This review

In brief

How it works

Our opinion

In detail

Card machines

Pricing

SumUp Solo features

Accessories and receipts

Reporting and extras

Customer service

Getting started

How SumUp Solo works

SumUp is known for its user-friendly, simple card payment solutions for small businesses and sole traders alike.

Its flagship model SumUp Solo is a special one: a square-shaped, standalone card reader without a physical PIN pad. Instead, it is operated exclusively via the front-facing touchscreen, like a purpose-built mobile device for card payments.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

All the box contents of a SumUp Solo package.

The card reader comes with a built-in SIM card with unlimited data for 4G connectivity, but can also function through WiFi.

It’s therefore ideal as a mobile card terminal as well as for table-service in, for example, a small café with a secured WiFi network. It also connects with SumUp POS software for a complete, stationary till setup.

To accept a card payment without a POS integration, you enter an amount and custom description on the screen, proceed to add a tip (if relevant), process the card and print or send a digital receipt. Transactions can be viewed and refunded on the terminal.

Accepted cards

Solo accepts a wide selection of chip and PIN and contactless cards and mobile wallets.

Payments settle in your bank account within 1-3 working days or the next day at 7am (including weekends and Bank Holidays) in an online SumUp Business Account linked with a complimentary Mastercard. If you like, you can then transfer funds to a bank account immediately.

You can order the Solo reader with a countertop stand or receipt printing dock that doubles as a power bank.

Photo: EC, Mobile Transaction

For a higher price, you can get the SumUp Solo and Printer set.

Our opinion: unique terminal for a small business

SumUp Solo is an interesting card machine for payments that don’t require an integration with a POS system (though it does connect with SumUp POS). It works well for simple transactions where you just enter a payment total, not itemised receipts linked with a food menu or inventory library.

It’s fundamentally different from its predecessor SumUp 3G because of its touchscreen and compact design, but they are equally basic in their features.

If you want more advanced features, you may consider Solo Lite that connects with POS systems but doesn’t work on its own, or the mobile SumUp Terminal that contains some POS features.

| SumUp Solo criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 4.8 | Excellent |

| Value-added services | 4 | Good |

| Service and reviews | 3.8 | Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.3 | Good/Excellent |

With Solo, you can truly use it solo, anywhere with a mobile connection or wireless internet. The accompanying stand or receipt printer makes it great for, say, hairdressers and pop-up shops with a counter, and the tipping options are advantageous for hospitality and professional services.

“I’d get the Solo with a printer, because the battery life can be short on its own, and the printer is a brilliant charger too. At a point of sale, though, you can just keep Solo plugged in.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Last but not least: the lack of monthly fees, commitment and complicated costs is attractive for a card reader. The upfront cost is low compared to traditional card machines, and the fixed rate competitive below a monthly turnover of £5,000.

For alternatives, check out our comparison of the best card machines

What are the card machine options?

SumUp sells two types of Solo card readers that are exactly the same size, but with crucial differences:

- SumUp Solo Lite: Card reader with PIN pad. Pairs with SumUp app on a phone or tablet to accept cards.

- SumUp Solo: Independent terminal with basic software to accept cards. Bought with or without a receipt printer.

For a start, Solo Lite only works while Bluetooth-paired with an app on a mobile device connected to the internet. So the “Solo” before “Lite” is a bit misleading when it’s never truly functional solo.

However, Solo (without “Lite”) truly works on its own through WiFi or 4G or with a POS system when paired with a register.

Because Solo Lite is only switched on when a transaction created in SumUp app is ready for the card payment, the battery life of Solo Lite is much better than Solo at over 1000 transactions from a full charge. Transactions on Solo are created from start to finish via a power-consuming touchscreen, so it only lasts 100 transactions from a full charge.

