PayNuts and Smartpay are two EFTPOS solutions that offer surcharging.

A market leader in Australia in this segment, Smartpay’s main selling point is in fact the option to pass on fees to customers. It has been a challenger to the banks for over a decade, but is increasingly seeing competition from payment companies like Square, Zeller and PayNuts that all aim to make payments even simpler.

PayNuts is a relatively new contender to the surcharging EFTPOS space, but offers some attractive features Smartpay is missing.

Let’s dig into the differences in features, fees and reviews of PayNuts and Smartpay to understand which is best for your business.

|

|

|

|---|---|---|

| Monthly fee | $0-$34.95 + GST/mo | $0-$29 incl. GST/mo |

| Contract | Cancellable any time | Cancellable any time |

| Setup fee | $90 + GST (only payable if leaving within a year) | None |

| EFTPOS transactions | Custom fees that can be passed on as a surcharge, or flat fee across cards | Custom fees that can be passed on as a surcharge |

| Settlement | Next business day (free) | Next business day (free) or same day (for a fee) |

| Chargebacks | Subject to fee | Free |

| Connectivity | 4G/SIM + WiFi + broadband | 4G/SIM + WiFi + Bluetooth |

| Payment types | EFTPOS, over the phone | EFTPOS, on website, payment links, over the phone |

EFTPOS terminals

Both PayNuts and Smartpay offer reliable terminals, though PayNuts’ are more modern.

The mobile terminal Verifone T650p is PayNuts’ main product, whereas Smartpay provides an older PAX D210e model.

Let’s start by looking at the Smartpay PAX D210e. Although a reliable solution, it lacks the most up-to-date technological capabilities you see in newer smart terminals. It tends to be used at fixed checkouts, but can be versatile with its WiFi connectivity and included SIM card that connects with 3G. It boasts an 8-hour battery life, but with constant use, it will likely not last that long. The terminal’s physical buttons are straightforward to use — a plus for accessibility, and for many, the familiarity of using buttons is preferred over a fully-touchscreen interface.

Credit: Smartpay

PAX D210e is Smartpay’s only model.

Credit: PayNuts/Mobile Transaction

The Verifone T650p offered by PayNuts.

In contrast, PayNuts offers a ‘smart POS terminal’ with Android software. It integrates with many well-known and sector-specific point of sale (POS) systems. PayNuts currently offers the Verifone T650p model, but other terminals (e.g. the lightweight PAX A77 without a receipt printer) are available based on specific business needs.

PayNuts’ Android terminal is touchscreen-operated, much like a smartphone. It is also portable, making it a great option for mobile businesses. In addition, it comes with dual-SIM cards (Telstra and Optus/Vodafone) for backup connectivity in case of technical problems. Other features of the PayNuts terminal include email receipts, tipping options, surcharging and a simple overview of payouts.

Overall, PayNuts stands out for those looking for something newer with more features and a connectivity backup in a second SIM card. It also integrates with over 600 business software options, compared with Smartpay’s 20+ POS integrations.

Ultimate comparison: Best EFTPOS machines in Australia

Pricing and fees

The pricing differences between Smartpay and PayNuts are important to highlight.

Smartpay is best known for its plan that passes all fees on to the customer, the ‘Zero Cost’ plan (which does have some fees, as we shall see). Cardholders, not the merchant, essentially cover the fees for eftpos, Mastercard and Visa transactions and pay no rental fee as long as they make over $10k monthly through that terminal. American Express, Alipay and WeChat Pay would cost extra, if you choose to accept these.

The Zero Cost plan, however, is only available for businesses accepting more than $10k monthly in card sales through each terminal.

The actual surcharge applied to transactions is calculated automatically, so that is nothing to worry about. You can also decide to pay the fee yourself, so you’re not forced to pass on fees.

Smartpay also offers a ‘Simple Flat Rate’ plan that’s pretty straightforward. Whether you accept Visa, Mastercard, Alipay or WeChat Pay, there is a single flat fee per transaction. This reduces the risks of unforeseen monthly fees or commitments, and you know exactly what you’re paying for. The drawback is that American Express (Amex) isn’t included on this plan, but it can be added for an extra cost.

PayNuts offers a ‘Low Fee’ plan starting at $29 monthly for terminal rental, with custom transaction fees added on top. While this is not as simple as Smartpay’s Simple Flat Rate plan, it may be a cheaper, more attractive option for some businesses who don’t want to charge customers for card payments.

On the other hand, PayNuts’ ‘Pay Nothing’ plan is comparable to Smartpay’s Zero Cost option. Instead of paying the transaction costs yourself, you pass them on to your customers as a surcharge. Just like with Smartpay, you may opt for taking on a specific fee yourself.

