Being able to process payments can’t be understated in its significance. From customer satisfaction to improving efficiency, fast payments are the lifeblood of any business.

Still, what happens when your old, reliable EFTPOS terminal suffers technical complications? Or worse, a network outage paralyses your ability to accept payments altogether?

Chances are most ordinary business owners aren’t technically adept enough to pull out the screwdrivers and troubleshoot the problem. So what can be done to prevent it from stalling sales?

Fortunately, Australian business owners don’t have to hang their hat solely on EFTPOS terminals. Many payment alternatives are available to ensure your bottom line won’t be impacted.

Apart from the technical complications, providing multiple payment options can be an effective way of boosting sales. Not every customer likes to pay by card, so other payment methods prevent some customers from being alienated.

Cash payments

Though electronic payment methods largely dominate, few options are quite as trusted as cash.

You never have to worry about internet connectivity or technical issues with a cash-in-hand transaction on the spot. In contrast, an EFTPOS terminal requires set-up processes, maintenance and the dependency on intermediaries charging for the privilege of it all.

One of the primary benefits of cash boils down to the perceived lack of transaction fees. But although 0% of cash transactions go to a payment processing company, you still have to factor in:

- the cost of staff hours for counting and end-of-day cashing up

- depositing coins and notes at your business bank

- security measures for storing and handling the cash (e.g. a cash drawer, security cameras)

However, the immediate availability of cash and ability to accept it anywhere are drivers that make it popular. You don’t have to wait for funds to be processed or transferred to a bank account – but you do need to keep an eye out for theft as well as counterfeit coins and notes.

Tap to Pay on iPhone or Android

Recently, Tap to Pay on an iPhone or Android device has become a popular backup for accepting payments.

Essentially, it’s a payment app that turns your phone into an EFTPOS machine through its built-in NFC. The NFC (near-field communication) chip is the technology enabling contactless payments for card machines, mobile wallets and smartphones alike.

Merchants just need to sign up with a payment solution with this feature in a mobile app. In the app, the merchant can enter an amount or create an itemised bill and select Tap to Pay. The payer can then hold their contactless card or phone over the merchant’s screen to complete the payment.

Photo: Mobile Transaction

You can use your iPhone or Android phone as a contactless EFTPOS machine.

This payment method does still require an internet connection through the phone, like an EFTPOS machine. But if your phone connects more reliably with WiFi or 4G than your main EFTPOS terminal, it may serve as a backup for when the latter fails.

The only downside is that Tap to Pay only accepts contactless payments, not chip cards that need to be inserted in a terminal. But this is generally not a big issue since contactless cards are so widespread in Australia.

