SumUp got some serious competition when Square Payments arrived in Ireland. The two payment providers have a lot in common.

American Square was the first to introduce an app-based card reader in 2009; then German SumUp launched their own in 2012. SumUp targeted European merchants who wanted to get paid simply, while Square pioneered easy access to payment tools – two sides of the same coin, but it shapes their products differently.

Key features of SumUp and Square:

|

|

|

|---|---|---|

| Products | Card processing, card machines, EPOS, payment tools, business account | Card processing, card machines, EPOS, payment tools |

| Strengths | Simple payment products that everyone understands | Quality, versatile payment features at a low cost |

| Contract | No lock-in, pay-as-you-go | No lock-in, pay-as-you-go |

| Card rate | Chip, tap: 1.69% Online, invoice: 1.69% Virtual terminal: 2.95% + 25¢ |

Chip, tap: 1.75% + VAT Online: 1.4%-2.9% + 25¢ + VAT Virtual terminal, invoice: 2.5% + VAT |

| Card machines | €25–€99 + VAT | €19–€169 + VAT |

| POS systems | SumUp App (free) Point of Sale |

Point of Sale (free) POS for restaurants, retail and appointments |

| Remote payments | Payment links, online store, virtual terminal, invoicing, gift cards | Payment links, online store, virtual terminal, invoicing, gift cards |

| Payouts | 2-3 working days 1 day with SumUp Business Account |

1-2 working days |

| Accepted cards | ||

| Contactless |

Both are suited for in-person and remote transactions with ecommerce options, but we’ve noticed some differences:

- While SumUp offers many payment methods, the card readers and individual online payment features feel bare-bones. This makes it easier and faster to use the app and terminals.

- Square has more payment and business management features, but this also makes the back office interface crowded and a little confusing sometimes, in spite of its general user-friendliness.

- Both platforms are excellent all-in-one solutions with most business functions needed in a small business, but only Square can scale up with advanced integrations.

So which one of them should your business choose in Ireland?

Very different card readers

Compared with the closest market leaders in Ireland – like Clover by AIBMS and Elavon – SumUp and Square offer some of the cheapest card readers with the lowest fixed rates. And they are not only affordable, but also (in most cases) of decent quality for the price, confirmed by our use of them over time.

Some of the card readers work with an app and others work on their own. Let’s start with the app-based, most inexpensive readers.

SumUp’s new Solo Lite reader connects with an iPhone, iPad or Android tablet or smartphone with SumUp App downloaded. It uses the mobile device’s internet connection to process payments online and sync transactions in the cloud. SumUp Solo Lite has a keypad for PIN entry and accepts chip and contactless card payments.

Photo: Mobile Transaction

Square Reader is very small and lightweight.

Photo: Mobile Transaction

SumUp Solo Lite works with an app.

Square Reader also connects to an app on a compatible mobile device with any of the Square POS apps downloaded: the free Point of Sale (iPad, iPhone or Android) or one of Square’s other POS systems for restaurants, retail or professional services.

Like SumUp Solo Lite, Square Reader uses the mobile device’s 4G or WiFi connection to process transactions from the till app. However, Square Reader does not have a physical keypad, so customers have to enter their PIN in the connected app.

Then you have the standalone card terminals that are more expensive because they connect directly to the internet to process payments.

The SumUp Solo card reader does this through a built-in SIM card with unlimited data for 4G connectivity, or WiFi. This means you can take card payments anywhere with wireless internet, even if the mobile network is weak.

Although it comes with a nice dock for the table and a pretty touchscreen instead of physical buttons, Solo’s functions are quite basic. You simply enter the transaction amount on the screen, tap or insert a card and send a digital receipt following a transaction.

Photo: Mobile Transaction

The cheaper SumUp Solo comes with a stand.

Photo: Mobile Transaction

SumUp Solo with printing and charging cradle.

The SumUp Solo and Printer bundle contains the Solo card reader and a receipt printer attachment that also keeps the reader charged all day.

“When testing SumUp Solo without a printer, our battery didn’t last for very long. The Solo printer really helps because it charges the terminal on the go, so we never ran out of power in a day.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Square has one standalone card machine: Square Terminal – a smart POS terminal with a large touchscreen. It only works with a closed WiFi network or broadband connection through an additional adaptor and cable (extra cost). Square Terminal does not have a SIM card, so won’t work with mobile networks out and about.

Photo: Mobile Transaction

Square Terminal works with WiFi only.

