We’ve tested Square’s card terminals and features at different times, in different countries, so our review is based on first-hand experience. Let’s first look at the key aspects of Square and our opinion, then go into details about it.

We love the Square Payments system, because it’s one of Ireland’s few truly affordable, quality card processing solutions for individual merchants and small companies.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

What is Square?

Square, or Squareup, is an all-in-one payments platform for small businesses.

Originating in the US, it was the first company in the world to release a card reader used with a mobile app – and in 2021, Square arrived in Ireland too.

It’s a market leader for coffee shops in the US, but Square is still more widely used in the UK than Ireland on the European side.

These are the products and services that Square Ireland offers:

It takes a few minutes to create an account on the Square website – no quote or phone call needed. You then have instant access to the browser-based Dashboard where you can accept payments remotely, or you can download one of the point of sale (POS) apps to start customising your register software.

Square card reader offer

No monthly fees or contract. Free delivery in 3-5 working days.

Mobile Transaction is an independent payments industry resource, trusted by over a million small businesses yearly.

Discounts do not influence our ratings , which are based on full retail price. (Policy)

The card readers accept the most popular debit and credit cards including Visa, Visa Electron, V Pay, Mastercard, Maestro and American Express. It also accepts the mobile wallets Apple Pay, Google Pay and Samsung Pay.

Accepted cards

Our opinion: a lot of value, less “premium” service

If value for money is key to your choice of card reader, Square is one of our top choices in Ireland.

It has the most free features for the price of a cheap card reader and fixed transaction rate – or you can just use the app, Tap to Pay or online payments without buying anything.

The pay-as-you-go structure with no contractual commitment makes it a good place to start at a low cost. Square’s fixed rate is higher than SumUp’s, but then it covers more such as chargebacks and more specialised apps.

We especially love the many online payment tools, which make you more resilient in the face of unpredictable market conditions. What’s more, this isn’t a closed platform, so growing businesses can connect it with external software for e.g. inventory and accounting.

Still, some users have highlighted that the customer service is limited. Despite the sleek looks of the POS terminal and user-friendly software, Square doesn’t invest much in personal service, so you’re left to set everything up yourself.

We’ve never needed support since all the products are generally easy to figure out, but some merchants might need it if they have a complex business setup.

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good Software: Good |

Good |

| Cost and fees | Good |

| Value-added services | Good / Excellent |

| Contract | Excellent |

| Sign-up and transparency | Excellent |

| Customer service | Passable / Good |

| FINAL RATING | [4.3/5] |

Bottom line: Square is one of the best payment solutions for small businesses in Ireland, given its user-friendly products, fair and transparent costs and excellent value with its suite of payment tools.

What we like and don’t like about Square

Pros

Cons

Pricing

Square card processing fees are just a fixed rate of 1.75% + VAT per chip and contactless payment regardless of the card brand, country of issue or whether it’s premium. Cash payments are free to process. No additional or monthly fees apply.

You don’t commit to a contract period, nor do you need to sell every month or reach a certain sales volume.

In Ireland, we’ve had reports that merchants who use the Restaurants and Retail POS systems (pricing further down) can negotiate transaction fees so they’re around 0.8%. And if your transaction volume exceeds €100k annually, you can also have lower fees.

Square’s general fees:

| Square Payments | Fees |

|---|---|

| Monthly fee | None |

| Chip, contactless | 1.75% + VAT |

| Online store, payment links | EU and EEA cards: 1.4% + 25¢ + VAT UK and non-EEA cards: 2.9% + 25¢ + VAT |

| Manual card entry in app | 2.95% + 25¢ |

| Invoice, virtual terminal | 2.5% + VAT |

| Refunds | Original transaction fee is retained |

| Chargebacks | Free |

Remote or online payments are charged a higher rate. Manual card entry transactions in the Point of Sale app cost 2.95% + 25¢ (both when the customer is and is not present). Virtual terminal and invoice payments cost a bit more at 2.5% + VAT.

Online payments through the online store, payment links and eGift Cards are 1.4% + 25¢ + VAT for Irish, EU and EEA cards and 2.9% + 25¢ + VAT for UK and non-EEA cards.

Refunds cost the original transaction fee, but the cardholder gets the full refund amount back. Chargebacks are free and dealt with by a dedicated support team for payment disputes.

Payments are deposited in your bank account within 1-2 working days. This is the default, but you can also set it to manual deposits if that simplifies bookkeeping.

