The four Ps of marketing (product, place, price, and promotion) have a fifth member – payments. And in 2022, perhaps no payment method is more prolific than Buy Now, Pay Later (BNPL).

Australia is a pioneer of BNPL, and Australian consumers quickly adopt new ways to pay and new credit solutions. As growth continues, current trends may point towards a fractious landscape for BNPL providers, which has connotations for consumers, credit card providers, and merchants.

Higher customer demand for BNPL payments

Consumers continue to flock to BNPL services for the cost-effective convenience they offer. But until recently, they used BNPL services most widely for discretionary retail purchases – a fact reflected in the meagre 3% of online transactions made using BNPL services in 2019. For everything else, they used credit and debit cards.

But the intersection of pandemic spending and the burgeoning popularity of BNPL services has caused Australian consumers to change their perception of credit cards and other forms of financial lending. Now, they seek more affordable options.

Research shows that 54% of younger Australians are turned off by the high-interest rates of credit cards, causing them to seek other means of lending. Access to interest-free lending heralded the rise of BNPL popularity. Three-quarters of Australians used such services during the pandemic alone – 80% of which plan to continue using them in future.

RBA calculations show that these same younger consumers (aged between 18 and 39), who are less enamoured by debit cards, are the principal users of BNPL services. As debit card use continues to decline, merchants are having to swallow the higher costs of having BNPL in their payments mix. The message is clear – fail to do so, and they risk losing out on significant portions of the younger population.

In-store growth may overtake that of online

Medium to long-term growth of BNPL in Australia remains strong. Payment adoption is expected to grow steadily over the forecast period, recording a compound annual growth rate (CAGR) of 24% between 2021-2028.

Recent moves by BNPL giants like Afterpay give us an indication as to where this growth may come from. The provider has joined others (like Klarna, Affirm, and Zip Co) in partnering with Google Pay and Apple Pay and have launched the Afterpay Card for in-store purchases. The digital card enables customers to pay through Afterpay via their digital wallets at checkout, which Afterpay claims will help them see a greater addressable market of 84%.

