Square and Stripe are two giant payment platforms with similar products, for very different businesses.

Launched in 2014 in Australia, Stripe soon got popular among serious online businesses. The nifty Square card reader landed in Australia in 2016, appealing to small businesses in general.

Square was initially focused on face-to-face merchants, but has since expanded services to online channels. Stripe’s developer-centric online payments platform is for custom solutions and bigger businesses, with or without EFTPOS terminals.

Let’s go through the main differences between the payment services.

|

|

|

|---|---|---|

| Best for | Brick-and-mortar shops, mobile vendors, cafés, service-based businesses | Web-first businesses |

| Lock-in | None | None |

| Fees | Pay-as-you-go No monthly charge |

Pay-as-you-go No monthly charge |

| In-person payments | EFTPOS machines + easy POS software |

EFTPOS machines Complex POS setup |

| Remote payments | Online store, virtual terminal, payment links, subscriptions, invoicing, custom solutions (APIs provided) | Online checkout, subscriptions, invoicing, virtual terminal, custom solutions (APIs provided) |

| Payouts | Next day Instant for a fee |

1-2 weeks (first), then every 2 days Instant for a fee |

| Card acceptance | Visa, Mastercard, Maestro, Amex, eftpos, JCB, Apple Pay, Google Pay, Samsung Pay | Visa, Mastercard, Maestro, eftpos, Amex, JCB, Apple Pay, Google Pay |

| Ease of use | Very easy | Requires some tech knowledge |

| Customer support quality | Generally good. Phone available. | Mixed. Mainly chat and email. Delays reported. |

No contract lock-in, but what about cost differences?

Both Stripe and Square challenge banks by offering more transparency.

This comes across in their pricing structure: no archaic contracts, setup fees, monthly fees (barring some features) or contractual obligations. This is the modern way that many startups, small businesses and professionals feel most comfortable with.

The main costs are instead pay-as-pay transaction charges.

| Square fees | Stripe fees | |

|---|---|---|

| Lock-in | None | None |

| Monthly fees | None (few exceptions) | None (few exceptions) |

| In-person transactions | 1.6% | Domestic cards: 1.7% + A$0.10 International cards: 3.5% + A$0.10 |

| Ecommerce transactions | 2.2% | Domestic cards: 1.7% + A$0.30 International cards: 3.5% + A$0.30 |

| BECS Direct Debit fee | n/a | 0.8%, capped at $5 |

| Recurring billing | 2.2% | 0.7% in addition to transaction fee |

| Currency conversion | Free | 2% |

| Payout fee | Next day: Free Instant Transfers: 1.5% |

Standard: Free Instant Payouts: 1.5% |

| Refund fee | Transaction fee is retained | Transaction fee is retained |

| Chargeback fee | Free | A$25 |

| PCI compliance* | Free | Costs may apply |

Transaction charges

Square transaction fees are deliberately simple:

- 1.6% for all EFTPOS payments, regardless of the card and country of issue.

- 2.2% for all keyed and online payments, regardless of sales channel.

For in-person payments, Square is definitively cheaper.

Stripe’s EFTPOS machines charge 1.7% + A$0.10 per domestic card transaction and 3.5% + A$0.10 for all other cards.

Not only is there a fixed fee (A$0.10) per transaction, making small amounts expensive – the domestic rate (1.7%) is also higher than Square’s 1.6%.

But Stripe saves you money if most ecommerce payments are made with Australian cards, which cost just 1.7% + A$0.30 compared with Square’s 2.2%. International cards cost more than Square, though: 3.5% + A$0.30 per transaction.

The fixed $0.30 fee could become expensive if most transaction amounts are low ($0.30 of $5 is the equivalent of a 6% fee!). In addition, Stripe charges a 2% currency conversion fee on transactions paid in a different currency from the customer’s card.

Recurring payment fees

Known for its customisable subscription systems, Stripe charges 0.7% on top of the card payment (1.7%-3.5% + A$0.30) or BECS transfer (0.8%) fees on a Pay As You Go plan. A monthly plan charges at least A$930 monthly with annual commitment, which works out better for higher sales volumes.