Square’s hardware costs:

| Hardware | Price |

|---|---|

| Square Reader | €19 + VAT |

| Dock for Square Reader | €35 + VAT |

| Square Terminal | €169 + VAT |

| Square Stand with built-in tap/chip readers | €119 + VAT |

| Square Register | €599 + VAT |

Square Reader costs €19 + VAT, and the optional Dock for charging and keeping the card reader in place costs €35 + VAT.

The newest Square Stand (2nd generation), that accepts contactless and chip cards, is €119 + VAT. If you want to avoid buying an iPad, you can opt for the all-in-one Square Register for €599 + VAT which combines a fancy-looking tablet screen and card reader into a complete checkout.

The general Point of Sale app is free. Additional employee permissions can be added for €25 + VAT per month per location (Team Plus subscription).

The specialised POS systems Square for Restaurants, Retail or Appointments have a free plan to get you started, but they require a paid subscription for advanced features (starting from €19 + VAT monthly per location).

There’s a free, basic online store plan, but you can upgrade to more features on paid ecommerce plans (€25-€69 per month on an annual plan).

Any third-party integrations are paid for separately through those other software platforms.

Square card reader

The most popular of the products is Square Reader, a pocket-sized card reader handy for contactless payments especially, though it accepts chip cards too.

It connects with a phone or tablet via Bluetooth, processing payments through an accompanying app. It works with iPad, iPhone and Android tablets or smartphones.

It’s quite small at 66 x 66 x 10 mm and 56 g, but then you need one of Square’s POS apps on a mobile device with Bluetooth activated to use it.

Photo: Emily Sorensen (ES), Mobile Transaction

Square Reader is quite small.

Square differs from other card readers in Ireland because customers need to enter their PIN on the touchscreen of the phone or tablet rather than a physical PIN pad.

What’s more, the card reader has no display, meaning the transaction amount and tipping options are displayed only in the app.

Some don’t like inputting their PIN on a personal smartphone, but the general public has got more used to it now.

Photo: ES, Mobile Transaction

PIN entry happens in the connected app on the mobile device screen.

Either way, we recommend positioning the mobile screen so it’s easy to shield the on-screen keypad during PIN entry, allowing customers to feel safe doing so.

Alternatively, the Tap to Pay option allows Square users to accept contactless cards and mobile wallets directly on their iPhone or Android device – no card reader needed. For this to work, you need NFC (near-field communication) activated on the phone.

