What is SumUp?

SumUp is a European payment company that recently just launched in Australia. It offers easy-to-use, highly affordable payment tools, particularly an EFTPOS terminal and payment links.

Merchants can sign up in minutes online, order the SumUp Air card reader and start to accept payments online straight away.

Accepted cards

Acceptance of eftpos cards, Visa, Mastercard and contactless mobile wallets are included without any contract. Next year, SumUp plans to add American Express and JCB acceptance too.

After accepting a tap-and-go or chip card transaction, the money arrives in your chosen bank account within 1-3 working days, or sometimes 2-3 working days longer for international cards.

The service is easy to use out of the box, but customer support is available during the week for support if needed.

Fees and pricing

SumUp fees are extremely simple. Firstly, there is no contractual lock-in or monthly fee – you just purchase the SumUp Air card reader for $49 (including GST) and pay 1.6% per tap or chip card payment accepted. This rate is automatically deducted before the transaction settles in your bank account.

There’s no shipping cost for the card reader, and it comes with a 14-day-money-back guarantee from the date of delivery.

| SumUp fees | |

|---|---|

| Contractual commitment | None |

| SumUp Air price | $49 |

| Shipping | Free |

| Monthly fee | None |

| Transaction fees | Chip and tap: 1.6%* Payment links: 2.1%* |

| Refunds | Free before the transaction’s payout Original transaction fee is charged after payout |

| Payouts in bank account | Free |

| Chargebacks | $10 each |

*Including GST

Payment links have a higher transaction fee at 2.1%. You only pay for successful transactions, not those that did not complete.

There is no fee for processing a refund if the relevant transaction hasn’t yet settled in your bank account. Once a transaction has reached your bank account (when the payout is complete), the transaction fee originally charged will be retained by SumUp while the cardholder gets their full refund.

If a customer disputes a payment with their bank, the merchant is charged a non-refundable chargeback fee of $10.

What are the alternatives?

See best EFTPOS machines for small businesses

SumUp card reader and app

SumUp currently sells one EFTPOS terminal in Australia: the SumUp Air card reader. It pairs with your smartphone or tablet via Bluetooth, using your mobile device’s WiFi or cellular network to process card payments.

The card reader’s battery life is long: 500 transactions from a full charge. That’s because it only needs to power up after you’ve entered and approved the transaction in the SumUp App on your phone.

Photo: Mobile Transaction

The card reader works in conjunction with SumUp App in order to take payments.

To accept a payment, you first open the SumUp App on your compatible iPhone, iPad, or Android smartphone or tablet. If you’ve added products to the items library, you’ll see a product grid where you just tap the items being purchased. Otherwise, a custom transaction amount is entered along with an optional description, after which you can choose to process the transaction via the Air card reader.

Air’s display then activates, ready for a contactless tap or insertion of a chip card. If required, the customer enters their PIN code on the touch-sensitive PIN pad on the glass surface of the card reader. It’s also possible to select cash acceptance or send a payment link, if the customer doesn’t have a card or mobile wallet on them.

When the transaction is complete, a digital receipt can be sent via email or text message.

Photo: Mobile Transaction

Air’s glass-surface PIN pad and display.

Photo: Mobile Transaction

The chip card slot is located at the top.

Because the front of Air is just one smooth plane of glass, it’s easy to keep this clean. However, the lack of physical marks on the keypad means that people with visual impairments might need help using it.

To use the app and card reader, it’s essential that your phone or tablet has Bluetooth switched on (for pairing with the card reader) and an internet/mobile network connection.

Payment links

If a customer doesn’t have their credit or debit card with them, or you want to get paid remotely or online, you can send a SumUp payment link.