Square Subscriptions – charging cards only, not bank accounts – cost 2.2% per recurring payment.

Since Stripe subscriptions accept BECS Direct Debit payments for 0.8% (capped at $5.00) + 0.7%, i.e. 1.5% compared with Square’s fixed 2.2%, Stripe can be cheaper for recurring payments.

Payouts

Standard payouts are free on both platforms, and both allow you to settle transactions instantly in your bank account for an extra 1.5% added to transactions.

But Square settles payments in your bank account the next day, including weekends (if your bank enables this), whereas Stripe takes several business days to clear payments.

Other fees

PCI-DSS compliance (card security paperwork) is managed free of charge by Square, while Stripe encourages users to address this but with some support provided. This could cost extra depending on the level of protocols required for your business. We have experience with this with a WooCommerce site using Stripe, and it was fairly simple.

Chargebacks cost A$25 each with Stripe, but are free with Square. Note that if you are chargeback prone, Square might consider you too risky. The chargeback fee with Stipe can add up for bigger online retailers though.

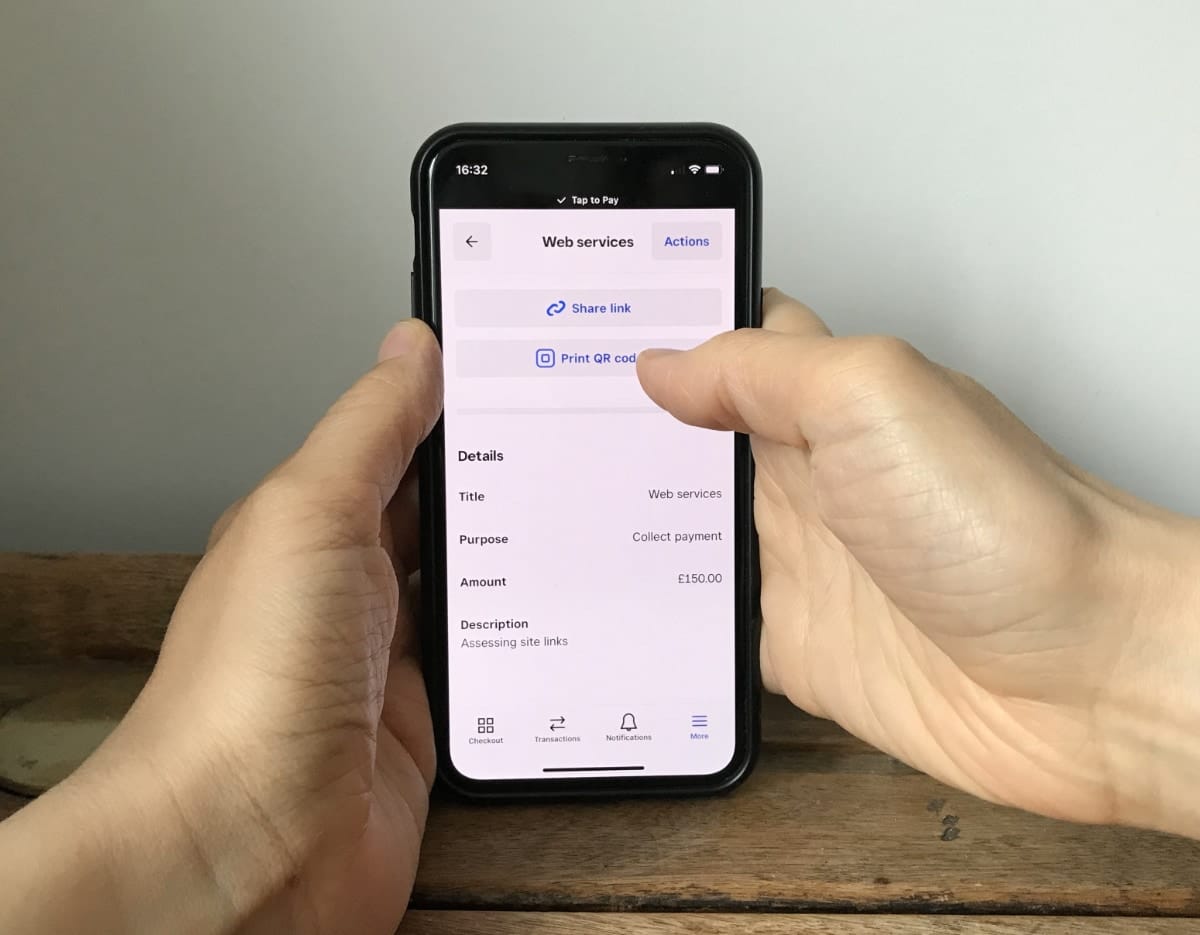

Photo: Mobile Transaction

We send Square payment links (pictured) from a phone. Square is excellent for easy ways to charge customers.

Complete webshop vs integrated checkout on your site

Though both platforms provide solutions for ecommerce, there’s a clear distinction in how this is done: Stripe is more developer-focused, and Square focuses on immediately accessible payment tools.