Square POS app

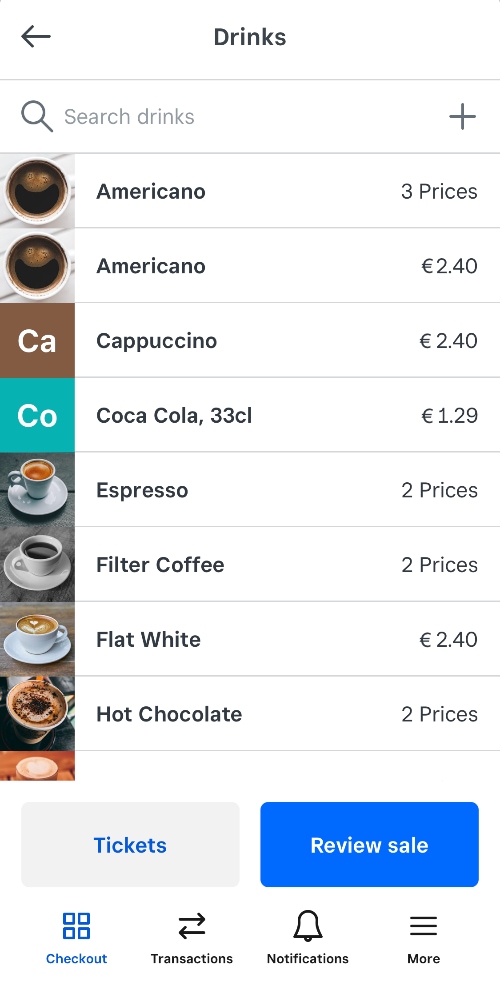

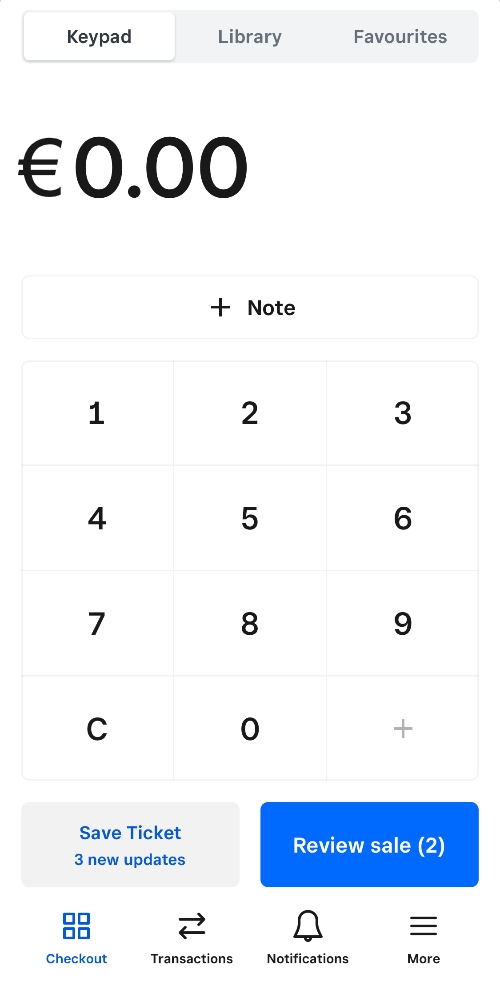

The free POS app Point of Sale is a big draw. It has the widest breadth of free features in Ireland for managing sales and business operations from any compatible Android or Apple device.

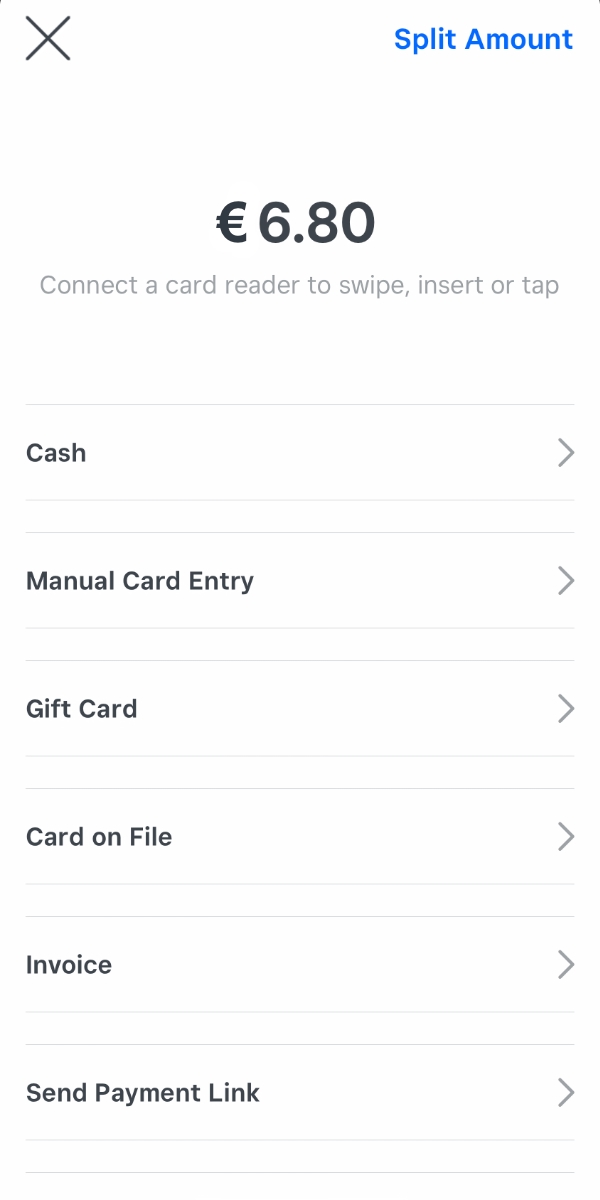

Apart from accepting cards through the contactless and chip reader, you can manually enter card details, send invoices and accept cash as well as create custom discounts, add tips and split the tender so customers can pay some of the transaction with a card and the rest with cash. You can also sell digital gift cards to be redeemed in your store.

The product inventory is great for tablets especially, as you can view a neat grid of products, the layout of which can be customised. Each product can have a picture, description, types (e.g. red, black, pack of 2, pack of 5), different prices for each type, and stock levels.

Mobile Transaction

Products in Square POS app.

Mobile Transaction

Add a euro amount to bill.

Mobile Transaction

POS app’s payment options.

To get the most out of Square’s tools, we suggest adding your products to the library before using the app. You can then track product popularity and differentiate between items when processing refunds. And of course, it makes it easier at checkout to just tap the product instead of manually entering each item or calculating a sales total, which are both possible.

You can also take advantage of the customer library where customer profiles can be added. This allows you to attach people to specific transactions, get customer feedback, track product preferences and manage sales more efficiently.