PayNuts also tailors rates to your business, which can be a good deal. Similarly, if you consistently process over $10,000 in card transactions per terminal each month, you do not pay any EFTPOS terminal leasing fees.

| Smartpay | PayNuts | |

|---|---|---|

| Plans | Zero Cost: $0/mo if sales above $10k/mo or $34.95 + GST/mo if sales below $10k/mo Transaction fees paid by cardholder Simple Flat Rate: Monthly fee applicable Fixed rate for all cards |

Pay Nothing: $0/mo if sales above $10k/mo or $29 incl. GST/mo if sales below $10k/mo Transaction fees paid by cardholder Low Fee: $29 incl. GST/mo Custom rates for different cards |

| Contract | Cancellable any time, but $90 + GST applies if leaving before 12 months | Cancellable any time with no early exit fee |

Smartpay charges for paper roll shipping and chargebacks, while PayNuts does not. There is also no cancellation charge at any point with PayNuts, whereas Smartpay charges $90 + GST if you leave the contract before 12 months.

We would recommend asking for a quote from the two to see how the rates compare. With PayNuts, short-term hire is also available.

Access to funds

Smartpay settles funds the following business day in your bank account, as long as the transactions were made before the nightly cut-off time. So payments accepted on a Friday or over the weekend will settle on Monday, plus any additional time it takes for your bank to clear the money in your account (clearance times vary between banks and card types).

PayNuts has a similar schedule with its standard Next Business Day settlement, but offers Same Day Funding as an upgraded feature for a fee. Same-day deposits allow you to receive funds in your bank account the same evening by 11pm, 7 days a week, if your PayNuts terminal accepts the payment before 8.20pm that day – a comparable service to Square’s popular instant transfers. With Next Business Day Funding, you only ever receive funds on business days.

Both PayNuts and Smartpay offer quick ways to receive funds, but PayNuts’ same-day payouts stand out for its speed and weekend accessibility, which can be helpful for companies with urgent expenses.

Online reports

With PayNuts and Smartpay, you can track transactions through online reporting tools.

Each EFTPOS machine from Smartpay shows transaction summaries that let you look at specific time periods — like a specific day or shift. A monthly statement is sent by email. But while Smartpay just launched an online dashboard for a small number of users, it is not yet rolled out to everyone. When it comes to reporting and cloud integrations, Smartpay appears more like a traditional provider than a cutting-edge challenger: no app, no integration with accounting systems like Xero, and not yet a user-friendly self-service dashboard with additional tools and analytics.

PayNuts, on the other hand, has a richer online reports stack. The PayNuts Merchant Portal is a browser-based dashboard with sales overviews, tables and charts. It gives you the flexibility of exporting detailed transaction reports and looking at real-time information of sales and fees.

On the whole, PayNuts offers a more sophisticated and user-friendly online reporting interface, while Smartpay is only slowly catching up with its recent, partial launch of an online dashboard.

