If you’re a self-employed taxi driver, you may need to install a card machine, and so do taxi fleet owners employing their drivers.

Either way, most taxis make more money with a card terminal so all passengers can pay the way they prefer. But what’s the best credit card machine for taxi drivers? We’ve tested quite a few that would suit taxis and shortlisted the best in this comparison.

Black cabs, private hire taxis and other licensed cab drivers in London have to abide by different rules than outside the city, which we’ll cover in the last section. The rules mean not all the card machines on this list are approved for London. For example, Zettle Reader and SumUp are not currently accepted.

Still, all the options included here are ideal for taxis throughout the UK.

>>For Irish alternatives, see this article instead

Mobile Transaction’s top picks of card machines for taxis:

| Card machine | Pricing | Key benefit |

|---|---|---|

|

|

|

“Instant access to funds with card, cab-specific add-ons and it works abroad” |

|

|

|

“Easy setup, sleek designs and free next-day funds in SumUp Business Account” |

|

|

|

“Simplest deal out of all cab-specialised card readers; TFL-approved” |

|

|

|

“Great for taxis with lots of international customers due to its multi-currency accounts” |

|

|

|

“Offline mode for rural areas; TFL-approved” |

|

|

|

“Trusted card reader across the UK, can switch on tipping” |

|

|

|

“Custom rates ideal for the higher transaction values” |

|

|

|

“Hardware kits tailored for taxis; TfL-approved” |

*Excluding VAT.

myPOS sells a few different card terminals with no contractual commitment or fixed monthly costs.

The myPOS Go 2 terminal – for £29 + VAT plus a £6 delivery charge – is the cheapest and simplest model. It’s ideal for taxis because it’s independent, small and comes with a SIM card with unlimited data for card processing. It has mobile connectivity options (4G and WiFi) and should work in rural areas.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

myPOS Go 2 and Pro come with a Visa card linked to an online account.

myPOS is more of a European company than UK-based. Their terminals and SIM cards work across the EU and EEA without having to put in a special agreement, so private hire drivers and taxis operating around the border (e.g. Northern Ireland/Ireland) could benefit from that flexibility.

Accepted cards

Transaction rates are determined by the type of card and where it is issued. UK- and EEA-issued Visa or Mastercard cards cost 1.1% + 7p per transaction. American Express costs 2.45% + 7p and all other cards incur a fee of 2.85% + 7p.

Payments settle immediately in an online myPOS account, and you can spend this money straight away for refuelling after trips with the Business Visa card included.

Transferring money from the e-money account to your bank account costs £1.50 per payout.

“myPOS sells the cheapest independent card machine (Go 2), though it takes more time and effort initially to sign up. Taxis love the instant transfers and Visa card, since you can spend funds immediately after each ride.”

– Emily Sorensen, Senior Editor, Mobile Transaction

It’s not that simple to register, as you need to submit paperwork and have an identity verification video call before the account is set up. In the UK, myPOS offers round-the-clock customer support every day of the week, though.

If you like the idea myPOS’s online merchant account, but prefer a better terminal, the myPOS Pro touchscreen terminal with a receipt printer is available for £229 + VAT.

On Pro, you can download additional apps that taxi drivers may find useful, such as dispatch software.

SumUp Air is a cheap card payment machine for taxi drivers. You buy it for £19 + VAT upfront, then pay only a fixed transaction fee of 1.69% for any card accepted. There’s no contractual commitment or monthly fees.

Photo: EC, Mobile Transaction

SumUp Air is a low-cost mobile credit card machine for taxi drivers.

The card reader connects with a SumUp app on your phone or tablet, using the mobile device’s 4G to process payments over the internet. The app also lets you send payment links, take QR code payments and more.

“I’ve always found the app very easy to use, with just the right amount of features like VAT and a transactions overview. The card reader might feel a bit slippery for cab drivers with its glass surface and rounded back, though.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Payments automatically clear in your bank account within 1-3 working days for no extra charge. With the SumUp Business Account and Mastercard, you can access transactions the day after by 7am, including weekends.

SumUp’s wide choice of accepted cards makes it a good choice for taxis serving lots of tourists (for example, airport transfers).

Additionally, the low fixed transaction rate stays the same for foreign and premium cards in contrast with most other card machine deals.

For £19 per month, you can reduce the fixed rate to 0.99% for domestic consumer cards, but international and commercial cards then cost 1.99% to accept.