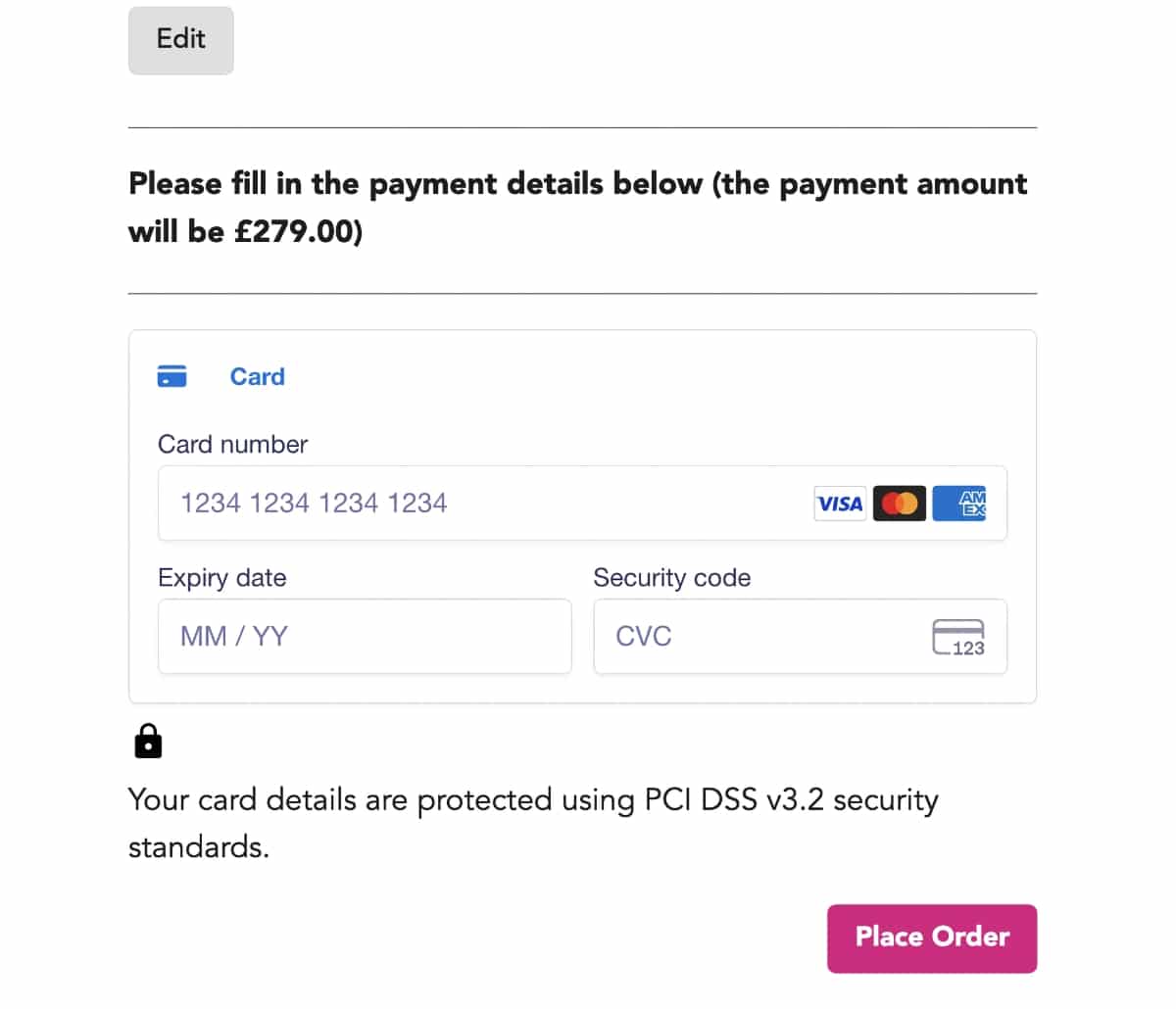

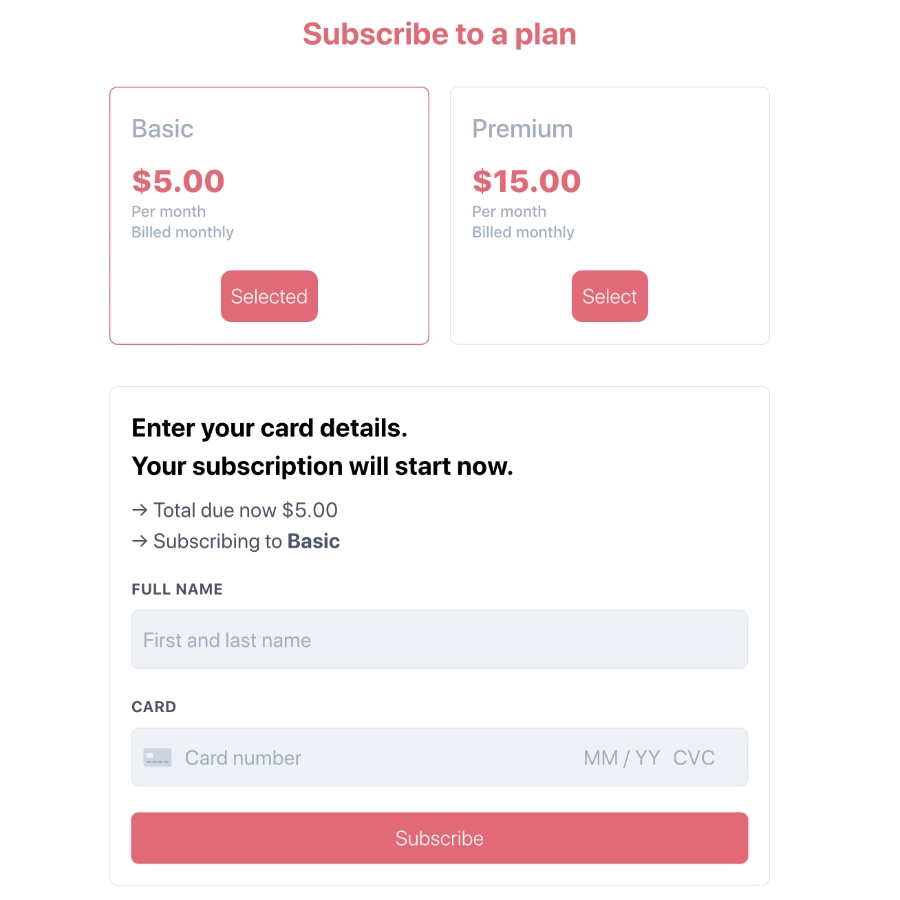

Image: Mobile Transaction

Example of a Stripe online checkout we used, but it takes some coding to tailor it for your website.