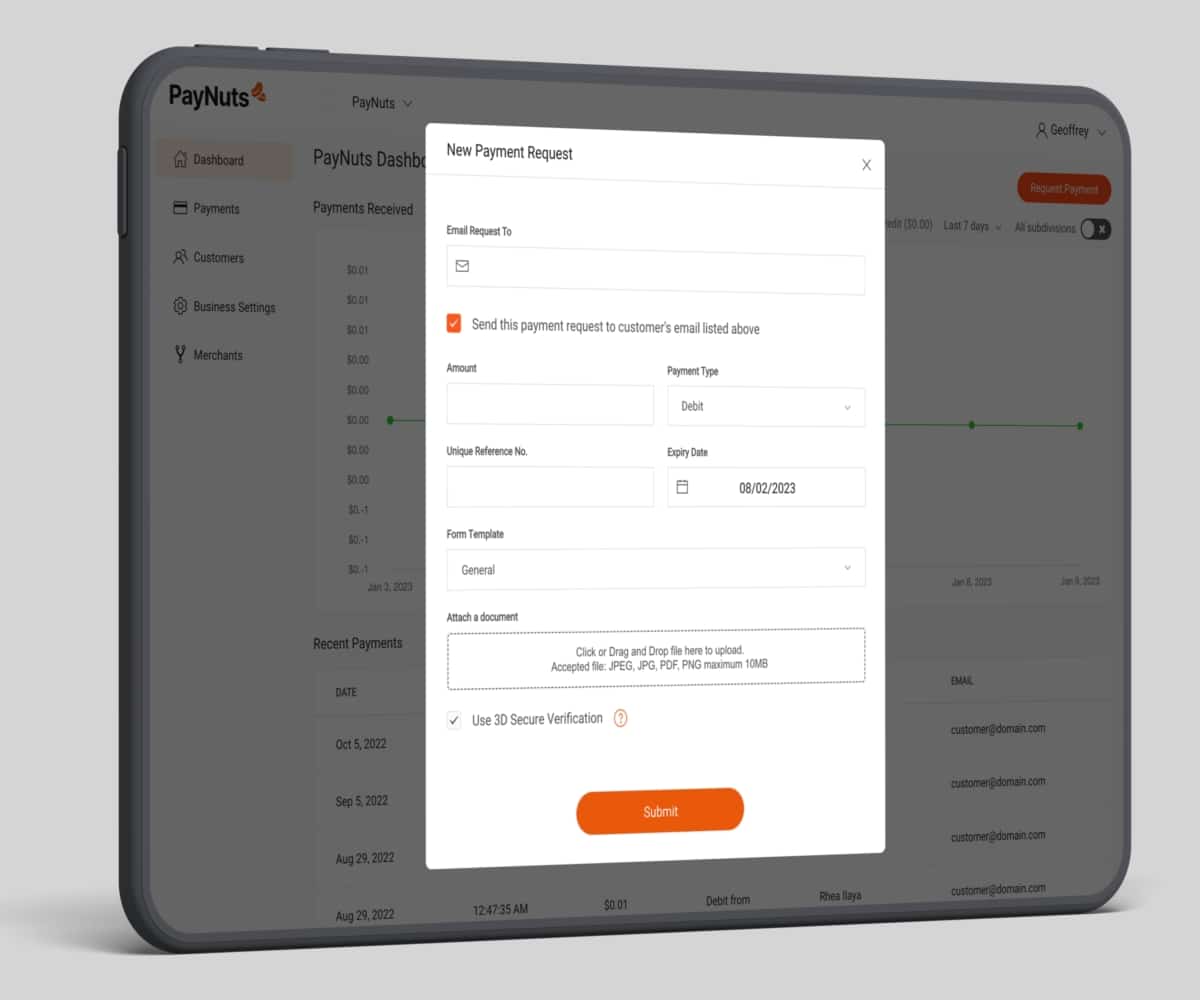

Credit: PayNuts

From PayNuts’ online portal, you can send payment links (pictured) and manage transactions.

Online payments

Some key differences in online payment features are worth highlighting for PayNuts and Smartpay.

PayNuts offers a multichannel payment solution covering in-store, online and mobile payments, including:

- Online checkout (payment gateway) for a website

- Payment links sent via email or SMS

- Browser-based virtual terminal where merchants can key in remote transactions

Smartpay, in contrast, focuses on in-person payments via its terminal, with only this option for remote payments:

- Keyed entry transactions on the EFTPOS terminal for over-the-phone payments

We should emphasise that keyed entry and virtual terminal payments carry more risks for the merchant than payment links. For example, the payment links offered by PayNuts come with 3DS2 (a robust authentication protocol) — meaning the risk is pushed to the issuing bank and not the merchant who could otherwise bear the security responsibilities of taking card details.

Customer support and reviews

Customer support is essential for any service, so we looked at the support services at PayNuts and Smartpay.

PayNuts includes 24/7 customer service via email, phone and chat. Since it is a fairly new company, customer reviews of the service are limited, but its prior brand name, More Payments, mostly received positive reviews.

User experiences at Smartpay, however, are divided. Although Smartpay offers 24/7 support, it is better for live support for urgent issues than complex problems related to the account. Its reviews for onboarding are mainly positive, but some critics raise issues about delays in troubleshooting.

In a nutshell, PayNuts makes itself accessible and dependable with its readily available customer service. While Smartpay also provides round-the-clock support, there are conflicting opinions about its response times. Despite the fact that PayNuts is still a young company under its present name, the favourable reviews it received under its previous name point to a company that places a high priority on client satisfaction.

Credit: Smartpay

Smartpay’s only product is its EFTPOS machine, with limited features beyond that.

Verdict

Customers signing up for PayNuts and Smartpay likely do so for their “fee-free” surcharging plans.

For businesses without consistent card sales above $10,000 monthly, PayNuts is better priced and with a product that’s more modern and versatile. Although, if you are accepting less than $5,000 monthly, Square would be an easier choice.

Small businesses with low transaction volumes below $10k monthly could benefit from either PayNuts and Smartpay’s services, who would both charge a monthly fee. Again, though, PayNuts fares better with its lower monthly fee and no fee for cancelling the contract before 12 months (which Smartpay charges for).

PayNuts also stands out for its online payment options, whereas Smartpay only lets you key in payments on the EFTPOS terminal. Businesses navigating an unpredictable cash flow might favour PayNuts for its same-day payout option too.

Once your transaction volume scales to above $150k annually, you might need other POS integrations. PayNuts is much more versatile with its 600+ integrations versus Smartpay’s 20+ integrations, and higher sales volumes usually go hand in hand with more advanced setups.

All this being said, Smartpay has been around for years longer than PayNuts, so it is a well-established choice for merchants who just need an EFTPOS machine on a cost-saving surcharging plan.

On the whole, the decision to choose PayNuts or Smartpay will depend on your particular business needs and transaction volume. You should compare each provider’s costs and features with your needs to make an informed decision.