Businesses can add staff accounts with limited permissions in the app. Creating a user account for each employee enables you to create time sheets in Square for tracking hours and overtime worked.

More advanced POS systems available

Restaurants can upgrade to Square for Restaurants, retailers to Square for Retail and professional services to Square Appointments, with features tailored to those industries.

The highly customisable Restaurants POS app for hospitality is a viable alternative to Clover by AIB’s modular POS system. It has table plans, menu and course management options, a kitchen display system (KDS) and much more for a fraction of the cost of Clover.

The Retail POS app mainly offers more inventory and vendor management and better reporting, while Appointments POS is for scheduling workshops, service sessions, classes and anything else that’s time-based.

So far, you can only integrate Square with Ricochet in Ireland as an alternative point of sale. So if you opt for Square, check if it has the right POS system for your needs.

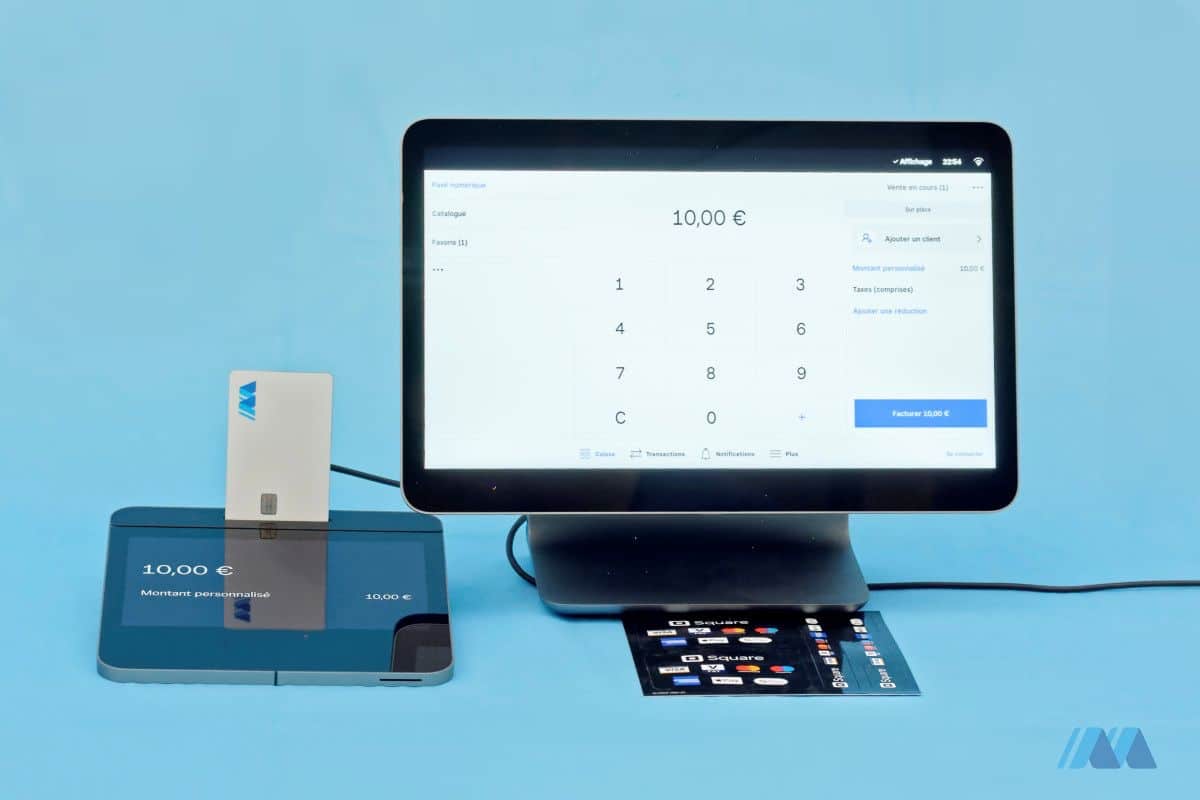

Square Reader vs Square Terminal

If a POS app on a mobile device is not for you, the card machine Square Terminal works independently. This is a touchscreen smart terminal with integrated POS features (similar to Point of Sale app) navigated directly on the card machine screen. It takes chip, contactless and swipe cards and accepts PIN codes on its touchscreen PIN pad, similar to how you would use a traditional card machine.

Given the large touchscreen and integrated software, Square Terminal is much bigger than the credit card reader. It also has a built-in receipt printer so you don’t need a separate one connected.

