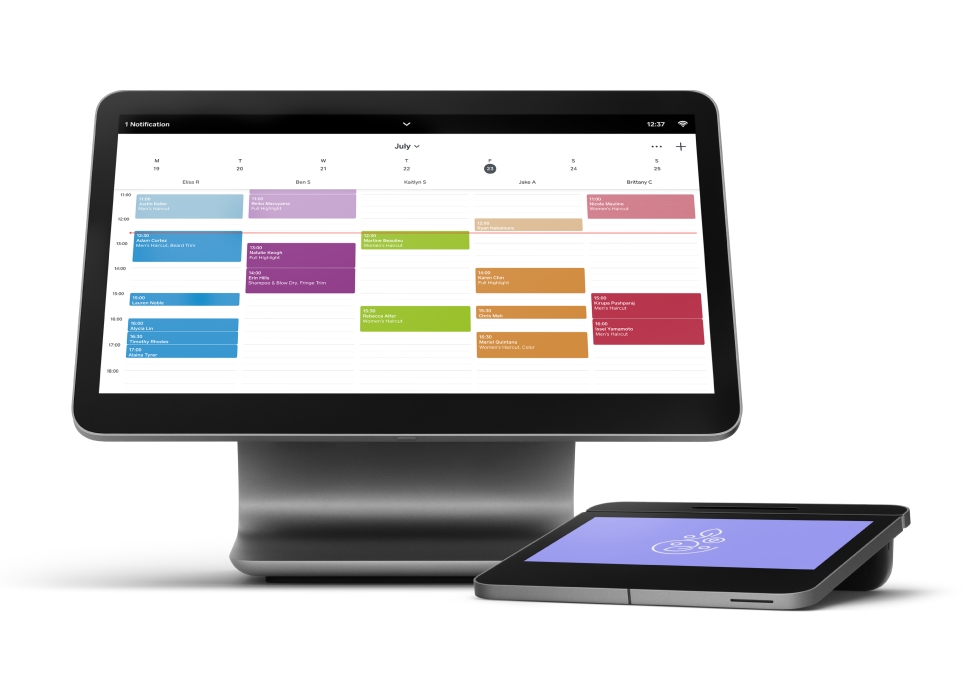

The Appointments app works on iPad, iPhone, Android tablets and smartphones, but you don’t need a consumer device if you purchase Square Register. This is a complete touchscreen register designed by Square that only works with Square’s POS apps. It has a stylish, touchscreen-based card reader attached, but no receipt printer or cash drawer (but these can be bought separately and connected to Register).

Photo: Square

Square Appointments app on Square Register, which has a card terminal attached.

What about ways to ensure your clients pay for their booking? Square Appointments deals with that through these options:

- Hold card for no-show protection – The customer is required to enter card details while booking, allowing you to charge the card a cancellation fee within 14 days of the booking. After this time, the card details are deleted in the system.

- Require prepayment – The customer is required to pay upfront for the service being booked.

Square has a default cancellation policy in the system, but you can create your own policy when editing these payment settings. It is up to you how much you charge for no-shows, but only up to £500 is allowed. Alternatively, you can choose not to require a saved card or prepayment.

Reports and analytics

No matter how you’re taking bookings and payments through Square, transactions are recorded in real time in the cloud. This data can be analysed in the Square account, emailed for print-off or integrated with external accounting software such as Xero and QuickBooks.

The Appointments app has a section for reports, transactions and payouts so these can be monitored on the go. Receipts can be reissued and transactions refunded from the app.

In the browser-based Square Dashboard, more complex sales analytics allow you to look at sales trends, division of payment methods, staff performance and much more.

Customer support and reviews

All Square users can contact support by email or telephone on weekdays between 9am-5pm.

Given the low cost of Square products, the fact that there isn’t a 24/7 service does not bother most merchants, but it does mean that replies to general queries can take a day or so to yield a response via email. Urgent issues are best dealt with over the phone during opening hours.

User reviews are generally positive because of Square’s ease of use, smooth payouts and excellent range of free tools.

Square Appointments in particular has had a lot of praise for its great value-for-money for individual professionals (no monthly fee!). It has also received some criticism that it may be a little pricey with more than one user, and the online booking website is not so flexible when you try to edit it. Moreover, the fact you can’t control when clients remove their card details from your system means you may not be able to charge for a no-show or late cancellation even when it’s a policy to do so.

Our verdict

Square Appointments is incredibly versatile, with a low barrier of entry for those on a budget. It doesn’t matter if you’re taking bookings online or in person, because Square includes so many different selling tools without additional costs.

The Square Appointments app can be used for selling both physical items and services, but it’s different from Square Point of Sale for its focus on the booking system mixed in with more general features. Consequently, it suits different professionals such as barbers, hairdressers, beauty salons, consultants, cleaners, wellness specialists, teachers and trainers.

But whereas Square leads with its general, interconnected payment flows, it lacks truly advanced customisation options suited for larger firms. Sure, you can integrate with other software platforms, but the booking flow is limited to Square’s (generally efficient, mind you) design.

We wholeheartedly recommend Square Appointments for individual practitioners and small teams of professionals, but it’s worth giving it a test run first if you’re a more complicated business with unique requirements.