SumUp Solo and Solo Lite compared:

| SumUp Solo | SumUp Solo Lite | |

|---|---|---|

|

|

|

| Price | £71.10 + VAT | £19 + VAT |

| Works without phone/tablet | ||

| Connectivity | WiFi, 4G (SIM included) | Uses phone’s/tablet’s WiFi or mobile network |

| Size | 83 x 83 x 17 mm | 83 x 83 x 17 mm |

| Battery life | 100 transactions | 1000+ transactions |

| POS integrations | SumUp’s own POS system | SumUp’s own POS system |

| Receipt printing | Only via SumUp Solo counter or mobile printer | Connects with various Bluetooth printers |

Solo Lite can connect with quite a few compatible, mobile receipt printers over Bluetooth. Solo has its own receipt printer (a stationary or mobile version) and does not work with other, generic-branded printers unless it’s through a POS system.

Photo: EC, Mobile Transaction

SumUp Terminal is considerably longer than the Solo and Solo Lite terminals.

What about SumUp Terminal?

An alternative to Solo is SumUp Terminal. This is an oblong, traditional-looking card machine with a large touchscreen and built-in receipt printer. Like Solo, it works independently through 4G (SIM card included) and WiFi, so would suit table-side payments as well as mobile businesses.

It contains the same SumUp POS software as the app you download on a mobile device to use with Solo Lite. Yet Terminal’s ability to print receipts makes it more similar to the Solo + printer sets, as you can use them anywhere to accept cards and print receipts without an external device.

With a SumUp POS Plus subscription, Terminal even gets more features like open orders and preset discounts.

Fees and pricing

SumUp Solo only costs a one-off price of £71.10 + VAT with just a desk stand or £98.10 + VAT with a receipt printer.

No setup fee applies, and it gets delivered for free within 2-3 working days. If you change your mind about the purchase, there’s a 30-day money-back guarantee on Solo.

There is no monthly fee, contractual commitment or other ongoing costs, just a fixed rate of 1.69% per card payment.

SumUp pricing:

| Charges | |

|---|---|

| Card machine price | SumUp Solo Lite: £19 + VAT SumUp Solo: £71.10 + VAT SumUp Solo + printer: £98.10 + VAT SumUp Terminal: £121.50 + VAT Shipping is free |

| Contractual commitment | None |

| Monthly fees | None |

| Transaction fee (any card) | 1.69% |

| Payouts in 1-3 working days | Free |

| Refunds | Before payout: Free After payout: Transaction fee is retained |

| Chargebacks | £10 each |

Payouts are processed free to your bank account within 1-3 working days or SumUp Business Account the next day.

It’s free to refund card transactions, as long as the transaction has not yet been settled in your bank account (i.e. within 1-3 days of the original transaction). After that, SumUp charges the original transaction fee for the refund.

If a customer disputes a payment, a chargeback fee of £10 occurs.

A membership subscription, Payments Plus, is available for £19 per month. This reduces your chip and contactless rate to 0.99% per transaction for domestic consumer cards (non-UK and commercial cards would cost 1.69%).

The popular card machine: SumUp Solo

SumUp Solo is a totally unique card terminal to enter the UK market. It is the first card machine 100% designed by SumUp in-house by a team of over 100 engineers and product designers.

We know previous card readers – such as SumUp Air – were only partly designed by SumUp, using certain hardware components by third parties.

Photo: Emily Sorensen (ES), Mobile Transaction

SumUp Solo checkout screen.

Photo: ES, Mobile Transaction

SumUp Solo menu screen.

And the result? A simple touchscreen terminal that can constantly evolve with software updates.

I find it comfortable to hold in my hand, lightweight and easy to slide into a pocket. The built-in software is quite basic at this point, but SumUp may add features down the line.

| SumUp Solo tech specs | |

|---|---|

| Dimensions | 83 x 83 x 17 mm |

| Card reader weight | 147 g |

| Display | Touchscreen, greyscale |

| PIN pad | On touchscreen (no push-button PIN pad) |

| Connections | 4G, WiFi, Bluetooth |

| SIM card & data | Built in, unlimited free data |

| Card reader technology | EMV (chip), NFC (contactless) |

| Battery life | 100 transactions from full charge |

| Accessories included | SumUp Solo card reader, USB-C charging cable, charging cradle with clear lid, card brand decals |

The screen

The (non-colour) touchscreen is highly responsive. When it’s on standby and not in the accompanying dock, you simply tap the dark screen to show the checkout screen.

Photo: ES, Mobile Transaction

Solo’s display in strong sunlight.