Accepted cards

SumUp App allows you to send a digital receipt via email or text after each transaction. To print a receipt, you need to buy a compatible receipt printer and connect it with SumUp Air over Bluetooth.

SumUp Air works best handheld, as there is no official card reader mount to install in the passenger compartment. This makes it unsuitable for licensed taxi drivers in London, where it is a requirement to have a fixed card terminal with the passenger.

Photo: EC, Mobile Transaction

SumUp Solo and Printer works without a mobile app and prints paper receipts.

Alternatively, you can use the SumUp Solo and Printer duo, the cheapest card machine with receipt printer in the UK. It works without a mobile app.

Although independent, Solo requires the printer-and-charging cradle to produce printed receipts anywhere with network coverage. You can otherwise send text and email receipts from the terminal display.

The card reader has a built-in SIM card with unlimited free data, working with 4G and WiFi alike.

SumUp’s customer support is available weekdays between 8am and 7pm and weekends between 7am to 5pm.

CabCard Services is a UK-based company specialising in card terminals for taxi drivers. Over 10,000 taxi drivers use CabCard, and we can see why: the pricing is uncomplicated and very affordable, and it includes dedicated 24/7 customer support via phone, email and web chat.

What’s more, CabCard’s Pocket 4G Terminal (Datecs BluePad 55 model) has been approved by Transport for London for use in London’s licensed taxis together with a DPP-250 receipt printer.

Photo: CabCard

CabCard’s 4G handheld reader is easy to use, with some of the lowest fees in the taxi sector.

Taxi drivers and fleet owners can choose between two card machine models: a larger terminal with receipt printing, and the Pocket 4G Terminal. The latter is the model featured for individual drivers.

CabCard Pocket 4G Terminal costs 99 + VAT upfront. It works independently, processing payments through the local 4G network through the built-in SIM card with data included. You can add tips directly on the card reader.

There are no monthly fees for this card machine, and the daily or weekly (your choice) bank account settlement is also free of charge. Instead of clearing transactions in a bank account, you can choose to process payouts to a prepaid Visa CabCard card.

For individual taxi drivers, all transactions incur a 10p authorisation charge in addition to the following rates:

- Personal Visa/Mastercard debit and credit cards issued in UK/EEA: 1.5%

- Business Visa/Mastercard debit cards issued in UK/EEA: 1.5%

- Business Visa/Mastercard credit cards issued in UK/EEA: 2.5%

- All non-EEA/UK Visa/Mastercard: 2.5%

- All Amex: 2.5%

Accepted cards

Compared with SumUp’s single rate of 1.69%, CabCard is pricier for short journeys because of its fixed 10p added to transactions whereas longer journeys have a lower cost due to CabCard’s lower 1.5% rate for most cards.

Taxi fleet owners can get special card rates (1% or less), the option to spread the cost of hardware over a contract term, and no setup or upfront charges. This includes software allowing you to monitor your fleet’s sales and driver performance in real time from the backend account.

Fleets can get their contract tailored in different ways, e.g. by deciding how drivers get paid through the CabCard system.

Self-employed taxi drivers also have access to view transactions and payout times in a CabCard dashboard on a tablet or smartphone.

Freelance taxi drivers can sign up for a free Revolut Pro account and order Revolut Reader, a small, app-dependent card reader. It works with the Revolut app, but can’t print receipts, so not all cab drivers will find it useful.

Drivers using FREENOW to get customers can also link that with Revolut Pro.

Photo: EC, Mobile Transaction

Revolut Reader is small and lightweight, with a very basic touchscreen for PIN entry.

We recommend Revolut mainly if you’re an individual taxi driver, since the Pro account is easier to manage. Registered cab companies have to sign up for a full Business account with a monthly fee and periodic verification requests in the name of security, which we’ve found tedious over time.

What we do like about Revolut is its excellent multi-currency accounts that let you keep different currency amounts separate to avoid exchange fees.

A Pro account also charges a fixed 1.5% for all Visa and Mastercard transactions, regardless of where the card is from. This is lower than the fixed rates from most competitors.

Accepted cards

The card reader is not as solidly built as, say, Zettle Reader. We noticed the screen is a little pixellated and had some issues with customer support who’s slow to resolved queries.

However, as long as there’s a connection with your mobile device, taxi drivers can add an amount in the Revolut app and proceed to accept a chip and PIN or contactless payment with the card reader.

