Cashless payments are mandatory in Ireland for taxis, hackneys, limousines and other private hire car drivers. If you don’t have a card machine yet, you certainly would be wondering which one to get.

A number of card machine providers are available in the country, but – at first galnce – they seem to care only for other types of businesses. You are also probably considering how much it will cost to acquire and maintain the device.

Thankfully, you don’t necessarily need a fancy device with a printer. While you must offer print receipts to your customers, your taximeter is likely to have a thermal printer attached.

What you are probably looking for is something easy to use inside a car, affordable and reliable. Considering these criteria, what’s the best credit card machine for taxi drivers in Ireland?

MobileTransaction’s shortlist of credit card machines for taxis:

| Card machine | Upfront cost | Ongoing costs | Offer |

|---|---|---|---|

| SumUp | €25–€99* | No monthly fee 1.69% card rate |

|

| Square Reader | €19* | No monthly fee 1.75% + VAT card rate |

|

| myPOS Go | €39* | No monthly fee Rates from 1.69% + 5¢ |

|

| Revolut Reader | €49* | No monthly fee 0.8% – 2.6% + 2¢ rates |

|

| Yavin | €99.50-€199* | €29/mo (no lock-in) Variable rate + 0.5% + 5¢ |

|

| Elavon Mobile | €19* | No monthly fee 1.75% – 2.5% card rate |

*Excluding VAT.

MobileTransaction’s shortlist of credit card machines for taxis:

| Card machine |

Costs | Offer |

|---|---|---|

| SumUp | €25–€99* No monthly fee 1.69% card rate |

|

| Square Reader |

€19* No monthly fee 1.75% + VAT card rate |

|

| myPOS Go | €39* No monthly fee Rates from 1.69% + 5¢ |

|

| Revolut Reader | €49* No monthly fee 0.8% – 2.6% + 2¢ card rate |

|

| Yavin | €99.50-€199* €29/mo (no lock-in) Variable rate + 0.5% + 5¢ |

|

| Elavon Mobile |

€19* No monthly fee Rates from 1.75% |

*Excluding VAT.

Check out the top offers in Ireland we’ve put together for you in this comparison. They all follow the requirements of the National Transport Authority, such as acceptance of contactless payments and of Visa, Mastercard and American Express via physical cards and digital wallets.

They also meet our rating criteria, ensuring that only the best devices for small businesses are featured in our top lists. These criteria include:

- Product – are the quality and features suitable for taxis?

- Pricing – are fees fair and payouts not too slow?

- Sign-up – are costs transparent and onboarding smooth?

- Value-added services – are useful extras included, such as reporting?

- Support and reviews – is the service good and what are users’ experiences?

- Contract – do you commit to a contract and is it easy to cancel?

We base our comments and advice on first-hand experience and tests done by our team of experts and real card machine users.

SumUp is ideal for taxi drivers looking for cheap fees and ease of use. You only pay 1.69% for any card accepted, and there is no contractual commitment or monthly fees.

Out of the three card machine models – Solo Lite, Solo and Solo & Printer – our favourite is Solo Lite with its long battery life (1000+ transactions), unique design and fast connection via Bluetooth to a mobile app.

Solo Lite is also the cheapest of the models (€25 + VAT), since it relies on the network connectivity of a mobile phone to process a transaction. This also means it will work in rural areas as long as your smartphone works with 4G or lower network connections.

Some drivers still buy Solo for €69 + VAT upfront (includes a countertop stand), a relatively low price for a standalone card machine. You won’t need an app to accept payments with this device, as it comes with a SIM card and unlimited, free data. In addition to 3G and 4G, it connects with WiFi.

Thanks to its small dimensions, it’s easy to hand the terminal to customers if they are in the back seat, so they can tap or insert their card.

Photo: MobileTransaction

SumUp Solo’s optional printer doubles as a charging stand for a battery boost in taxis.

A possible downside of Solo is a short battery life when left on standby, so it’ll need access to a power socket or the matching receipt printer that doubles as a charging dock, in case it runs out. You can buy the Solo and Printer bundle for €99 + VAT. This also allows you to print a paper receipt for passengers who request it.

Solo lets you change to almost any European language in case your client doesn’t understand English.

Payments are automatically cleared in your bank account for no extra charge within 2-3 working days, though Amex transactions might take 2-3 days longer. A big draw is the SumUp Business Mastercard allowing access to funds the next day, during weekends too. This has proven popular with drivers as their go-to card for petrol.

SumUp accepts contactless and chip and PIN cards from pretty much all card brands, making it a good choice for taxis serving areas with many tourists (e.g. Dublin’s city centre, airports, inter-county train stations).