If stationed in the countertop- or receipt printer dock, you have to press the power button on the side to activate the screen.

You can adjust the screen brightness to suit any environment and set it to turn off the screen after 30 seconds, 1-5 minutes or never.

We tested the maximum screen brightness in strong sunlight, and the screen was still readable. It was grey and not bright in the sun, though better than its predecessor SumUp 3G’s display that had complaints about being hard to see in the sun.

Battery life

The battery life is officially 100 transactions from a full charge, but in reality, it depends on how it’s used.

With maximum screen brightness and frequent testing, the battery on our Solo did not take more than an hour to use half its power. When we only used it for transactions with low screen brightness, it lasted longer.

Keeping Solo on standby drained the battery within hours when we first tested it, but SumUp has improved the battery life significantly since.

In addition, the countertop and mobile receipt printer attachments act as a power bank charging the terminal when low on battery (while placed in the printer). From a full charge, the mobile receipt printer can print up to 800 receipts without a recharge.

It takes a few hours to charge Solo from 0% to 100% in the basic desk dock, whereas the mobile receipt printer only takes 1 hour to fully charge itself and the card reader together.

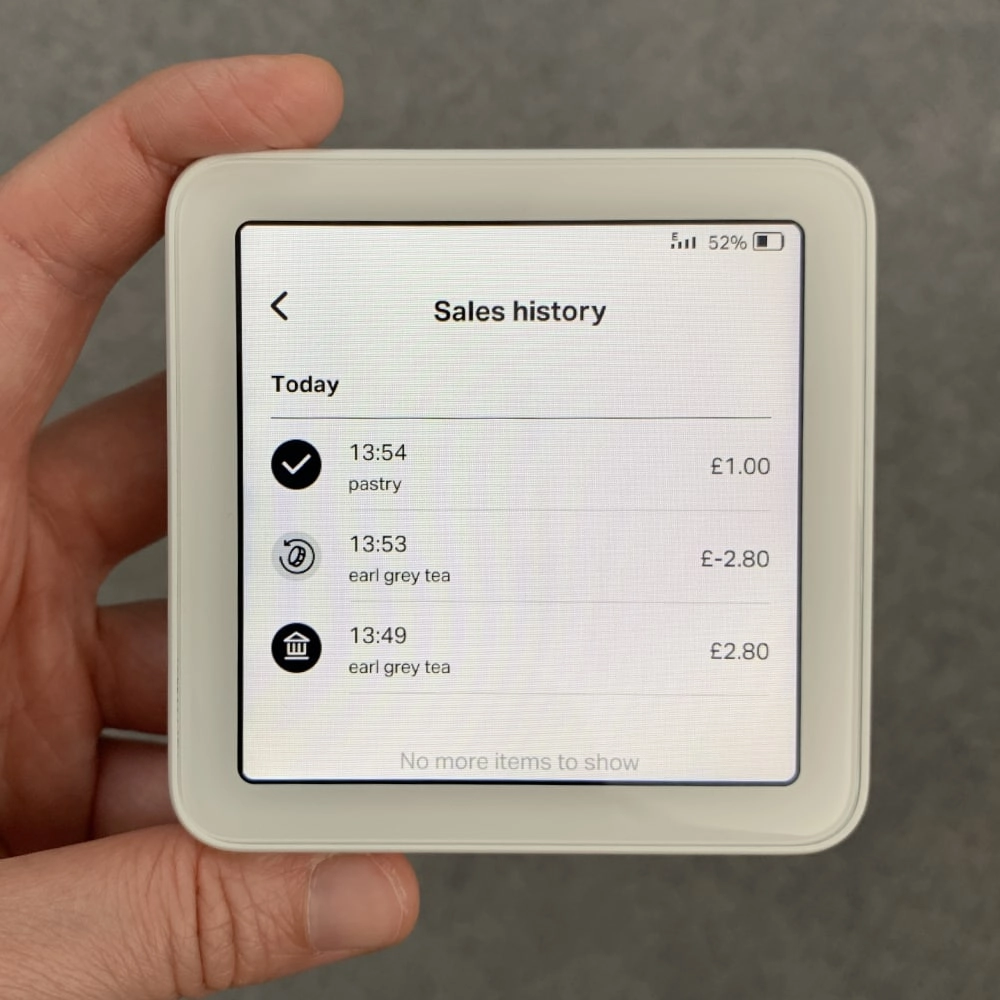

Software on Solo

What about the software? Here are the features:

Photo: Mobile Transaction

You can only enter one amount per transaction.