While the card reader works with 4G and WiFi through a connected mobile device, Terminal only works with a secured WiFi connection. If you purchase a ‘Hub for Square Terminal’, it can be connected to an Ethernet cable as well.

In other words, Reader is more suitable for on-the-go payments and Terminal best for a fixed location or area with a closed WiFi setup.

Photo: ES, Mobile Transaction

Square Terminal has Point of Sale app built in, while Square Reader only reads cards.

Square alternatives in Ireland

So how does Square compare with other card payment services in Ireland?

Clover’s touchscreen terminals may look similar, but they have myriads of fees and contractual commitment. We know Clover has been popular for years, but believe that’s more because of a lack of choice in the past than actual value for money.

The other main competitor is SumUp that – like Square – has pay-as-you-go fees without a monthly charge or contract.

SumUp’s card readers have a PIN pad made of flat, touch-sensitive glass that’s easy to wipe. In contrast, Square Reader is smaller and comes with more POS app features.

Photo: ES, Mobile Transaction

Square Reader (left) is smaller than the old SumUp Air (right).

As for standalone card machines, SumUp Solo is cheaper than Square Terminal, but its software is too basic for some merchants (e.g. no inventory or customer library). But Square Terminal only works with WiFi, not mobile networks like SumUp’s card machines.

myPOS is another pay-as-you-go merchant service, but it’s more complicated to set up and use, with confusing fees too. Those with a Revolut account could try Revolut Reader, but the associated POS features are much more limited than Square’s.

Restaurants and cafés might want to look at other hospitality POS systems for an informed decision about whether Square is best.

Hardware and accessories

For a full point of sale setup, you can wirelessly connect Square with compatible receipt printers, kitchen printers (for restaurants), cash drawers and barcode scanners. What other accessories are available? The card reader dock can be attached to a countertop and keeps the reader charged all day.

Square Stand for iPad enables you to swivel the tablet screen to face the customer for PIN entry. It has a contactless reader and chip card slot built in so you don’t need an additional card reader next to it. But the stand is only compatible with 10.2” or 10.5” iPads, not Android or other iPad sizes.

Square-branded equipment generally looks very Apple-inspired – sleek and minimalistic – so prioritising iPad compatibility is not surprising.

Quite a few receipt printers work with the system, but some only work via Square Stand in which case you need to use iPad, not Android. There is also a compatible kitchen printer that can withstand heat, which is ideal for printing order tickets in hot restaurant kitchens.

Photo: Emmanuel Charpentier, Mobile Transaction

Square Register is a complete checkout, without a cash drawer (it can be added, though).

Square Register is a smart choice if you plan on using Square’s POS system for more than a year. It has a tablet screen and customer-facing card terminal, though not a cash drawer.

We loved unpacking and using Square Register – it feels like an Apple-grade device that’s super-easy to use. It’ll turn heads at a checkout where aesthetics are important.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