The Viva Wallet Black Cab Solution is a bundle containing a Datecs BluePad 55 card reader (same as CabCard’s) with a holder for the customer compartment and wireless receipt printer. This makes it compliant with Transport for London’s rules for Black Cabs, so it is on their list of approved card machines.

Taxi fleets and other private hire cabs can, however, also benefit from the taxi management features included in the solution.

Photos: Viva Wallet

Viva Wallet’s card reader connects with an app that controls it over Bluetooth.

The card reader requires downloading the Viva Wallet app on your smartphone. In this, you enter the transaction which is then sent to the card reader placed in the passenger compartment, ready for a contactless tap or chip and PIN transaction.

Pricing has to be requested from Viva Wallet directly, but everyone has the choice of paying either one upfront cost for the card reader (purchase) or a monthly subscription fee to avoid the upfront price. This can be cancelled any time – there’s no long-term contract.

Transaction rates also need to be requested from the company. Promisingly, everyone has the option to earn back the cost of transactions by using the complimentary Viva Debit Card for business expenses.

Another cool feat of the Viva Wallet Black Cab bundle is the fact you can accept cards offline on the card reader. So if you’re driving in rural areas or anywhere with a spotty network connection, this won’t be an issue for card payments.

Just note that transactions are only fully completed the next time there’s a live internet connection through the built-in SIM card, so there is a slight risk of it not going through if the card processor detects a problem then.

Accepted cards

Transactions settle in an online Viva Wallet business account the next day, though it is possible to manually deposit funds into a bank account, which takes a further 1-2 working days. The online account is linked to the Viva Debit Card, so it is most convenient to use this as your main business account.

Zettle Reader (previously iZettle Reader) is another low-cost card reader that works in conjunction with a mobile app.

It normally costs £69 but the first one is £29 + VAT, and then you only pay a fixed transaction rate of 1.75% for any card accepted. There are no monthly fees and no contractual lock-in.

Photo: EC, Mobile Transaction

Zettle Reader is a modern mobile card machine for taxi drivers (it comes in black too).

Zettle accepts the widest choice of credit and debit cards out of all options on this list. Like SumUp and Revolut, Zettle’s fixed rate is the same for premium and foreign cards unlike many other card machine services that charge more for these.

Payments go directly into your bank account within 1-2 working days. There are no payout fees.

The card reader connects via Bluetooth with a compatible iPhone, iPad, Android phone or tablet with the Zettle Go app installed. You enter the fare amount in the app, and the card reader switches on, ready to accept a contactless or chip and PIN payment.

Receipts are sent via email or text from the app, but it’s also possible to connect a mobile receipt printer for paper receipts.

The payment app works like a simple point of sale (POS) system with a few extra features like tipping, but there’s not much else we think is useful for taxis.

Zettle’s customer service team is only available on weekdays between 9am and 5pm.

Accepted cards

Similar to SumUp, there is no official card reader mount to secure Zettle Reader in the passenger compartment. That means you can only use it handheld in the cab, so it is not approved by Transport for London.

Takepayments is a UK merchant service provider offering card machine contracts to a various small businesses, including taxi drivers. Their contracts are 18 months for a mobile terminal with a SIM card.

Because the card machine is rented, you pay a monthly charge – for instance, £25 + VAT for the Takepaymentsplus plan.

Card rates are based on your expected turnover, transaction size and types of cards accepted. If you want to accept Amex, you’ll need to get an extra contract with American Express.

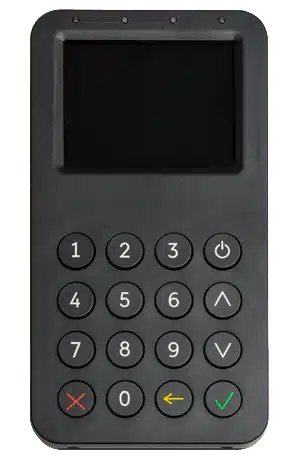

Photo: Emily Sorensen, Mobile Transaction

Takepayments’ most popular card machine is PAX A920Pro.

A downside for self-employed taxi drivers working uneven hours is the monthly minimum sales volume charge – if you don’t make a specific minimum (determined at the start of your contract) for a month, you pay a charge from £10 + VAT.

Although there’s no setup fee, you pay an early termination fee if leaving before 18 months are up.

