Smartphones can completely replace a dedicated card reader and process payments on their own.

How so? Through the contactless technology Tap to Pay on iPhone/Android (not tap and go which is contactless payments in general).

We see this payment method has become more popular as a supplement to an EFTPOS machine – and for some tradies, it’s a complete substitute.

In this article, we explore how to use your phone as an EFTPOS machine with the options in Australia.

Image: Mobile Transaction

Tap to Pay works with both contactless cards and mobile wallets.

Tap to Pay solutions in Australia

In 2025, Australian merchants have quite a few ‘EFTPOS on phone’ choices.

In an effort to stay competitive, many well-known EFTPOS companies have introduced their own Tap to Pay options. These are usually separate apps or features added to their existing apps.

Complete overview of mobile EFTPOS apps with Tap to Pay in Australia:

| Solution | Android | iPhone | Costs | Key info |

|---|---|---|---|---|

| Square | Yes (offer) |

Yes (offer) |

1.6% /transaction, no monthly fee or contract | Quick and easy to start, fast payouts |

| Zeller | Yes (offer) |

Yes (offer) |

1.4% /transaction, no monthly fee or contract | Easy sign-up online, support every day |

| Westpac | Yes | Yes | 1.4% /transaction, no monthly fee | Good business account, but high-maintenance service and sign-up |

| ANZ Worldline | Yes | Yes | 1.3% /transaction + other fees, no contract | Sign-up not quick or wholly transparent |

| Tyro | Yes | Yes | 1.4% /transaction, no monthly fee | Okay product, but mixed service |

| NAB | Yes | X | 1.4% /transaction, no monthly fee or contract | Same-day funds in NAB bank account |

| Shopify | Yes | Yes | 1.75%-5% /transaction, from A$7/mo, monthly or annual contract | Feature in Shopify POS app, but only worth it with online shop |

| SumUp | X | Yes | 1.4% /transaction, no monthly fee or contract | Simple product with little presence in Australia |

| Pebl | Yes | Yes | 1.8% /transaction, no monthly fee or contract | Fairly new company with few users |

| Airpay | Yes | X | 1.29%+ /transaction, A$29 one-off licence fee, 1-year contract | Outdated service with unnecessary lock-in |

| Stripe | SDK* only | SDK* only | 1.7%-3.5% + $0.25 /transaction, no monthly fee or contract |

Requires coding a custom solution |

| Adyen | SDK* only | SDK* only | Custom fees | For companies with high sales volume |

* Software development kit (SDK) for adding Tap to Pay to your own payment app.

Out-of-the-box solutions

In Australia, the following providers offer Tap to Pay out-of-the-box on both iPhone and Android devices:

- Square

- Zeller

- Westpac

- ANZ Worldline

- Tyro

- Shopify POS

- Pebl

At Square, it’s available in an iPhone or Android app that also connects with Square Reader, sends payment links and accepts QR code payments. Merchants signed up with Zeller can enable Tap to Pay in its main app.

Although Square offers the most adaptable, user-friendly features, its transaction rate of 1.6% for Visa, Mastercard, eftpos and Amex cards is not the lowest.

SumUp offers a lower rate with its EFTPOS app for iPhone, but doesn’t yet offer Tap to Pay on Android.

Zeller, Westpac, NAB and Tyro charge 1.4%, also without monthly fees or a contract (in most cases). ANZ Worldline charges even less per transaction – 1.3% – but comes with hidden fees. Newcomer Pebl has the highest fixed rate, 1.8%, but some useful app features like invoice reconciliation.

Shopify requires a monthly fee for ecommerce with a POS app included, with high Tap to Pay rates (1.95% or 5% on their cheapest plans). It therefore only makes sense to use Shopify if you’re already running an online shop through it.

Only Android users can opt for NAB and Airpay, though we don’t recommend the latter because Airpay’s fees are higher (rates go higher than 1.29%) and require a year’s commitment.

Photo: Mobile Transaction

The complex solutions

Stripe and Adyen are both intended for developers and large businesses wanting to add Tap to Pay functionality into their own software. We therefore don’t recommend it for individual entrepreneurs or small businesses that simply just need to accept contactless payments.

For example, Xero has Stripe integrated in its accounting software, so accounting users only need to sign up with Stripe to accept contactless taps.

Advantages

Disadvantages

A couple of the disadvantages relate to customers having to touch and hold the phone.

Sometimes, a Tap to Pay app might ask for a PIN code, mainly when the transaction amount exceeds the contactless limit ($100 or $200 for physical cards). The merchant is then forced to give the customer the smartphone so they can enter the code on the touchscreen.

This is not the most hygienic solution, and customers may also be reluctant to enter their card PIN on a stranger’s phone if they’re concerned about security.