So it’s made for portability around your business premises, not in random locations at, for example, a client’s house.

The default software on Square Terminal is the Square Point of Sale app, so it works as a portable checkout or small POS-and-payments terminal on a countertop. It’s also now possible to link the terminal with Square’s other POS systems for a more tailored setup.

Apart from these card payment devices, Square has an iPad stand (Square Stand) and tablet register (Square Register) with tap and chip card acceptance built in.

Square is compatible with more hardware. For example, restaurants can connect a kitchen printer so quick-service ordering runs smoothly. SumUp Solo, on the other hand, doesn’t connect with other receipt printers than its own and doesn’t link with cash drawers or barcode scanners.

My own experience of the card machines is that Square’s are better quality and seem to last longer than SumUp’s. But I should note: SumUp’s card machines accept more card brands – Diners Club, Discover, UnionPay and JCB on top of the other major card brands accepted by both.

New option: Tap to Pay on a smartphone

Sometimes, merchants might not have a card reader handy, in which case Tap to Pay on Android is now an option for both SumUp and Square users.

This is basically where cardholders pay with their contactless card or mobile wallet directly on your Android phone instead of a dedicated card reader. Transaction rates are the same as card reader rates, so there’s no penalty charge for using it.

As of yet, this function doesn’t work on iPhone in Ireland, so only businesses using NFC-enabled Android devices benefit.

Fees: pay as you go, with small differences

Neither SumUp nor Square requires contractual commitment or monthly fees. Instead, you create a free account, purchase a card machine upfront and pay only a fixed transaction rate for successful payments.

There is no minimum monthly sales volume required or fixed monthly fees for the basic point of sale (POS) apps.

| Costs |  |

|

|---|---|---|

| Card reader with app* | SumUp Solo Lite: €25 | Square Reader: €19 |

| Standalone terminal* | SumUp Solo: €69 SumUp Solo & Printer: €99 |

Square Terminal: €169 |

| Chip, tap transactions | 1.69% | 1.75% + VAT |

| Ecommerce, link transactions | 1.69% | EU & EEA cards: 1.4% + 25¢ + VAT UK & non-EEA cards: 2.9% + 25¢ + VAT |

| Invoice transactions | 1.69% | 2.5% + VAT |

| Virtual terminal transactions | 2.95% + 25¢ | 2.5% + VAT |

| Keyed card entry in app | 2.95% + 25¢ | 2% + VAT |

| Chargebacks | €10 each | Free |

| Refunds | Free before payout, transaction fee retained after that | Transaction fee is retained |

*Excluding VAT.

|

|

|---|---|

| Card reader with app* | |

| SumUp Solo Lite: €25 | Square Reader: €19 |

| Standalone terminal* | |

| SumUp Solo: €69 SumUp Solo & Printer: €99 |

Square Terminal: €169 |

| Chip, tap transactions | |

| 1.69% | 1.75% + VAT |

| Ecommerce, link transactions | |

| 1.69% | EU & EEA cards: 1.4% + 25¢ + VAT UK & non-EEA cards: 2.9% + 25¢ + VAT |

| Invoice transactions | |

| 1.69% | 2.5% + VAT |

| Virtual terminal transactions | |

| 2.95% + 25¢ | 2.5% + VAT |

| Keyed card entry in app | |

| 2.95% + 25¢ | 2% + VAT |

| Chargebacks | |

| €10 each | Free |

| Refunds | |

| Free before payout, transaction fee retained after that | Transaction fee is retained |

*Excluding VAT.

The app-dependent card readers are the cheapest: €25 + VAT for SumUp Solo Lite and €19 + VAT for Square Reader. Both have free payment apps to go with them.

Square Terminal comes in at €169 + VAT, but it does have a built-in receipt printer and POS software installed. The closest SumUp gets to that is the SumUp Solo and Printer package for €99 + VAT, or €69 + VAT without the printer.

Photo: Mobile Transaction

Receive next-day payouts with SumUp Mastercard.

Transactions through SumUp’s card machines cost 1.69% regardless of the card brand, country of issue or type of card (e.g. premium, consumer, business). In comparison, Square’s chip and tap transactions are 1.75% + VAT regardless of the card type. So SumUp’s chip and tap rate is lower overall.

Square charges different rates for EEA and non-EEA/UK cards through the online store, payment links, QR codes and eGift cards, plus a fixed €0.25. The fixed fee makes small transaction values expensive, so it’s best to accept high amounts online.