Accepted cards

Transaction rates vary between payment cards. The range of fees is typically 0.3%-2.5% with the lowest fees attributed to domestic, personal Mastercard and Visa cards. Foreign, premium cards usually have the highest fees. You also pay a flat authorisation charge on top of the percentage.

Takepayments likes to get to know its merchants before signing them up, and it is during this conversation that you can inquire about card machines.

Takepayments’ main card machine, PAX A920Pro, is not currently approved for London taxi drivers, but it may be accepted if you ask Transport for London. That’s because the card machine has a receipt printer and can be fixed to a car.

Takepayments’ customer support is available to phone every day of the week, but only within opening hours: weekdays between 8am-7pm, Saturdays 9am-5pm, and Sundays between 9am-1pm.

PayaCardServices offers a taxi-specific card payment solution (sometimes called Payataxi) that includes a Miura M010 card reader, Bluetooth printer for receipts and card reader mount for the passenger compartment. This setup makes it suitable for London taxis.

Photo: PayaCardServices

The TfL-approved Payataxi hardware bundle includes a card reader, receipt printer and mount.

The terminal only works with a connected mobile app on your phone, so you’ll need a phone to process payments.

You can choose between several different price plans depending on whether you are a black cab driver or private hire driver. The most tailored solutions are for private hire fleets, but black cab drivers get multiple pricing options.

The black cab solutions has three main options (prices exclude VAT):

Pay Weekly, option 1: £75 installation fee, £4.99 a week, 2.69% +15p Mastercard/Visa, 3.95% +15p Amex

Pay Weekly, option 2: £75 installation fee, £99 for hardware kit, £2.99 a week, 2.39% +15p Mastercard/Visa, 3.95% +15p Amex

Buy Outright: £75 installation fee, £299 for hardware kit, no weekly fee, 1.99% +15p Mastercard/Visa, 3.95% +15p Amex

Accepted cards

Fleets and private hire companies can just pick one plan (excluding VAT):

Pay As You Go: £99 setup fee, from 3.5% per transaction, no weekly fee or lock-in

Some of these plans come with contractual commitment, so do ask PayaCardServices for more details. You also have to pay for PCI compliance (card payment security standard) on some plans.

London taxis – what are the rules imposed by TfL?

All licensed taxis, Black Cabs and private hire taxi services in London are only allowed to use Transport for London’s (TfL) approved card machines. Otherwise, the taxi will be given an unfit notice and in some cases have the licence revoked.

What does TfL require around card payments?

- All licensed taxis in London must have a TfL-approved card payment machine installed in the passenger compartment.

- Drivers are not allowed to use a handheld, non-fixed terminal with passengers – the terminal must be fixed in the customer compartment.

- The card terminal must be able to produce a printed receipt if requested by the customer.

- The taxi must display contactless and card acceptance signs.

- You are not allowed to add a card payment surcharge to the fare total.

TfL does not allow any exemptions on these rules, although if there are possibly-compliant card machines not on the approved list, you can contact TfL who will consider whether to include it.

We’ve looked at the models currently listed as approved which includes:

| TfL-approved card machine model | Where to get it |

|---|---|

| Datecs BluePad 55 | CabCard Services Viva Wallet |

| Ingenico iPP250 | CMT |

| Ingenico iPP350 | CMT |

| Miura M010 | Acceptacard/Payataxi Cabvision ComCab The Payment House |

| Miura M020 | Taxiworld The Payment House |

| Miura M021 | Cabvision |

| Verifone E285 | Curb |

| Verifone VX680 | Curb |

| WisePad 3S | Helix Pay |

| TfL-approved card machine model |

Where to get it |

|---|---|

| Datecs BluePad 55 | CabCard Services Viva Wallet |

| Ingenico iPP250 | CMT |

| Ingenico iPP350 | CMT |

| Miura M010 | Acceptacard/Payataxi Cabvision ComCab The Payment House |

| Miura M020 | Taxiworld The Payment House |

| Miura M021 | Cabvision |

| Verifone E285 | Curb |

| Verifone VX680 | Curb |

| WisePad 3S | Helix Pay |

Some of the providers and models shown are outdated, and it may well be that newer models are now approved since some of the ones listed are being phased out across industries.

Furthermore, some of the setups are not approved by TX4, Vito, TXe or Dynamo taxis. The TfL website says which providers are approved for your type of taxi.