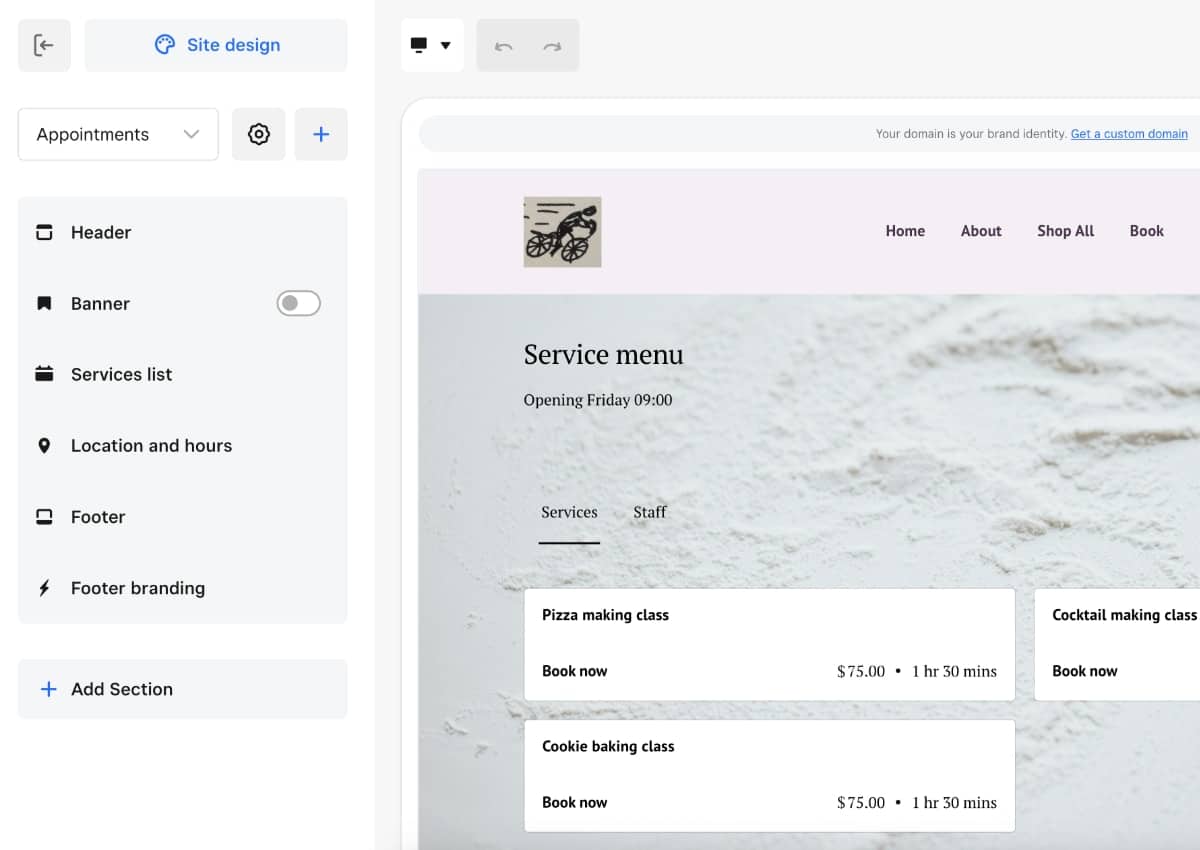

Square offers an ‘all-in-one’ ecommerce platform with a website builder, payment system and hosting, plus optional integrations with online ordering. It’s built for non-technical merchants keen to create and manage an online store without hiring someone to do it for them.

Unless you only need a basic online store, Square has a monthly subscription for hosting and advanced ecommerce features, though its features won’t surpass Shopify’s for retail.

“I find Square’s online store platform very user-friendly and clutter-free. For complex ecommerce, though, I’d rater integrate Stripe with an online store builder like WooCommerce.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Image: Mobile Transaction

We tried Square Online and found it a bit basic.

Stripe does not provide a website builder or hosting, but serves as an online gateway (online checkout) that integrates with an existing website.