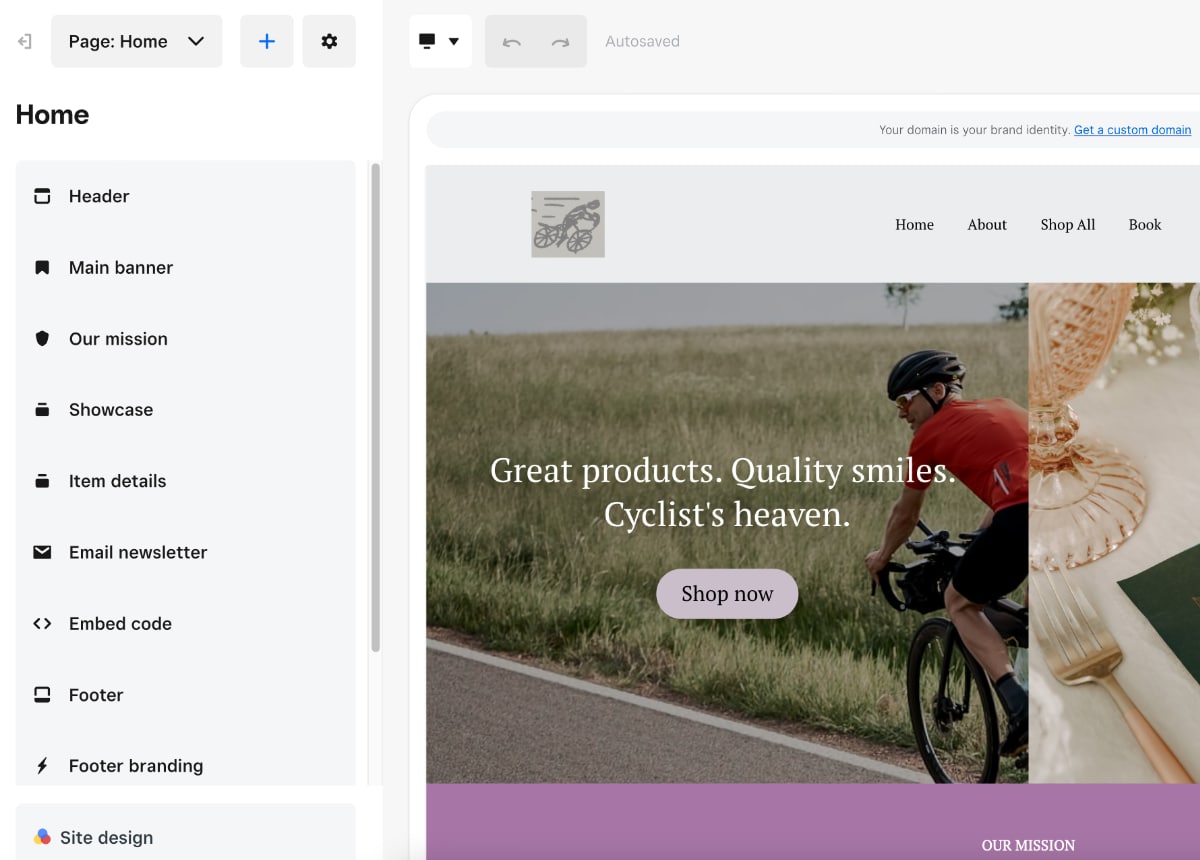

Online payment options are varied

Square is a payment platform, first and foremost. Card machines are only part of the picture. In fact, the many remote and online payment options available for free through the dashboard (browser portal) or an app are second to none.

All Square merchants have free access to:

- Basic online store builder

- Online ordering page

- Payment links

- QR code payments

- Email invoices (with dedicated app)

- Virtual terminal for telephone payments

- E-gift cards

Payment links and QR codes (Online Checkout) are accessed in the Point of Sale app or the Dashboard. Invoices can be sent from and managed in the Point of Sale app or through the dedicated Invoices app.

Image: Mobile Transaction

Square Online lets you build and launch an online store via a simple website editor.

An online ordering web page can be created and linked to a QR code to display in store for contact-free ordering. The ordering page is also ideal for click-and-collect, or you can create a complete online store with shipping or collection options at checkout through Square Online.

The website builder is quite basic compared to a full-fledged ecommerce platform like Wix or Shopify, but it’ll do for merchants who just need an easy website for selling online. Plus, the online store can be connected to takeaway platforms through Deliverect, and many other ecommerce integrations are available to expand your online services.

Transactions over the phone or by mail order can be completed in the Virtual Terminal. From any desktop browser, you can log in to the Square account and go to the Virtual Terminal section where you key in a customer’s card and transaction details.

If you’re planning to sell online or over the phone without a subscription, Square trumps all the alternatives in Ireland. We have simply not seen a better virtual terminal, ecommerce or payment link features more extensive at no monthly cost.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