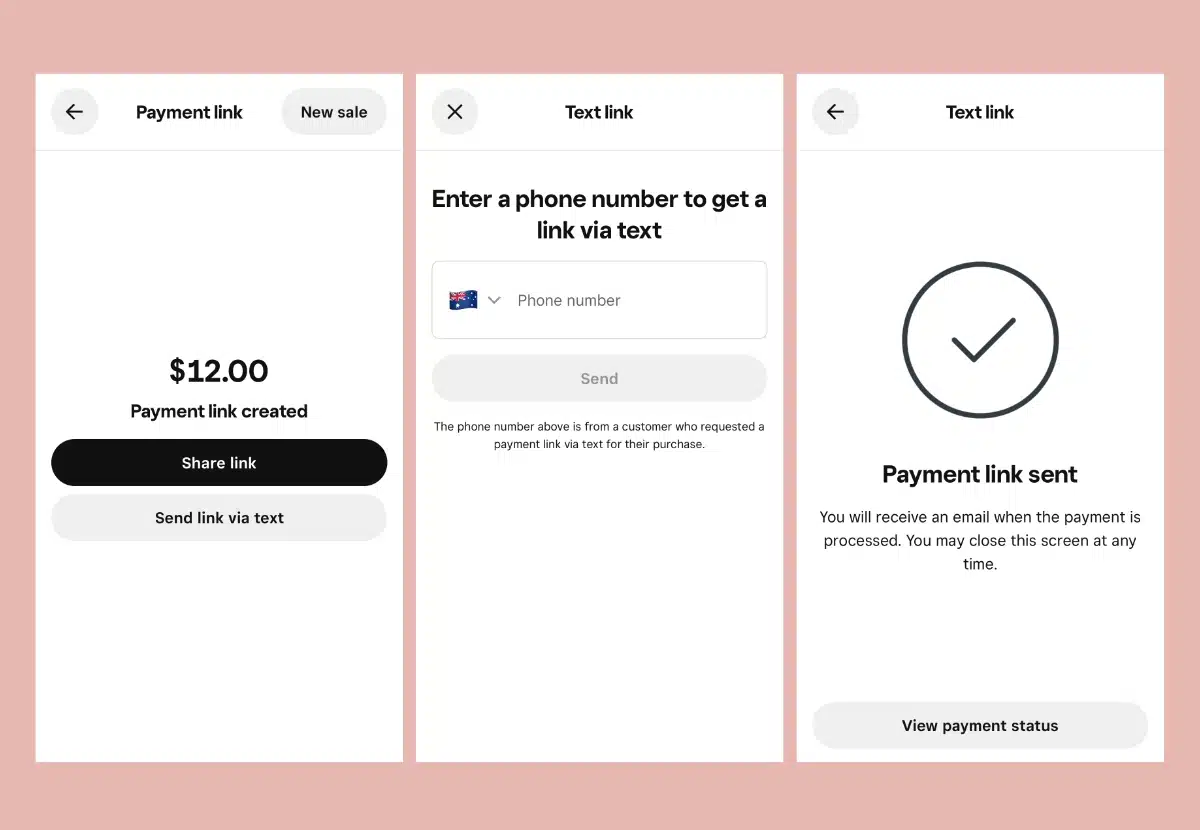

Payment links

Payment links are a type of link generated through a mobile app or browser dashboard, giving you the option to create and send payment requests with little to no hassle.

Distributing these links is fairly effortless, with various channels like email, text messages or apps like WhatsApp all being great platforms to share the links through.

Here’s how it works: You enter a transaction amount or add items to a bill in the software you send payment links from. Then you select how to share it (via text, email, messaging app or copy-and-paste).

Image: Mobile Transaction

Sending a payment link from the Square POS app is straightforward on a phone, as seen here.

Once the customer receives your payment link, all they need to do is click on it to launch their web browser, where they’ll automatically be redirected to the relevant page. Next, the customer just enters their card details and confirms the details to complete the secure transaction online.

Not only does this remove the limitations of having a fixed location or hardware; it also means that the customer doesn’t have to download a specific app or create an account to purchase something.

This simplicity translates into convenience for your customers by reducing the number of barriers to purchasing something. In other words, it makes it more likely they will complete the sale.

Payment links serve most effectively for businesses operating in diverse environments, such as pop-up shops or even things like remote consultations.

QR codes

Say, for instance, you’re trying to sell something at a trade show or crowded marketplace. What do you do when a potential customer expresses interest in one of your products?

Instead of fumbling for cash or relying on a temperamental EFTPOS terminal, have you considered presenting them with a QR code?

Essentially, these are just codes you can display on your smartphone screen or print as physical labels to present on your counter.

Next, customers can pull out their smartphones to scan the code to launch a payment interface tailored to your payment method of choice – not dissimilar to how payment links work.

There are a few different options at your disposal here. Some of the more prominent examples are digital wallets like Alipay and WeChat Pay, which are popular mobile payment platforms in many regions, not just Australia.

Merchants can set up QR code payments through a payment company. The easiest (and free) one is Square that accepts debit and credit card payments via QR codes.

Gift cards or vouchers

When trying to attract new customers to your business, giving them the option of paying for things with gift cards and vouchers has generally been proven to be quite effective. This payment option usually takes on quite a few different forms, further adding to its flexibility.

For instance, you might opt for physical gift cards as they have a strong potential for customisation. Oftentimes, you’ll buy a gift card that’s beautifully designed and presented, making it a thoughtful gift for the recipient.

Gifts cards can be physical cards or e-gift cards, both with unique advantages.

On the other hand, you have electronic vouchers which similarly offer convenience, but also ease of delivery so your customers can just download it on their phone and not worry about carrying around a paper voucher.

What’s more, you actually tap into the psychology of gifting by offering vouchers and gift cards. For example, many people like to purchase these prepaid options for a special occasion or maybe just as a general token of appreciation.

In practice, this usually results in increased sales or higher online engagement, as most people tend to eagerly redeem their gift cards or vouchers as soon as they receive them.