Photo: Mobile Transaction

Entering a transaction description can be fiddly with big fingers, as the keys are small.

Photo: Mobile Transaction

It can take several seconds before it’s ready to accept a card.

Photo: Mobile Transaction

Ready for a contactless or chip and PIN transaction.

Photo: Mobile Transaction

Receipt options after a payment.

Photo: Mobile Transaction

Entering a mobile number for SMS receipt.

Photo: Mobile Transaction

Smart tipping options before a payment.

Photo: Mobile Transaction

Tipping settings.

Photo: Mobile Transaction

Sales history section.

Photo: Mobile Transaction

Transaction options.

That’s it for features.

Updates and additional POS features

You can connect the terminal with SumUp’s free POS app and SumUp POS Pro for complete till system features. Solo is in fact the recommended card machine for SumUp’s hardware bundles for fixed counters, as it looks good and syncs well with the POS system.

SumUp may also decide to add new functions through its regular software updates. For instance, we experienced a sudden increase in language options from one day to another while testing.

The card machine automatically shows when new updates are available, but you can also check software updates manually on the terminal. If you need to, you can log out of the account from the settings menu (you must log in with your SumUp account details the first time you use it).

Accessories and printed receipts

As a standalone card machine, you don’t have to connect Solo with anything else unless you want a full SumUp POS system.

If you buy the cheaper Solo package, the main accessory included is a non-slip display stand to put on a countertop. This doubles as a charging dock (not a power bank) with an internal storage compartment for a USB charging cable.

Photo: EC, Mobile Transaction

Solo stand’s compartment with USB charging cable.

You can either plug the charging cable into Solo directly, or place Solo in the cradle and plug the cable into the dock to charge the card reader. You’ll need your own adapter plug for the USB cable, or charge it through a USB charging socket.

The countertop dock’s clear, magnetically attached lid is a great, stylish protection to keep the reader free from dust and dirt. The included decals showing all the cards accepted by SumUp Solo can be stuck onto the lid perfectly.

Photo: EC, Mobile Transaction

SumUp Solo in its dock with lid on.

Photo: EC, Mobile Transaction

With the lid off, chip cards can be inserted.

Receipt printers

If you buy a Solo and Printer package, you don’t get the above countertop dock. Instead, you get a receipt printer-and-charging dock specifically designed for the SumUp Solo card reader.

There are actually two versions of this: a stationary, square-shaped one and a mobile, curvy one. They cost the same in a bundle with the card reader (£98.10 + VAT), but if bought separately, the mobile one is pricier (£69 + VAT) than the stationary printer (£59 + VAT).

We have tested the mobile printer, which looks great as both a countertop stand and portable printer, so it works equally well at till point and on the go.

No other receipt printer works with Solo.

Photo: EC, Mobile Transaction

SumUp Solo in the mobile printer next to Solo in a basic desk stand.

Other POS hardware

You can connect the card reader with point of sale equipment like a cash drawer, barcode scanner and kitchen printer through the SumUp POS Pro system. This is a customisable POS system for hospitality and retail, depending on your requirements.

Alternatively, it can connect with the SumUp app on a tablet, if you just need basic till features without a monthly cost.

Photo: EC, Mobile Transaction

Underneath the SumUp Solo Printer, you have non-slip grips.

Photo: EC, Mobile Transaction

You can use the terminal inside or outside the receipt printer.