Some merchants consider purchasing a phone to dedicate for this purpose, but then why not buy a card reader that’s cheaper and less likely to be stolen?

Photo: Mobile Transaction

Your EFTPOS app will show simple prompts during a tap transaction.

In addition, tap-to-phone only processes contactless payments, not chip cards that have to be inserted. If a chip card doesn’t have a contactless function, your smartphone will be useless.

Also, even the most modern smartphones need to be charged more frequently than dedicated EFTPOS readers.

So when can it be a good solution?

Tap to Pay could be considered a secondary card reader for emergency situations (e.g. during technical issues with an EFTPOS terminal or WiFi) or to accept payments from customers who don’t have cash (if you try to be a cash-only business).

Card reading on a smartphone is also useful for home deliveries and shops, bars and restaurants with large serving areas. Portability is, in fact, the main advantage of tap-and-go on phones.

Is a card reader better than Tap to Pay?

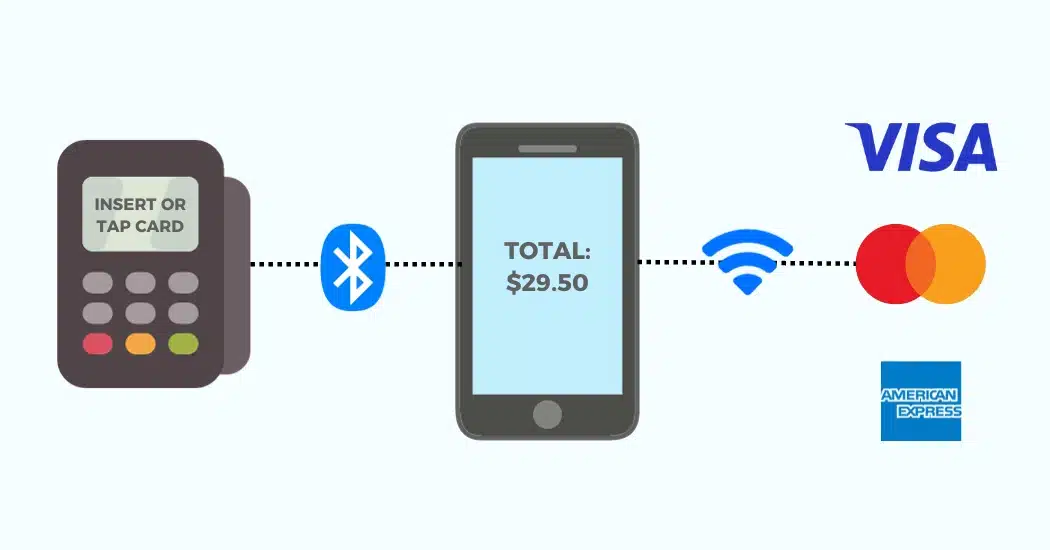

Mobile card readers are inexpensive EFTPOS terminals linked over Bluetooth with a phone that’s connected to the internet. They are extremely portable and lightweight devices designed for the sole purpose of processing card payments.

Unlike a purpose-built card reader, a phone with Tap to Pay has many apps that not only drain its battery, but also make it more vulnerable to technical issues.

Image: Mobile Transaction

Inexpensive card readers connect via Bluetooth with a smartphone to accept card payments.

Here are 3 of the most competitive card readers in Australia:

The most popular phone-dependent card reader, Square Reader, can be purchased for $65 incl. GST. It has no contractual lock-in or monthly fee, just a rate of 1.6% per transaction.

Square is popular for its instant transfer option for an added fee, free next-day payouts (weekends too) and many payment tools without a contract.

Tyro Reader costs less at $39 incl. GST. It doesn’t have a monthly fee or lock-in and only charges 1.4% per Visa, Mastercard, eftpos and JCB transaction (Amex costs more).

Smart Mini by CommBank is sometimes offered free, but normally costs $59 with a transaction fee of 1.1% for Mastercard, Visa, American Express, UnionPay, JCB and eftpos cards. It may have hidden fees, but could be your most convenient (and cheapest) option if banking with CommBank.

Why mobile card payments are popular

Although no regulations in Australia require businesses to have a card reader or accept card payments, many consumers avoid using cash. Still, some merchants are reluctant to accept cards.

That’s because banks and traditional merchant service providers often have inflexible terms for small, new businesses with limited sales. This could involve monthly charges and myriads of EFTPOS fees affecting your bottom line.

Surcharging is a way to fund transaction fees (though the RBA plans to ban it), if customers aren’t put off by the extra cost.

This is where smartphones have come to the rescue of small merchants. Mobile card readers and Tap to Pay are typically affordable and mostly without commitment or complicated fees.