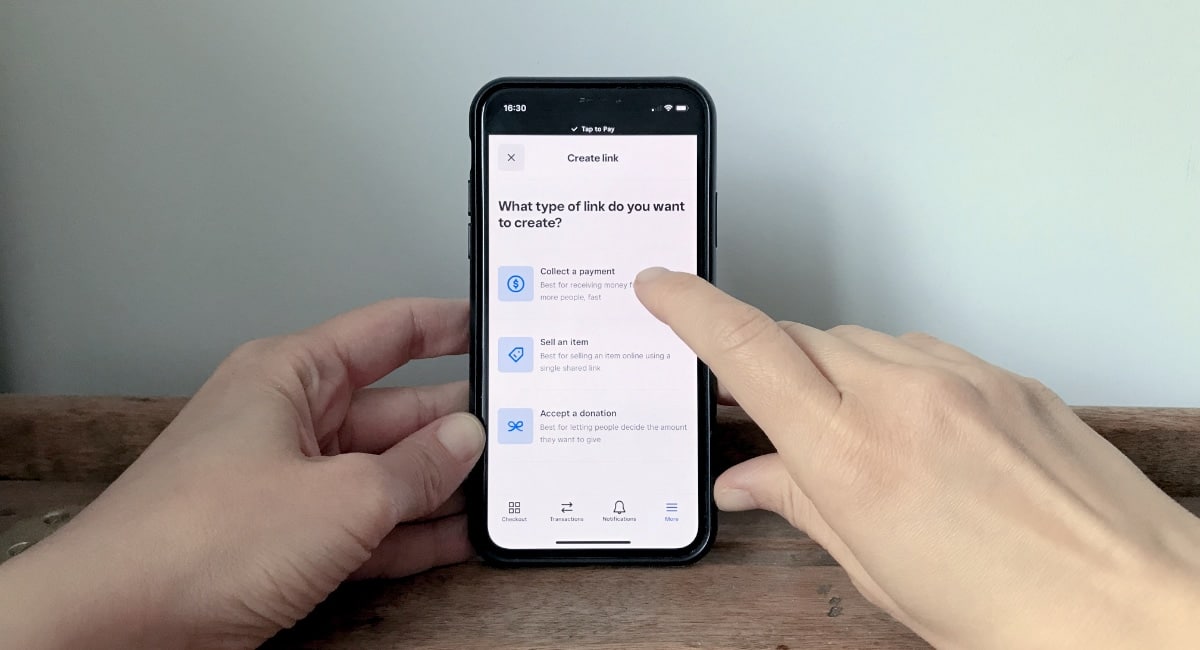

Digital wallets make it possible to pay with a BNPL card in store.

Visa’s planned expansion of its BNPL offering, Visa Instalments, to Australia also shows definite inroads towards the growth of buy now, pay later in-store. The offer will allow any Australian consumers with a Visa credit card to make payments through Visa Instalments and track them through their mobile banking app.

Thanks to the enormous market reach that mobile payments offer, in-store growth could overtake online growth. Shoppers are used to tapping their phones at checkout, so integrations with digital wallets like Google and Apple Pay present enormous new addressable markets.

Competition might lower merchant fees

Merchant fees for BNPL providers like Afterpay typically roam between 4% and 6% for merchants. But increased competition in the space means retailers are pushing for lower fees.

Despite competition from other well known BNPL providers like Klarna and ZipPay, Afterpay has remained the apex in Australia. PayPal, however, has recently entered the BNPL space. Despite not being known as price competitive, their service PayPal Pay in 4 might have the clout to pressure Afterpay in a way others have not been able to.

PayPal doesn’t charge any additional cost to merchants beyond its standard 2.6% rate and $0.30 fee. Such low percentages, coupled with PayPal’s nine million customer base, will force other BNPL players to evaluate where else they can continue to make money or face losing merchant contracts to lower fees elsewhere.

But it’s not solely competition from BNPL providers that might cause merchant fees to drop. Concerns are growing among Australian banks as they experience a decline in credit card businesses due to the broader adoption of BNPL services and its effect on interest margins. In response, banks are developing their own BNPL technology.

Businesses that dip into the customer base of large financial institutions through BNPL will likely benefit from much more affordable partnering options than typical BNPL fees. They will also probably generate more revenue through a higher customer pre-approval rate, as customers will have been subject to a credit check at the start of the transaction.

Stricter regulation might limit growth

Buy Now, Pay Later services in Australia have recently come under a firestorm of scrutiny and subsequent regulations. As competitive forces continue to pressure BNPL providers, bureaus have launched investigations to understand practices around data collection, behavioural targeting, data monetisation and the risks they may create for customers. Basically, any way BNPL providers make money.

Australia’ central bank has already started regulating BNPL providers. The bank has now stopped BNPL firms from barring merchants from passing on surcharges to consumers – a move that would cut into a significant source of revenue for BNPL companies.

The central bank is arguing that BNPL lending has become an expensive necessity given the product’s growth, meaning there is a merchant interest in BNPL providers no longer enforcing no-surcharge rules.

Why is this relevant? RBA research found that 60% of consumers would decline BNPL loans if merchants added 4% or higher surcharges to the purchase price. So, not only would a significant source of revenue be reduced for BNPL providers, but the popularity of the service as a whole may well suffer, too.

Where will BNPL end up?

The future of BNPL services is by no means set in stone. There are claims that “it’s just another type of debt on top of credit card debt, utility debt and rental arrears.” Albeit a profitable one. In 2019, for example, BNPL providers reaped over $43m from missed payments (up 38% on 2018).

In light of this and the entries to BNPL services that banks are making, BNPL services will likely persist. However, their existence as a means of interest-free lending will probably phase out. Credit checks will likely become mandatory for customers to be accepted, and we may even see some acquisitions by banks of leading providers.

Regardless, for Australian merchants, BNPL remains a critical capability.