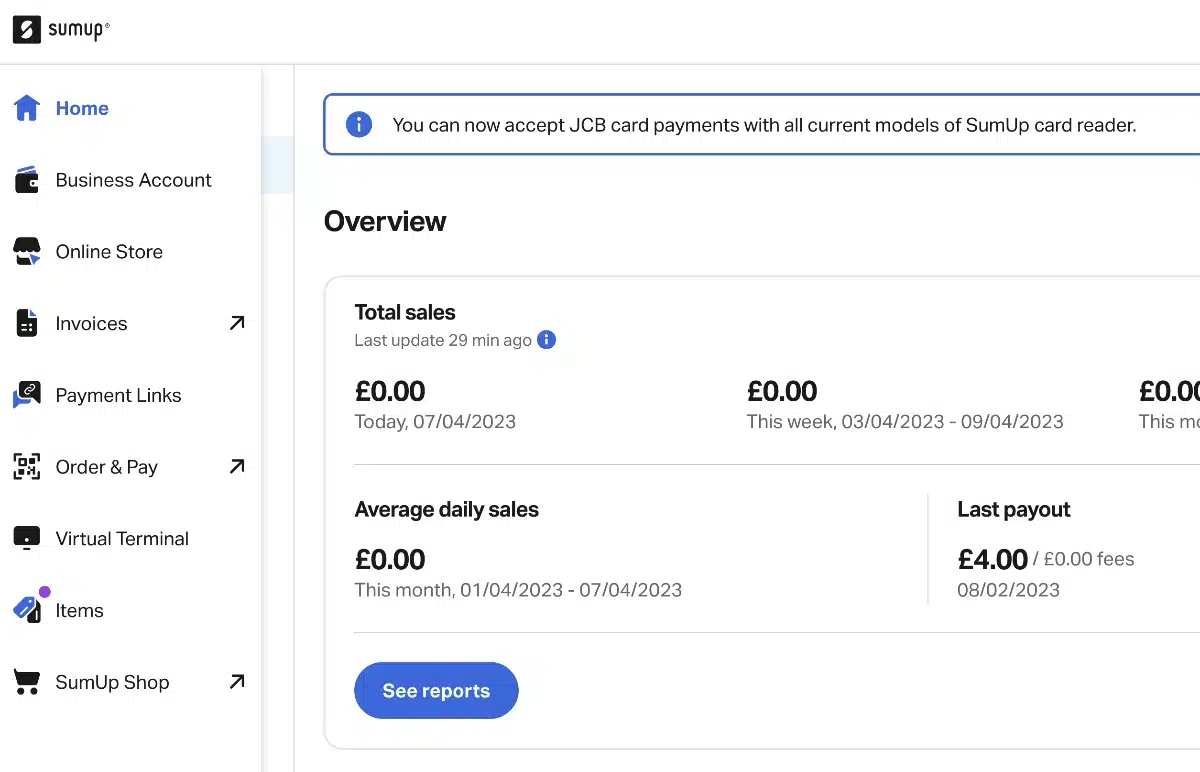

Reporting and other free extras

If you need more than a basic transactions overview on the terminal, you can log into your SumUp Dashboard on a laptop. Here, you can analyse sales and export sales reports.

You’ll also see many additional features (included free) such as invoicing, a product library and your SumUp Business Account.

Photo: Mobile Transaction

SumUp Dashboard in a web browser.

Even if you don’t have a card reader, we recommend downloading the SumUp app on your phone because it has lots of additional features. You can send payment links, accept QR code payments, sell and accept gift cards, and create a basic online store.

The app also has an overview of payouts, employee accounts (staff can have different logins) and a product library to sell from.

Customer service

All SumUp merchants can phone, email or message customer support on weekdays between 8am-7pm and weekends between 7am-5pm. Some customers do not get prompt support, while others do – calling is usually the fastest way to reach the team.

You cannot access help guides on the terminal, but it does show the URL to SumUp’s online FAQs that you can look up on your phone.

Photo: EC, Mobile Transaction

SumUp Solo and Printer with a chip card inserted.

Getting started

SumUp is one of the easiest options around for getting started with card payments.

You simply go on the website, click to get started and complete an online sign-up form (takes about 5-10 minutes). You can then order the card reader online and wait 2-3 working days to receive it by post.

It may take a few days before your bank account – which must be in a name that matches your business name – is linked to your SumUp account, but you can still accept payments straight away. As soon as the bank account is verified, transactions can be released in your bank account.

Alternatively, you can choose to receive transactions in the online SumUp account, if you want to keep it separate from your bank account.