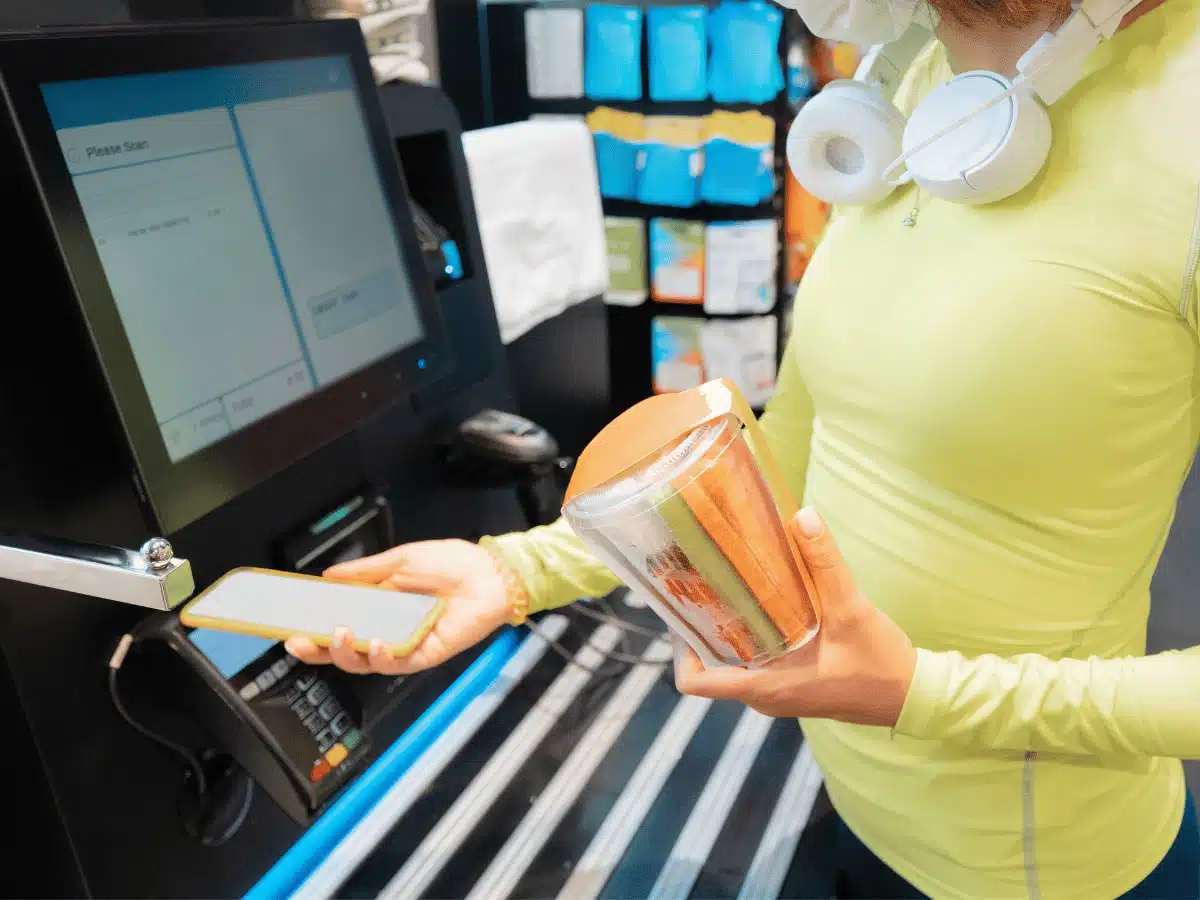

Self-service checkout solutions

Lastly, we have self-service checkouts. This is an automated system enabling your customers to pay for things without the presence of a staff member.

It can be one of the most efficient payment alternatives, as the lack of human intervention means you can leave customers to their own devices and focus on other priorities. But it also costs more, since it requires a specialist hardware terminal linked with a card reader and/or secure cash system.

Self-service checkouts are mostly used at large retailers due to their cost.

You’ll commonly see these kinds of solutions in vending machines or shops with only a few staff members. They typically have a user-friendly interface that’s integrated into the vending machine or point of sale system.

It’s potentially a more effortless option, as customers don’t have to wait in long lines or interact with anyone. All they do is select their desired item and make the payment like normal. But if they need help registering a product or operating the terminal, you need a staff member after all.