Accepted cards

Furthermore, the low fixed transaction rate stays the same for foreign and premium cards, in contrast with most other card machine deals with higher rates for such cards.

Through their merchant portal, you can export sales reports for accounting, among other extra features. Cash payments can be registered in SumUp App along with tips (which the Solo accepts directly on the display).

On the downside, SumUp’s customer service isn’t 24/7. If you experience an issue late in the evening, you will need to wait for the next business hour to get in touch. But you can contact them at specific hours over the weekend.

Learn more: SumUp Ireland review

Square Reader is a low-cost card reader that works in conjunction with a mobile app. You will save from the start, paying only €19 + VAT for the device.

Then you pay only a fixed transaction rate of 1.75% + VAT for any card accepted. There are no monthly fees or contractual lock-in.

Like SumUp, Square’s fixed rate is the same for premium and foreign cards, unlike many other card machine services charging more for these.

Photo: MobileTransaction

Square Reader is small, but powerful.

Payments go directly into your bank account the next business day, but you won’t face payout fees.

Square Reader’s small size and low weight are also ideal for use inside a vehicle. Plus, the battery is likely to last a full day’s active use, or many days if it’s just on standby (we have verified this).

But Square’s customer service team is only available on weekdays between 9am and 5pm, Monday to Friday, leaving you without support on weekends and evenings.

The card reader connects via Bluetooth with a compatible iPhone, iPad, Android phone or tablet with the Square Reader app ‘Point of Sale’ installed.

You enter the fare amount in the app, and the card reader switches on, ready to accept a contactless or chip and PIN payment.

As a taxi driver, you might not need many of the app features. But some that you will find useful are tipping and alternative payment methods (in case the card reader doesn’t work), such as payment links and QR codes.

You can also use the app to register cash transactions and export data to Excel for accounting purposes.

Accepted cards

Square Reader accepts Visa, V Pay, Mastercard, Maestro, American Express, and the digital wallets Apple Pay, Google Pay and Samsung Pay.

Learn more: Square Reader review

myPOS Go 2 comes with the draw of working across borders without having to put in a special agreement. If, for instance, you collect passengers to/from Ireland and Northern Ireland, you will benefit from this flexibility.

The device is quite affordable (€39 + VAT).

It works independently with a SIM card with unlimited data for card processing. Like Elavon Mobile further down, the myPOS Go card reader resembles a narrow calculator with its push-button PIN pad and small (but colour) display.

Photo: MobileTransaction

myPOS Go 2 connects with WiFi, but works with low network connections.

As well as WiFi, the card reader works with GPRS, 3G or 4G and will likely work well in areas with poor connectivity.

There is no contractual commitment or monthly fee, but the card fees do depend on the card being accepted. For consumer cards, you are charged 1.69% + €0.05 for Visa, Mastercard, V Pay and Maestro cards issued in Ireland, the EEA or the UK.

Commercial cards, other brand brands and non-EEA cards have a much higher fee: 2.89% + €0.05 per transaction. If most of your passengers pay their fares with American or corporate cards, for instance, myPOS’s cost can become high.

Settlement takes up to 2 hours, the fastest in this top list of card machines for taxi drivers. That said, payouts land in an online myPOS business account, not your bank account. This comes with its own business Visa card you can use at petrol stations and most other stores.

Accepted cards

In contrast with competitors, will have to pay a fee to transfer money from the online account to a bank account. Other costs apply, such as chargeback and inactivity fees. myPOS Go is also the only one on this list to charge for shipping the device (€5 + VAT).

Finally, getting started with myPOS isn’t as simple as with SumUp or Square. You will need to submit paperwork and have an identity verification video call before the account is set up.

In Ireland, myPOS offers round-the-clock customer support every day of the week.

Learn more: myPOS review

Revolut Reader is another affordable solution that many in Ireland are interested in. To buy it, taxi drivers need a Revolut Business account first and then apply for a Merchant Account via the Revolut Business app. This could take a few days to process.

But once you have that and have ordered the card reader for €49 + VAT (a €5 shipping fee is also added), taxi drivers just need to open the Revolut Business app, create a transaction and connect the app with the card reader to accept chip and PIN cards or contactless payments.

Photo: MobileTransaction

mx

When we tested Revolut Reader, it generally worked okay, but the terminal’s screen is a bit pixellated and the casing is not the sturdiest.

Since you have to open the business account app and navigate to the payment section, it also takes a bit longer to create each transaction compared with, say, SumUp and Square that have dedicated payment apps.