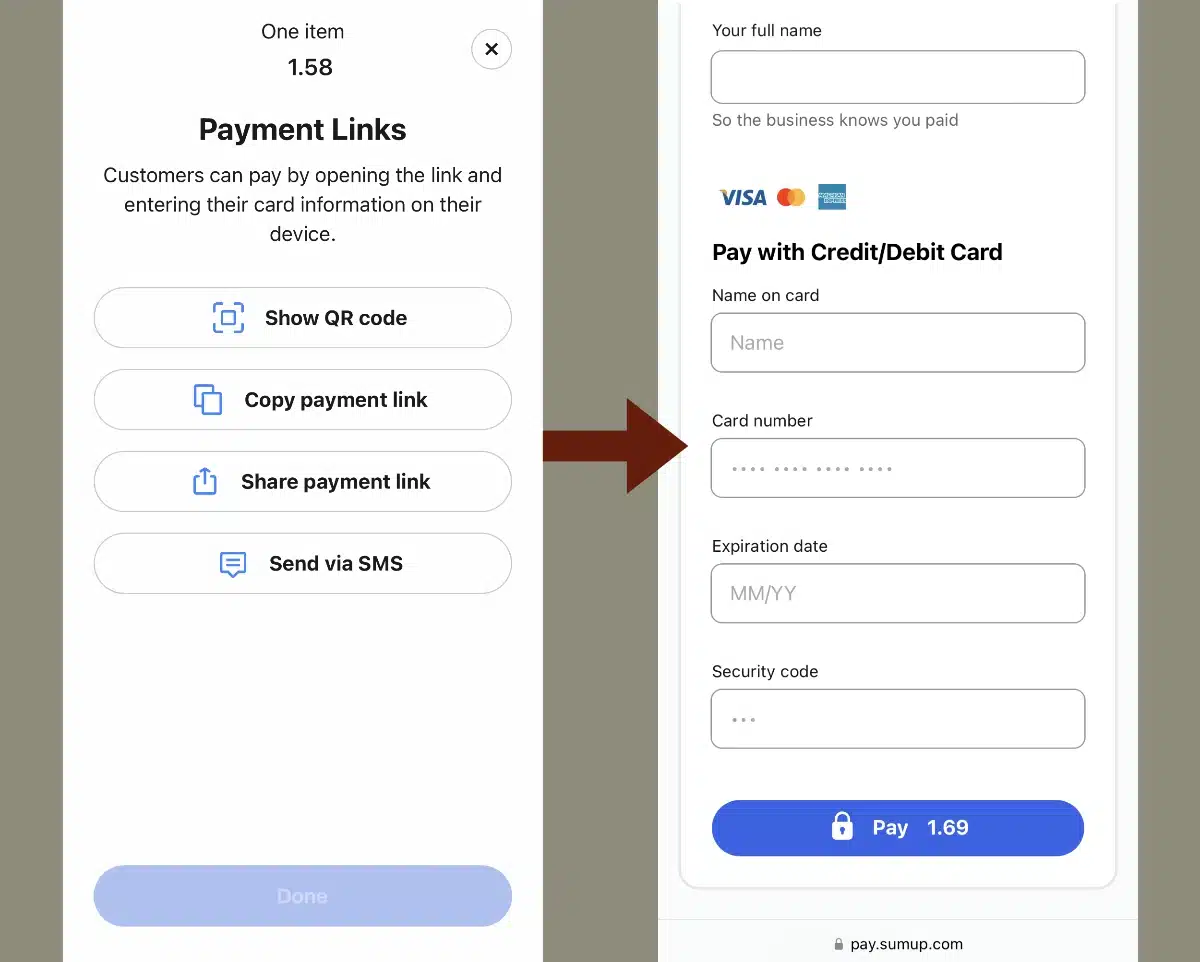

Like when using the card reader, it requires creating the transaction in SumUp App first. Then you select ‘Payment Links’ and whether you want to share it by:

- Showing a QR code on the mobile screen

- Copying the link/URL to paste it into a message or email

- Sharing the link via a mobile app of your choice

- Sending it via SMS

Image: Mobile Transaction

The merchant’s options for sending a payment link, and the payment page received by the customer.

If a QR code was chosen, the customer needs to be there in person to scan it with their smartphone camera to open the link. In all cases, the link opens a checkout page in the customer’s web browser, where they are prompted to enter their card details to complete the transaction online.

This is a really useful way to take deposits over the phone or sell remotely, as there is no monthly cost for it, just the transaction fee for completed payments.

Online dashboard and reports

After sign-up, merchants can access an administrative account in their web browser called SumUp Dashboard.

This is where you can generate very simple sales reports that can be exported to your chosen accounting software. It is also where you can add employees (with adjustable permissions) who need to use the card reader too.

SumUp Australia has no integration options, only the built-in features mentioned in this review.

Service and SumUp reviews

Since SumUp strives to offer a low-cost solution, it also limits the customer support hours. Merchants can phone, chat-message or email the support team between Monday and Friday, 9am – 6pm (AEST). This means there’s no help during evenings and weekends if suddenly the system stops working.

We have personally not needed urgent support out of hours from SumUp, but busy venues operating during sociable hours might want a backup solution in case there are issues.

Users generally leave good reviews about SumUp across Europe, citing the ease of use and affordability as top advantages. There are also concerns about technical issues with the card readers and poor support when trying to address it. In Australia, reviews are very limited, though, so we have yet to see how good the service is on average on this continent.

Better than Square and Zeller? Here’s our verdict

While SumUp has developed into a feature-rich business solution in Europe, the Australian SumUp offering is still in its infancy. The main product is the app-dependent card reader Air, which works well for many sole traders and very small businesses like cafés, market stalls and small, independent shops. Payment links are a useful addition, but Square offers these too along with many more free online payment features.

If you’re looking for the cheapest EFTPOS machine solution, SumUp Air is a good deal if your card transactions amount to less than a couple of thousand dollars per month. Both SumUp’s EFTPOS rate and terminal price (the only upfront cost) are lower than Square Reader’s, the main market competitor.

| SumUp criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 4.1 | Good |

| Transparency and sign-up | 4.5 | Good/Excellent |

| Value-added services | 3 | Passable |

| Service and reviews | 3 | Passable |

| Contract | 5 | Excellent |

| OVERALL SCORE | 3.8 | Good |

But if you’re out to save money long-term and want a solution that can grow with you, we recommend considering Zeller Terminal if you can afford the higher upfront price. Its rate is lower (1.4%), the terminal is high quality, and it connects with plenty of business tools without commitment too.

When it comes to simplicity, however, some business owners might prefer SumUp’s very simple software interface and card reader. The availability of support and add-on features are limited, but if you just need in-person EFTPOS acceptance on a budget, SumUp meets that need.