Certain all-in-one platforms like Wix and Squarespace allow you to easily activate Stripe without knowledge of coding. But a Stripe checkout on a WordPress site requires adding a piece of code (Application Programming Interfaces/APIs) correctly into the system.

What’s great about this approach is the freedom to customise the style and features of the payment process – but it does require being comfortable with codes.

Square also offers APIs so you can use its payments system on a website that’s not hosted through Square. This allows customisations of style and function too. It is also possible to create payment links that go to a simple online checkout page we think is quite user-friendly on mobile phones.

EFTPOS terminals

If you’re looking for a card reader and POS system without a complicated setup, Square is a go-to choice in Australia.

We personally love its user-friendly, frequently-updated point of sale apps for hospitality, retail and booking systems. Their cool-looking EFTPOS machines were extremely easy to set up without a manual in all cases we’ve tested them.

Square’s card machines: easiest to use

Square’s two main card terminals are:

- Square Reader ($65 incl. GST) – small card reader connecting with a POS app on a smartphone or tablet

- Square Terminal ($259 incl. GST) – portable WiFi terminal with POS app on its large touchscreen

They can be purchased upfront or via interest-free payments over 3, 6 or 12 months.

Square Reader is best for mobile payments, since it’s tiny, but it does need to be connected with an iPhone, iPad or Android device to accept cards. Square Terminal only works with secured WiFi, so is better for fixed premises where, for example, table service is required.

Photo: Mobile Transaction

Square Reader works with contactless taps and chip cards.

Photo: Mobile Transaction

Square Terminal sits securely on a countertop.

Then there are the hardware kits that look like they were designed by Apple:

- Square Register ($799 incl. GST) – tablet POS register with a touchscreen card reader attached

- Square Stand ($119 incl. GST) – iPad holder with built-in chip and contactless card reading capabilities

They look very smart and are very easy to set up, as we noticed when we tested them (below photo).

Photo: Mobile Transaction

Square Stand and Register.

Stripe Terminal: for custom setups

Stripe, on the other hand, has EFTPOS terminals (Stripe Terminal) that require a custom configuration with POS software. They include:

- BBPOS WisePad 3 (A$89 + GST) – small, push-button card reader that connects with an app

- BBPOS WisePOS E (A$329 + GST) – touchscreen card terminal that works independently or with an app

- Stripe Reader S700 (A$499 + GST) – independent touchscreen EFTPOS terminal

There are some ready-made apps that work with the BBPOS WisePad 3 reader, but they’re really not the best and often charge extra on top of Stripe’s transaction fees. In Australia, certain POS systems like Abacus, or ecommerce software like Big Cartel, work with it through quick setup steps.

Photo: Mobile Transaction

Stripe WisePad 3 is the most affordable of Stripe’s EFTPOS terminals.