With that being said, there are major benefits: payouts in the Revolut account within 24 hours and a low card rate for Irish consumer cards: 0.8% + €0.02.

If you’re accepting cards from Northern Ireland or outside the EEA, you will pay the high rate of 2.6% + €0.02, though.

Only the most popular card brands are accepted, including Visa and Mastercard.

Accepted cards

On the other hand, you benefit from additional payment methods through the app, such as payment links and QR codes so passengers can pay on their phones if the card reader is out of action.

Revolut’s customer support is available via an in-app chat 24/7, but our own and other users’ experiences of the service team are a bit mixed.

From your customers’ point of view, however, seeing the Revolut-branded card reader is a great conversation starter, given how popular this fintech brand is in Ireland.

Learn more: Revolut Reader review

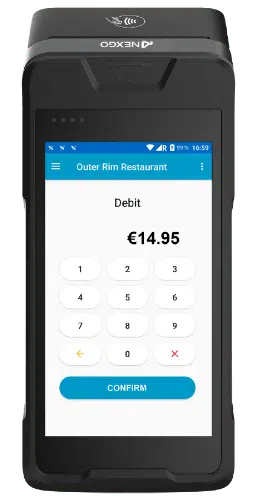

Yavin is a French company offering a couple of decent card machines in Ireland: Yavin Terminal with a receipt printer (Nexgo N86 model) and the smaller, slimmer Yavin Reader (Nexgo N6 model).

Yavin Terminal has a long battery life of up to 8 hours of active use from a full charge, or up to 240 hours on standby. Yavin Reader will similarly last you through a day,

They work in rural areas with a low 2G or 3G connection, but also with 4G or WiFi. In addition, the Terminal model has been approved for use in hazardous locations such as gas stations, since it’s built to withstand heat and blasts (to a certain extent, at least).

Yavin Terminal isn’t cheap, but is good quality and has tipping options.

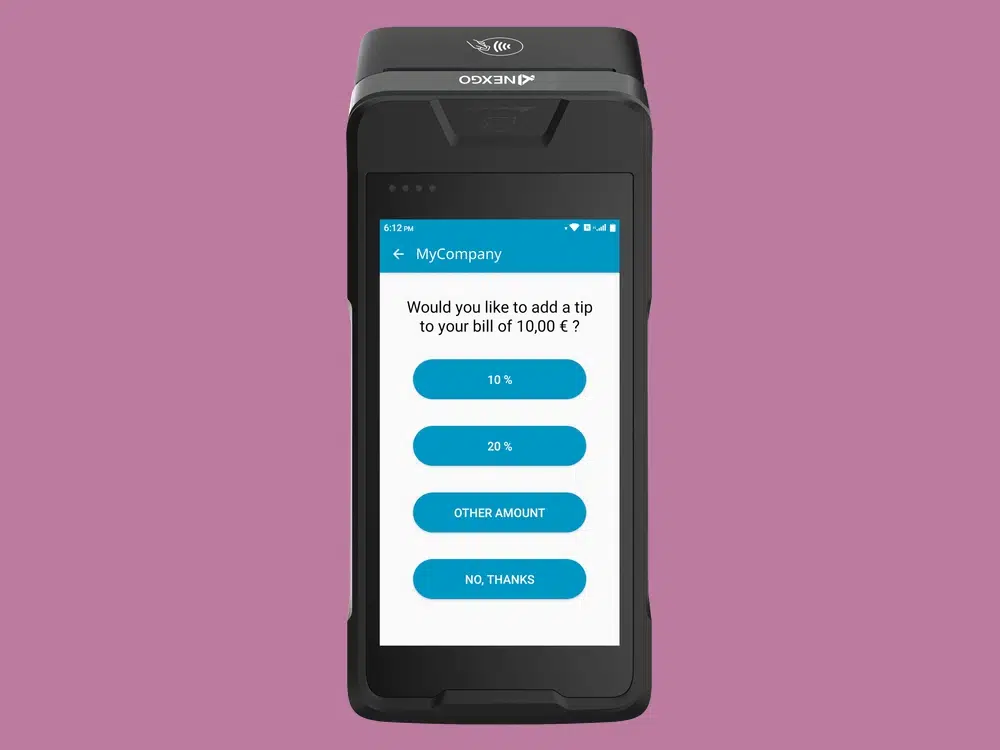

Taxi drivers will like the ease of use on either card machine: you just enter the transaction amount and hand the customer the terminal for a contactless tap or chip card payment. A virtual PIN pad shows on its display when this is needed, and tipping options can be added if you activate this feature.

Receipts can be texted and emailed, or printed via the built-in receipt printer in Yavin Terminal. The Reader model does not have a receipt printer.