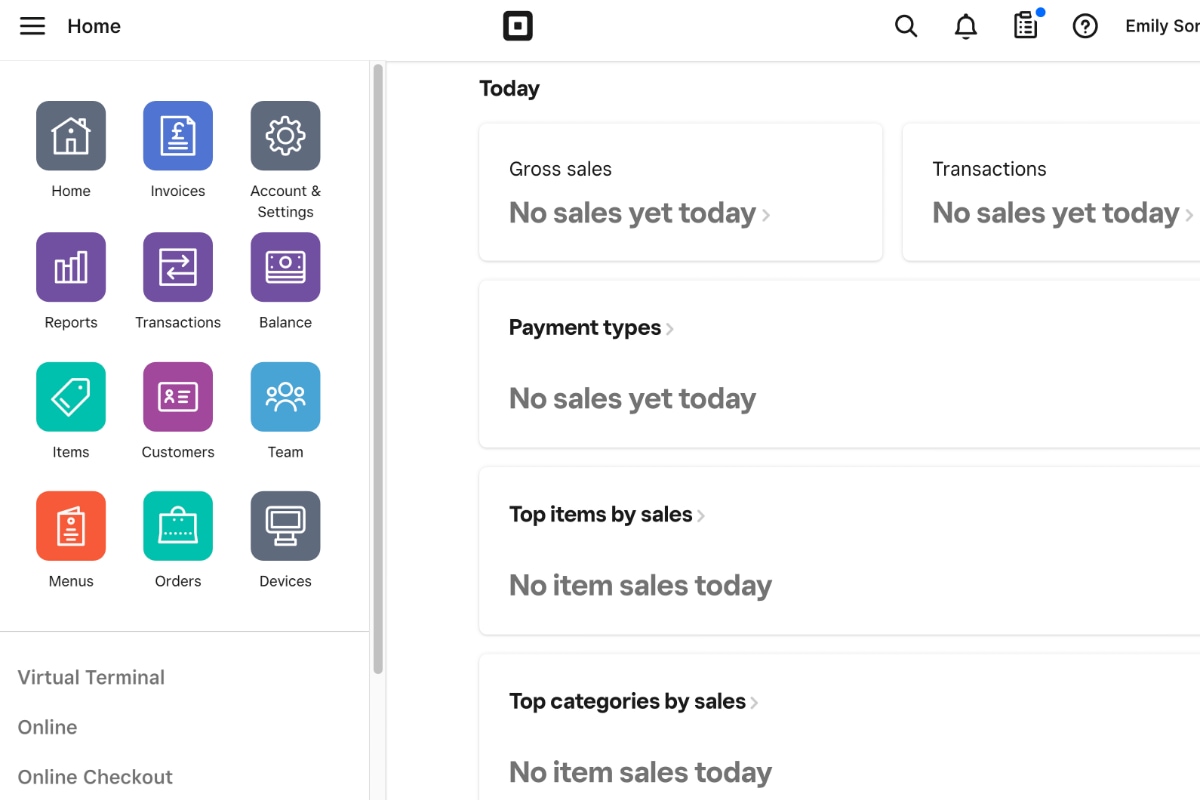

Reports and accounting

In any supported internet browser, you can log into your Square account and export data to Excel for accounting purposes. Because the system is cloud-based, the account is synced with shop activities in real time so you can always check in on how sales are going.

The POS app also shows transactions, payouts, amount of cash in the till drawer (if cash management is on) and sales reports you can email from the app.

Image: Mobile Transaction

Dashboard gives you an overview of sales from any web browser.

The analytics are in-depth compared to similar card reader services. Square Dashboard provides an overview of key sales data, but many more analytics are accessed in the reports section. You can, among other things, analyse employee sales, taxes, product categories and product modifiers applied to sales.

For more complex accounting features, the system integrates with Xero, FreshBooks and other supported software.

Who is it best for?

Square aims to suit every business type. Having tested the POS app, we can verify it’s especially useful in the retail and hospitality sectors – food-and-drink in particular – due to its comprehensive product library, checkout functions, tipping, analytics and staff management features.

Those selling at multiple locations can distinguish between sales at different locations. And let’s not forget the very small size of the card reader, which makes it the handiest for mobile payments at, for example, market stalls, home visits and conferences.

As with other payment companies, Square has a list of prohibited businesses. Some of these industries include pharmaceuticals, adult products and services, certain marketing services, certain financial services, and illegal or otherwise questionable products and services.

Photo: ES, Mobile Transaction

Square blends in completely with white surroundings.

Customer support, reviews and complaints

Square is available to phone or email between 9am and 5pm Monday to Friday. There is no weekend or evening support for free users, which is fine if the system works, but not so good if you need help at night in a bar, for example.

That’s why the paid Restaurants subscription includes 24/7 phone support exclusively.

Customer reviews in Ireland have been largely positive, but some users have complained of:

- Low standard of customer support

- Fixed rate a bit high compared with SumUp

- “Premium implementation service” is poor and not worth the money

- Accountant access may cost €25 per month

- Custom reports could be more flexible

- Physical gift cards getting stuck in the post to Ireland from UK supplier

Nevertheless, the online resources are comprehensive with guides and articles covering many aspects of the products. Most merchants are able to find answers there. We’ve personally very rarely needed to contact support – the system has just worked for us without issues.

In other countries, some merchants report having their account rejected out of the blue, but it appears many of them are types of businesses deemed as high risk.