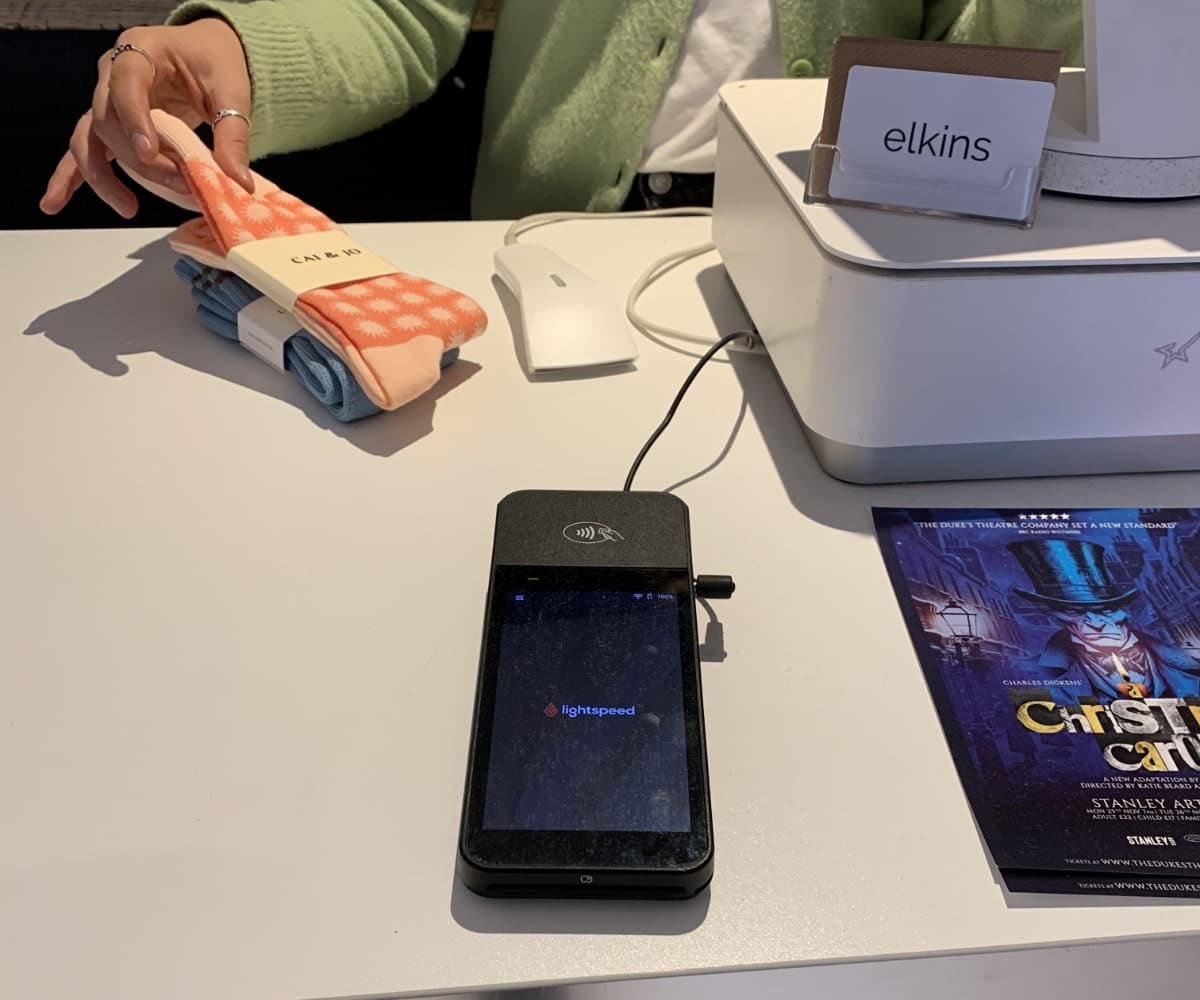

Certain POS systems like Lightspeed use Stripe terminals with their own branding on them. In those cases, the merchant doesn’t deal with Stripe themselves and may pay different fees decided by the POS company.

Still, we think most Stripe Terminal users choose the product because it works with their own, custom ecommerce solution. If EFTPOS machines are needed, they are adapted around that.

Photo: Mobile Transaction

Lightspeed point of sale uses Stripe Terminal for EFTPOS transactions.

Surcharging on EFTPOS machines

What about surcharging? Square has this built in as a simple feature, even with the option to have it automatically switched on at weekends only to compensate for higher staff costs during that time.

Stripe’s terminals have to be configured around your particular point of sale and surcharging setup, none of which is straightforward initially. In all honesty, this is not the best solution if you’re going for a specialised, but straightforward, POS system.

Which is best for card machines?

Square’s point of sale products are superior with its many ready-to-use features that suffice for most small, face-to-face businesses.

Both EFTPOS solutions work with most sectors (food and drink, retail, services) and connect with receipt printers, cash drawers, barcode scanners and other POS accessories.

But Stripe should only be considered for tailored setups, or if it’s already part of a POS system you choose.

Remote payments: both have many options

Online payments are not just about online stores, as both platforms would agree on. The following payment functions are also offered:

Invoicing

Both Stripe and Square allow you to send one-off or recurring email invoices that customers can pay through. These can be managed through the web dashboard, but only Square has a dedicated (and free) invoice app.

