Buy now, pay later (BNPL) services are among the most popular ways for credit card-shy Gen Z and Millennials to get their instant-gratification fix. Offered at the point of sale or online checkout, consumers can buy a product straight away and pay for it later through instalments.

Australia’s BNPL market is a battleground, with a few companies jockeying for market share: Afterpay, Humm Group, Zip Co, Klarna and Payright.

Towering above the competition is Afterpay. By far the largest service provider, it had a BNPL market share of 43.8% in 2021 according to IBISWorld, followed by Zip Co’s 23.6% market share. So for the small businesses and retailers across Australia whose interest is piqued – how does Afterpay work?

How it works, in a nutshell

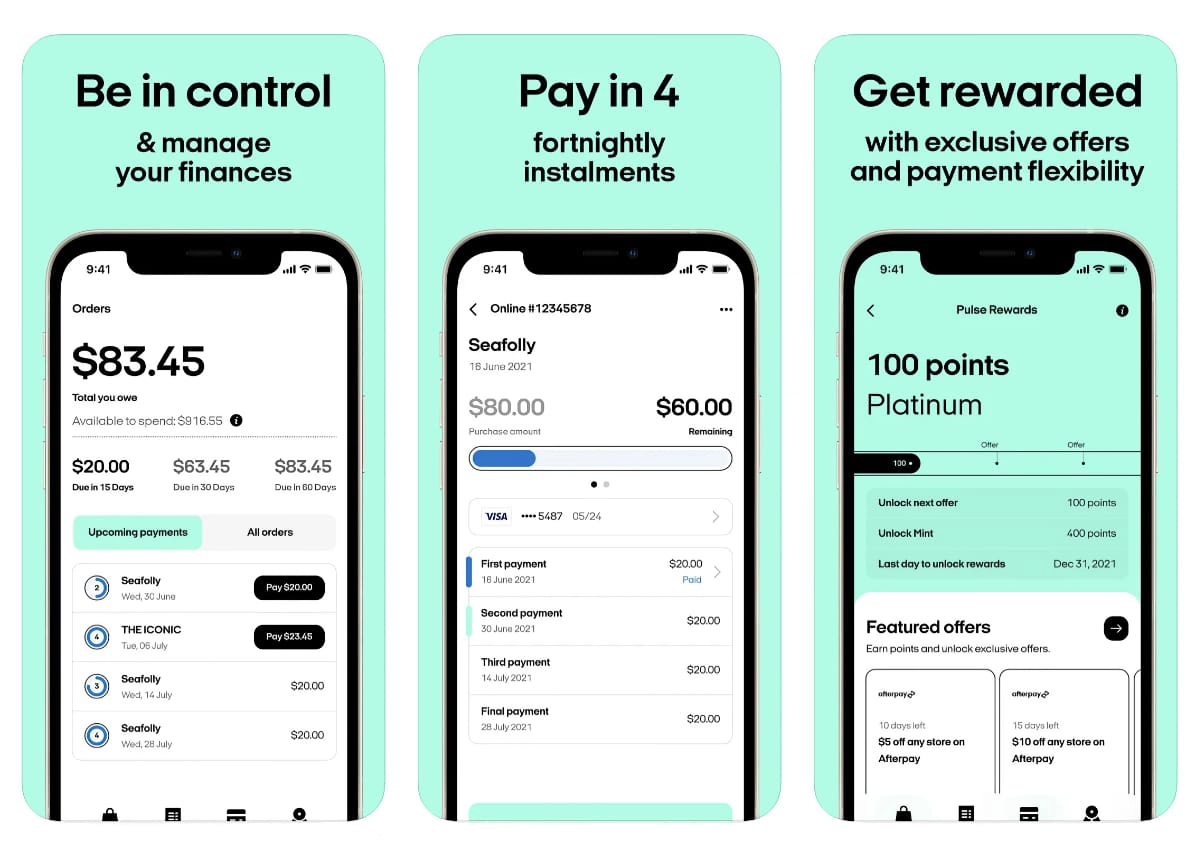

Afterpay lets consumers buy a product immediately for an upfront cost of about 25% of the total price, followed by 3 more interest-free instalments over the next 6 weeks. The merchant is paid the total purchase amount upfront, minus a transaction fee.

Businesses can enable Afterpay for online and in-store transactions depending on what their payment provider allows. For consumers, there are no credit checks, no interest and no additional fees when paying on time.

How costly is it exactly?

Deciding whether implementing Afterpay is worth it for your businesses is just like choosing the right EFTPOS system. It comes down to cost, margins and your sales volume.

Afterpay makes money by charging merchants a fixed transaction fee of $0.30 and 4-6% commission on each sale. This is significantly more than EFTPOS fees (ranging between 0.8-1.75% for the leading EFTPOS machines). Not quite cold-sweat-inducing, but enough to make businesses think twice.

But the benefits of Afterpay may be enough to outweigh the additional cost. For example, customers might be less likely to abandon large online shopping carts at checkout – where’s the risk if they’re only paying a small portion of the total price on the day?

In fact, studies show Afterpay may increase cart size, profits, customer acquisition, and sales volume. Specifically, merchants using Afterpay have experienced:

- 11% increase in profits

- 13% more customers

- 17% increase in average shopping cart size

And it’s not just about profits (though we all love profit most). Merchants using Afterpay may benefit from a reduced risk of fraud. The service settles payments upfront with merchants, which reduces the risk of credit card fraud – welcome news to any small business that has been caught on the wrong side of fraudsters or struggled with chargebacks.