Although it’s super-easy to start using the card machines straight from the box, it does take up to 10 working days to receive them from mainland Europe.

So far, the service only accepts Visa, Mastercard, Apple Pay and Google Pay. Payouts settle in your choice of IBAN account within 2-3 business days, which is an industry standard of speed, but slower than most other options in this comparison.

The full price is €179 + VAT for Reader or €199 + VAT for Terminal, but a voucher code gives you a 50% discount so it’s only €89.50 or €99.50 + VAT upfront.

Accepted cards

Then you have to pay €29 monthly (VAT not applicable) for the privilege of using the card terminal, but this can be paused any month you don’t use the product. There’s no lock-in period, so you can cancel the service altogether at any point.

You pay a variable interchange fee + 0.5% + €0.05 per transaction. Interchange fees are Visa’s and Mastercard’s standardised rates that vary according to the type of card accepted.

For instance, domestic consumer debit cards have the lowest rates while foreign, commercial credit cards carry higher fees. In most cases, merchants pay less than 1% in total for a transaction, which is considerably less than alternatives on this list.

Learn more: Yavin Terminal review

Elavon Mobile (previously MobileMerchant) is a basic card reader that works with an app on a smartphone or tablet (iOS or Android) via Bluetooth. As long as your mobile device has a WiFi/3G/4G connection, the reader can accept cards anywhere.

It’s an affordable option you can buy for €19 + VAT – but this price can vary. There are no monthly fees or long-term contracts.

For Visa and Mastercard transactions, the 1.75% fee is attractive, but this cost is higher for other cards.

Elavon Mobile resembles a calculator, but also comes in white.

You might also need to pay other fees, such as chargeback or paper statement fees.

On the upside, all funds are deposited into your bank account the next working day for no extra cost.

The Elavon card reader is small and lightweight. It will be easy to use inside a cab, but it looks quite basic, resembling a calculator with its push-button keypad and flat, rectangular shape.

The app has tipping and cash features but is rarely updated, so you might come across issues while trying to process payments.

The good news is that you can accept a good amount of cards: Visa, Mastercard, V Pay, JCB, UnionPay, American Express and Diners Club cards, as well as Apple Pay and Google Pay.

Accepted cards

Elavon Mobile’s customer support is available 24/7, which is great for taxi drivers taking passengers on weekends or evenings.

Learn more: Elavon Mobile review

Verdict: which credit card machine is best for taxi drivers?

Choosing the best card machine as a taxi, hackney, limousine or other private hire card driver is about understanding what is more relevant to you.

We generally recommend SumUp for its excellent value, with its fixed card rate for all cards, free business account and range of low-cost card readers that all work on the go. Solo Lite lasts longest from a full charge but requires an app, whereas Solo suits drivers who prefer a standalone terminal.

Square Reader comes with many free payment tools in its linked Point of Sale app, and it’s a reliable card reader as long as your smartphone has a live connection with a mobile network or WiFi.

myPOS Go is the only alternative that works across borders, and its complimentary business account and Visa card give you the flexibility to spend earnings immediately.

Revolut Reader is really useful if your main business account is with Revolut. The low domestic transaction rate on consumer cards is a real asset, but if you have lots of Northern Irish clients, the higher rate would apply.

Yavin is recommended for taxi drivers in search for something more robust and with enough transactions to afford the fixed monthly cost. It’s certainly the best quality terminal, but hasn’t got the same amount of software features as Square or SumUp.

Finally, the app-based Elavon Mobile is a cheap and simple card reader, but you might face problems with the app that’s not as modern as our other recommendations above.

| Payment machine | Best For | Website |

|---|---|---|

|

Popular option for those who need a flexible, low-cost device with a predictable rate | |

|

Good, cheap card reader that connects with interesting features on your mobile phone or tablet | |

|

Almost instant transfers with a debit card for spending the money straight away | |

|

Low rate on Irish consumer cards and myriads of banking features in business account | |

|

High-quality terminal, for those with enough transactions to afford the monthly cost | |

|

Basic app-based option and cheap upfront, 24/7 customer support line |

| Payment machine |

Best For | Website |

|---|---|---|

|

Popular option for those who need a flexible, low-cost device with a predictable rate | |

|

Good, cheap card reader that connects with interesting features on your mobile phone or tablet | |

|

Almost instant transfers with a debit card for spending the money straight away | |

|

Low rate on Irish consumer cards and myriads of banking features in business account | |

|

High-quality terminal, for those with enough transactions to afford the monthly cost | |

|

Basic app-based option and cheap upfront, 24/7 customer support line |