SumUp charges the same fee for payment link, QR code, online store, invoice and gift card transactions as the card reader payments: 1.69%. Keyed transactions through the app or virtual terminal cost 2.95% + 25¢.

“SumUp’s low fee for online payments is a real selling point, especially since no VAT is added. Square adds VAT to its rates, charges more for transactions and adds a fixed fee that bumps up the cost of ecommerce transactions.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Square does not charge for chargebacks, but SumUp has a €10 chargeback fee. If you refund a transaction within 2-3 days (before the payout is settled), the refund has no charge with SumUp – otherwise, it costs the original transaction fee. Square retains the original transaction fee when processing a refund, regardless of whether the payout took place or not.

Neither platform charges for standard payouts to your bank account.

With SumUp, settlement takes 2-3 working days, but with the complimentary SumUp Business Account and Prepaid Mastercard, you always have access to transactions the following day (including weekends) in an online account. This account comes with an IBAN so you’re able to transfer money to other countries, not just within Ireland.

Square just settles money in your bank account within 1-2 working days and offers no business account.

Photo: Mobile Transaction

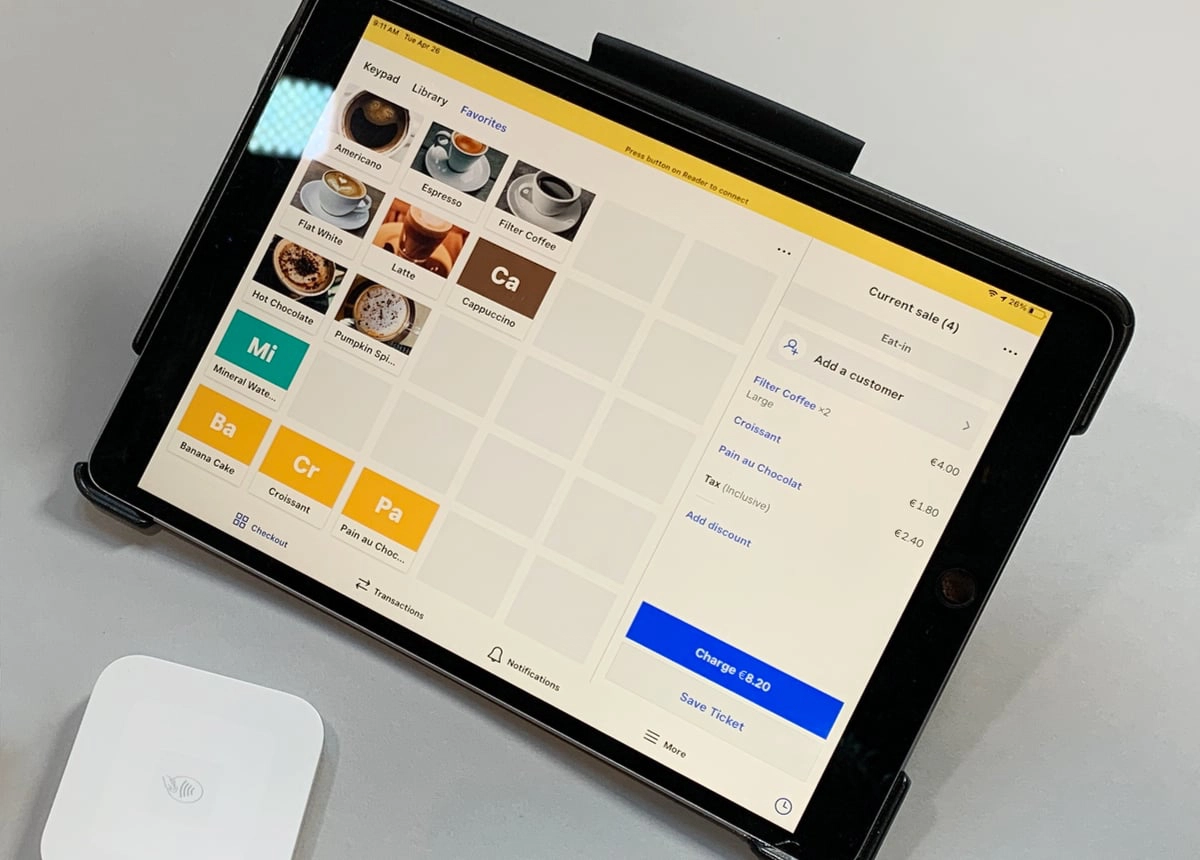

Square Point of Sale (pictured) has more till features than SumUp App.