We strongly recommend reading the fine print of what trades Square does not allow to avoid having payments suddenly rejected.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

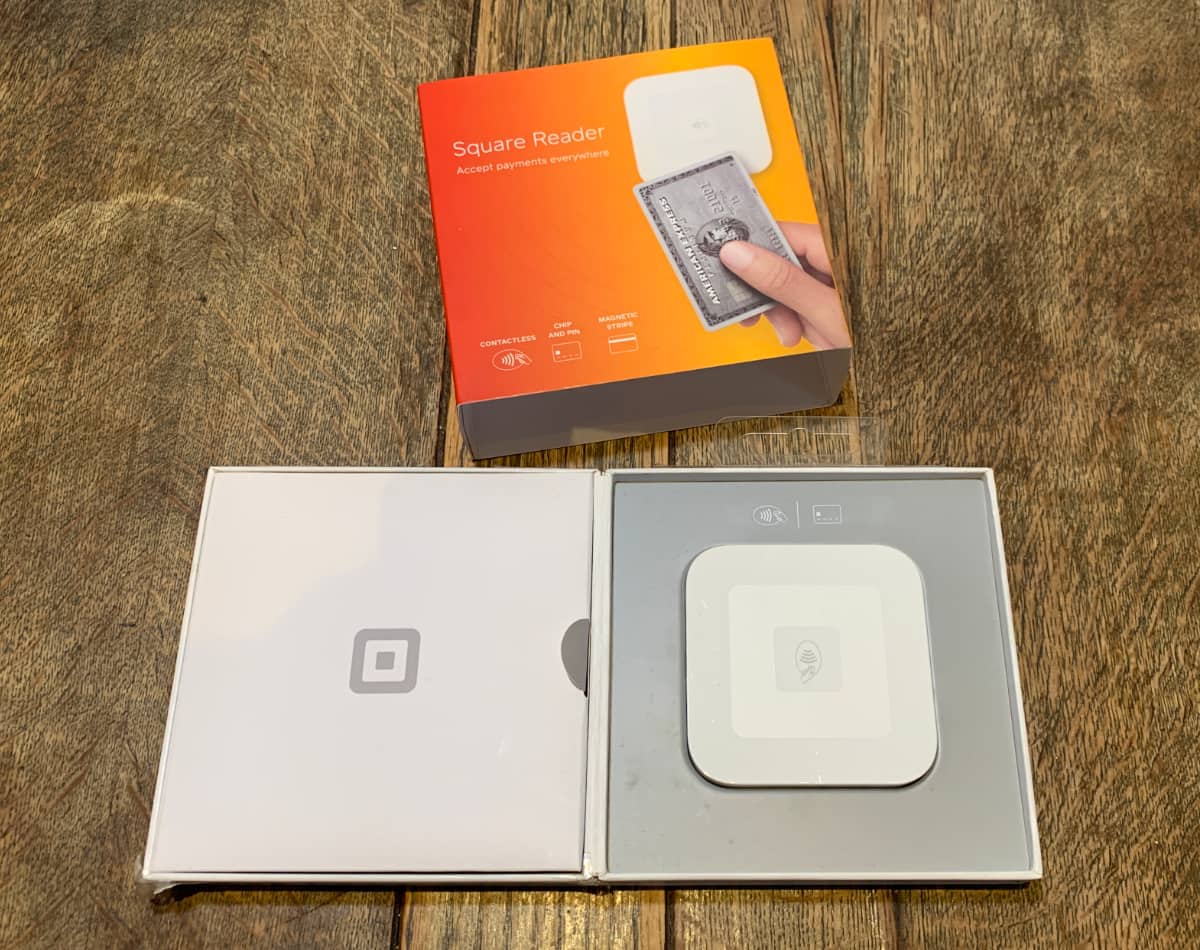

Getting started

Before purchasing a card machine, you need to sign up for a Square account and connect your bank account. It typically takes four days to have a bank account verified, but you can still take payments before the verification is finalised. After completing the straightforward sign-up form, you can order a card reader.

It is still limited where you can buy Square’s products in Ireland other than Square’s own website. You could try buying from Currys or HuntOffice, but these might end up pricier compared with Square’s own promotional offers.

We connected a personal bank account with a history of receiving sole trader income, and this was verified after four days. To be accepted, Square requires that the bank account allows for both deposits and withdrawals to support the refund and chargeback system. Online-only accounts like PayPal are not supported, nor are prepaid card accounts. Furthermore, your bank account must operate in euros.

Photo: ES, Mobile Transaction

Our card reader arrived two days after ordering it online.

Our Square Reader order was a positive experience. We received the securely-packaged parcel two days after purchase. Prior to the free delivery, we got text notifications saying when it’ll arrive, with options to pick a specific time or request leaving it at a neighbour’s address.

When the account is set up, it’s time to download the Square Point of Sale app on your smartphone or tablet and log in. The card reader can then be connected to your mobile device via Bluetooth – and you’re ready to take your first payment.