Subscriptions

Stripe has the tools to create pretty much any subscription system you want, provided you have a developer to do this. Then you can charge customers automatically on a recurring basis either through BECS Direct Debit or by card.

Although not visibly advertised, Square also has a feature for recurring payments for card transactions only. It doesn’t require a coder to set up. Instead, we could just choose the settings for it in a simple interface.

Virtual terminal

The feature-rich Square Virtual Terminal can be used as a standalone product with no monthly fees, just the transaction rate. It allows you to take MOTO (Mail Order and Telephone Order) payments.

Stripe can also activate a simple virtual terminal in the dashboard, but only wants you to use it as a backup solution. This is because Stripe is not geared towards remote payments keyed in by the merchant, while Square is.

Payment links

Only Square has an easy-to-use pay-by-link solution. It allows you to define a product or service with a fixed price and generate a payment link for it.

You can embed this as a button on a website, send it as a QR code or URL for a remote payment, or even create a donation link that allows customers to enter an amount to pay.

Image: Stripe

Stripe has many options for creating subscriptions, whether complex or simple.

Advanced payment systems

Stripe and Square both allow you to build their payment system into any website or app of yours.

But Stripe is the most advanced with its extensive API documents that are easy for developers to learn. This is its key strength: Stripe has many options to build complicated payment systems for marketplace platforms, subscription services, loyalty apps and much more.

Transactions, payouts and reports

Let’s start with the similarities between Square and Stripe:

- Transactions automatically process to your bank account

- eftpos, Visa, Mastercard, Maestro, American Express, Apple Pay and Google Pay are accepted

Square also accepts Samsung Pay through its card readers, whereas Stripe accepts BECS Direct Debit online as well.

There are some slight differences in payout times.

Square settles transactions in your bank account the following day, 7 days a week except for public holidays.

Stripe, on the other hand, takes up to two weeks to settle your first payment in your bank account. From here, Stripe automatically settles every two days unless manually changed.

Both offer instant transfers for an added fee of 1.5%, where you receive the payout within minutes in your bank account.

Detailed transaction reports are free on both platforms. Businesses with SQL coders on hand can pay a monthly fee for Stripe Sigma (fees will change depending on amount of processed transaction), providing access to in-depth user data from the payments processed in your business.

Square’s free analytics detail products and services sold, as long as you make use of the inventory library linked with all sales channels.

Customer support: a bit better at Square

While Square only responds to customers on weekdays between 9am and 5pm, Stripe boasts round-the-clock support every day of the year.

It doesn’t take much digging to find more complaints about Stripe than Square, though.

For example, there’s no phone number for Stripe so you’re reliant on email, messaging chat or requesting a call-back. Square has a phone number and email address for queries.

We should emphasise Stripe has significantly more reviews in Australia, so it’s easier to find more complaints about it.

Both companies receive complaints about slow responses and frozen accounts with funds inaccessible to their owners. Account holds happen on many payment platforms, but it appears that Stripe users experience them more in Australia compared with Square.

Stripe has a good reputation when it comes to solving general queries, but anything more serious appears to be more difficult for the support team to fix. This issue is amplified with Stripe’s lack of phone support.

Square similarly gets complaints about their support team, but many more reviews indicate happy users appreciative of the overall service and ease of use.

Our verdict

Choosing Stripe or Square depends a lot on your resources, business model and tools required.

Square is built for the lay merchant who wants a very user-friendly, complete system that can be managed easily without special knowledge. In particular, Square works great as a low-cost POS solution for merchants that also want remote payment options thrown in the mix for free.

In contrast, Stripe is intended for the tech-savvy, online-only business that needs a unique payment system adapted to their business model. It’s mainly enterprises or bigger businesses that benefit – they get lower card processing fees as well.

Unless Stripe is already integrated on your ecommerce platform of choice, it takes some coding knowledge to tailor a solution. This will be overkill for many who just need a simple payment system like Square’s.