More POS features through Square

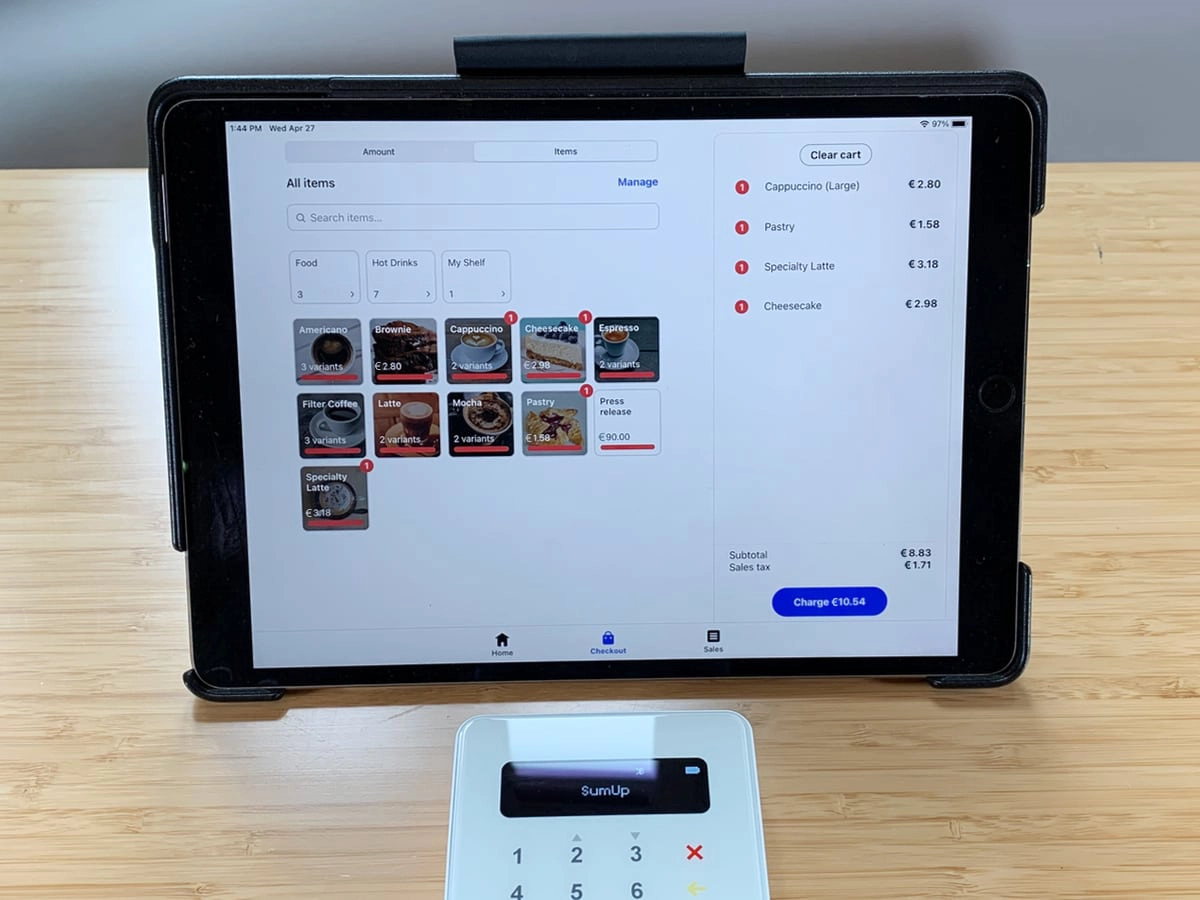

Many micro-businesses find there are enough POS features in either of the free apps, but the most advanced of the two is Square Point of Sale.

SumUp and Square both have an inventory library with product variants, images and VAT rates. There are options for tipping, accepting cash and refunding payments, and transactions and payout statuses can be accessed in the apps. Staff members can have their own logins with restricted access to certain features.

On top of that, Square has more features for inventory, employee management (incl. timesheets), splitting the tender, attaching customers to bills, discounting, marking transactions for eat-in, delivery, pick-up or takeaway, and more. You can view sales reports in the Square POS app and sell or accept gift cards (physical or online) from the till. These functions are lacking in SumUp App.

Photo: Mobile Transaction

SumUp App is a simple point of sale without in-depth inventory features (here pictured with the old SumUp Air card reader).