Customers also seem more motivated to make purchases they typically think twice about with Afterpay. They may even be more likely to make repeat purchases with brands, as they will be familiar with your store checkout process.

While Afterpay does not specify a minimum purchase amount for use at checkout, many brands configure their minimum and maximum order values themselves. Such customisation may seem innocuous, but it might lead us to infer that Afterpay designed its service with businesses selling larger ticket items in mind.

Afterpay app, as seen in App Store.

For example, setting a minimum spend of $50 might encourage customers to at least hit that threshold when shopping. Additionally, Afterpay may request the average order volume and annual sales from small businesses looking to sign up for the service.

So although Afterpay users may spend more than with a credit or debit card, the service may not suit cafés, convenience stores or smaller-value items.

How to add the service to an online store

Afterpay integrates with ecommerce store builders and shopping cart software, including some of the best ecommerce platforms for small businesses in Australia.

Setting up Afterpay on ecommerce stores is straightforward, similar to how you would enable other payment options like PayPal or credit cards.

In Shopify’s case, merchants head to the installation guide on Afterpay’s developer site. There, they’ll find a link to the installation page. Once clicked, they then log into their ecommerce account. From there, it’s a case of connecting Afterpay with the store, granting access, installing and then activating Afterpay.

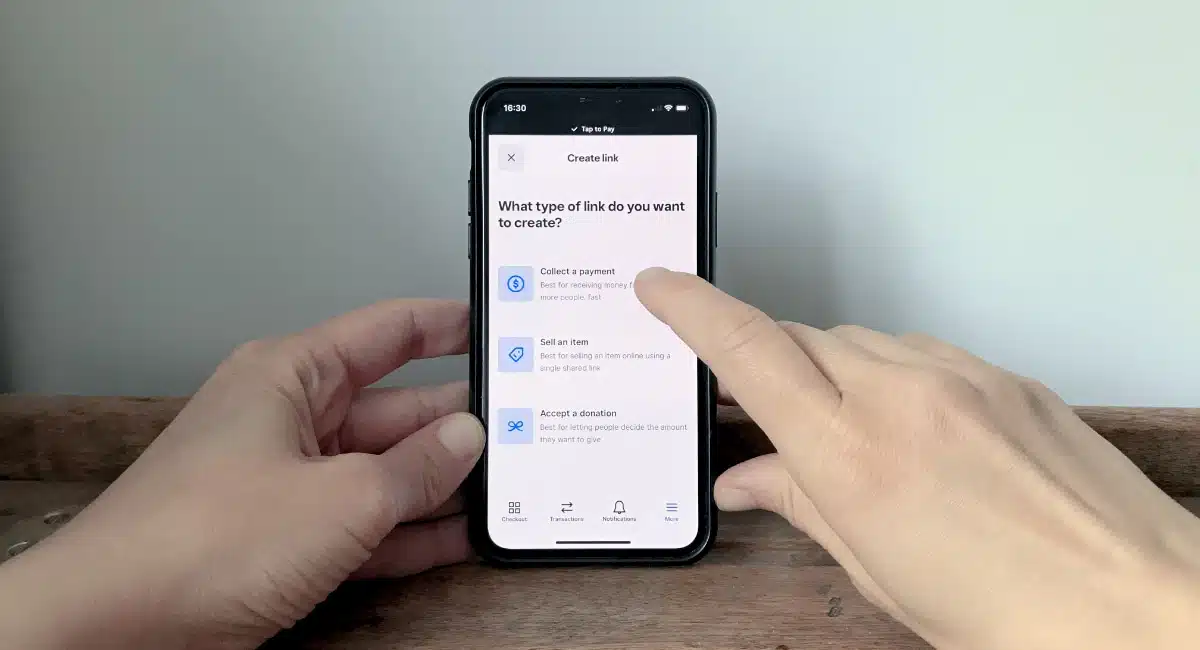

What about small businesses’ other ecommerce darling, Square? Since Block Inc. (Square’s parent company) acquired Afterpay in 2022, businesses only need to sign up with Square, check under payment methods if it’s available to them, and toggle it on to add Afterpay acceptance to online and in-store payment options. If it’s not shown as an option in the Square account, it means your business is currently ineligible for it.

There is no monthly fee for this with Square, only a 6% + $0.30 (excl. GST) fee per transaction, which can sound a little excessive, but reasonable for BNPL payments.

How to offer Afterpay in physical stores

The original way of enabling in-store sales was through Afterpay’s barcode solution. This service is no longer accepted. Instead, merchants can set up their physical locations to accept the Afterpay Card on their card machines.

Customers store this card in their digital wallet and tap it on a contactless EFTPOS machine where Afterpay is accepted.

Eligible Square merchants only need to toggle on Afterpay acceptance in their account to add it to their point of sale as a payment option. When that’s done, any of Square’s card machines can accept it when the customer pays with their Afterpay Card.

Other merchants will have to jump through a few more hoops, and not all EFTPOS providers can accept it. Businesses have to submit a request form and ask for help from Afterpay to enable the functionality on compatible POS systems.