SumUp offers a more advanced POS system: SumUp Point of Sale (previously Goodtill). It has POS features for both retail and hospitality in its main subscription, with optional add-ons for advanced stock and a kitchen display system. There’s also SumUp Bookings, a free appointments system for booking clients.

Otherwise, SumUp integrates with Loyverse which is not the most advanced POS system.

Square has three upgrade options: Square for Restaurants, Square for Retail and Square Appointments. These actually have a free plan too, so you can use the fundamental app version of them, then upgrade when serious about using the full version. The card reader cannot currently connect with other POS systems in Ireland.

The Square platform can be extended with different third-party apps for advanced functions like inventory management, online ordering, accounting and marketing. But you may not be dependent on integrations since additional tools are continually added to the platform.

SumUp only connects with the above POS systems and PrestaShop as the only ecommerce platform – no accounting systems. Instead, SumUp tries to offer a broad enough toolset within the platform.

Remote payments included, but more with Square

Square and SumUp merchants benefit from multiple ways to get paid remotely, but they have slightly different features.

The overall payment methods overlap (see table below), but Square tends to have more advanced features within each method.

|

|

|---|---|

| Payment links | |

| Online Checkout: Links for transactions, individual products & donations (created in app or browser) to send, text or share online. Embeddable pay buttons. QR codes to share or print. | Payment Links: Links for transactions (created in app) sent as SMS or shared via email or app. QR codes to share or print. |

| Over-the-phone payments | |

| Virtual Terminal: Available in web browser. Linked with product library. Set up recurring payments (card on file). | Virtual Terminal: Available in app & web browser. Only basic details entered. |

| Ecommerce | |

| Online: Full-fledged online store builder (free & paid plans). Free online ordering page for delivery, takeaway & pickup. | Online Store: Create basic web store page from app or web. Basic delivery & pickup options. |

| Invoices | |

| Invoices: Send email invoices from app & browser (free & paid plan). Dedicated invoice app. | Invoices: Send email invoices from app & browser. Create credit notes, quotes & delivery notes in browser. |

|

|

|---|---|

| Payment links | |

| Online Checkout: Links for transactions, individual products & donations (created in app or browser) to send, text or share online. Embeddable pay buttons. QR codes to share or print. | Payment Links: Links for transactions (created in app) sent as SMS or shared via email or app. QR codes to share or print. |

| Over-the-phone payments | |

| Virtual Terminal: Available in web browser. Linked with product library. Set up recurring payments (card on file). | Virtual Terminal: Available in app & web browser. Only basic details entered. |

| Ecommerce | |

| Online: Full-fledged online store builder (free & paid plans). Free online ordering page for delivery, takeaway & pickup. | Online Store: Create basic web store page from app or web. Basic delivery & pickup options. |

| Invoices | |

| Invoices: Send email invoices from app & browser (free & paid plan). Dedicated invoice app. | Invoices: Send email invoices from app & browser. Create credit notes, quotes & delivery notes in browser. |

Square offers remote payment features for nearly any situation, whereas SumUp prioritises ease of use over complexity.

For example, Square Virtual Terminal allows you to split the payment into different payment methods, itemise bills with existing products from your library, set up recurring payments associated with a customer profile (with a ‘card on file’ function), and more. You can only add an amount, description and payment details in SumUp’s Virtual Terminal.

Square Invoices has its own app for managing invoices and deposits, sending estimates and recurring billing. Advanced features like payment milestones, project folders and custom fields on invoices can be added for €20 per month.

SumUp also has email invoices, but not with its own app. The free invoicing software in SumUp Dashboard is, however, quite varied and complete. You can, for example, send credit notes which is not possible with Square.

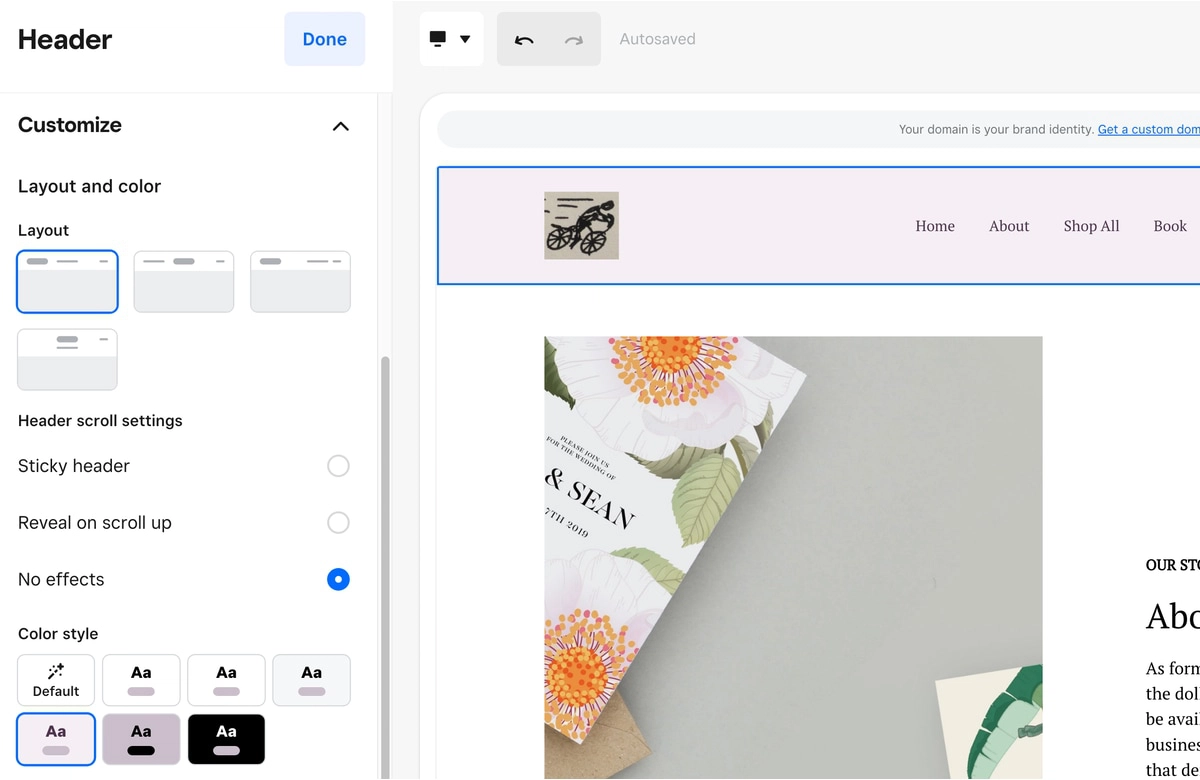

Image: Mobile Transaction

The free Square Online plan has a basic website editor for simple ecommerce sites.

Square Online is a website builder that can be used for free with limited features, or on paid plans for a professional-looking website. The free version lets you create an online ordering page for click-and-collect, drop-off or delivery orders, and you can sell e-gift cards online. This can be combined with QR codes printed off so customers can order from their tables.

In comparison, SumUp Online Store offers an extremely fast way to create a very basic store page with a unique URL to share online. It allows customers to order items for shipping, delivery or pickup.

“With Square, you’re better equipped to grow an online business, whereas SumUp gives you very accessible online selling tools in the app. I can’t say which is the “best” option, since those are things merchants prioritise differently.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Square Online Checkout lets you create payment links (or QR codes) for individual products, transactions, donations (open or fixed amounts) or buy buttons to embed on your existing website. Online purchases through the links are managed in a dedicated orders section in the Dashboard.

SumUp’s payment links are sent from its POS checkout via text, social apps or email. You can also generate QR codes to place around your premises for a fixed or open amount, or show a QR code on your checkout screen for customers to scan at the till.

Square more adaptable, SumUp makes things simpler

SumUp and Square excel at making payments extremely accessible for small businesses.

It’s quick to sign up online, affordable to get a card reader, and their software is some of the most user-friendly even for non-techy merchants. Unlike Clover, you get no long-term contract, and are not required to pay a fixed monthly fee, just a few predictable card rates.

Square has considerably more register features and payment tools than SumUp, particularly for food and drink. Growing businesses can connect Square with different software platforms for accounting, ecommerce etc., whereas SumUp hardly has integration options.

But SumUp does offer a free Mastercard and Business Account that can act as a replacement for a bank account. Mobile SumUp merchants can access the virtual terminal and business account or create a basic online store from an app, none of which you can do in Square’s app.

Then again, Square has its own app for invoicing and staff management, plus sales reports in the app. Square merchants also have lots of tools in the online dashboard for business owners to expand online and analyse sales from afar.

In short, Square is expandable but user-friendly, while SumUp is slightly cheaper for merchants who don’t want too many bells and whistles.