- Pros: Average rate. No commitment. 24/7 support. Compatible with many POS systems. Same-day payouts with free bank account.

- Cons: Takes up to 2 weeks to receive a terminal. Monthly cost. Poor reviews. Card reader and app not great.

- Choose if: You want a decent quality touchscreen EFTPOS machine that works with a particular POS system.

Overview

In brief

What is it?

Our opinion

In detail

Card machines

Pricing and payouts

Reports and banking

POS integrations

Remote payments

Support and reviews

What is Tyro?

Tyro Payments is one of the largest EFTPOS machine providers in Australia. It offers a range of payment solutions for small and medium-sized businesses in most sectors.

Apart from a few EFTPOS machines, Tyro offers a bank account, business loans and online payments. Transaction rates and terminal rental fees are generally fixed, but the bank account for same-day settlement is free.

Our opinion: looks better than before

The main benefits of Tyro are perhaps the reasonable card rates and lack of lock-in mixed with a free bank account for same-day settlement. You’d have to stomach the monthly EFTPOS rental cost for Pro, though, which you can avoid by getting an inexpensive card machine with similar rates elsewhere.

“I would rather buy a Zeller Terminal upfront (which has the same rate as Tyro) and get more add-on features – such as POS software – than rent from a slow-moving merchant service provider that doesn’t prioritise its software.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Tyro Go, the card reader, is simply not worth the cost, judging by its limited user base highlighting its damning technical issues.

Compared with the big Australian banks, however, Tyro is in many cases a better deal for small to medium businesses. Should you need a business loan, Tyro might even be able to offer you one.

| Tyro criteria | Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.9 | Good |

| Transparency and sign-up | 3.2 | Passable |

| Value-added services | 3.8 | Good |

| Service and reviews | 2.7 | Bad/Passable |

| Contract | 3.9 | Good |

| OVERALL SCORE | 3.6 | Passable/Good |

We have, however, seen bad reactions from merchants in light of the technical issues experienced a few years ago, and poor reviews by the small user base of Tyro Go. The service from Tyro generally appears like it’s not investing enough in the products, so we would be wary of recommending it wholeheartedly.

It is unclear whether Tyro is able to connect with an online store, which is odd given the importance of ecommerce now. That being said, the many POS systems that work the Tyro terminals make it suitable for a lot of different businesses within hospitality, retail and services.

Best for: Small and medium businesses that prefer a well-known EFTPOS provider with a traditional service.

Card machines: much-improved models

Tyro offers two different card machines:

- Tyro Pro – standalone, mobile terminal with a touchscreen or push-buttons

- Tyro Go – small card reader that works with an app

Since Tyro Pro covers the most popular – and actually reliable – models, we’ll focus on that first. Tyro Go has its issues, as we’ll come to later.

Tyro Pro – two standalone EFTPOS machines

There are actually two terminals to pick from in the Tyro Pro category, which can both be integrated with a POS system or used independently:

- Pro Touch – with a 6″ HD touchscreen

- Pro Key – with a push-button keypad under a 4″ touch display

They work wirelessly with WiFi and 4G (SIM included), so they can be used on the go or around premises, if not fixed by a countertop register with an Ethernet cable. Their battery can last all day too, so mobile merchants won’t struggle unless they always have the screen brightness on high (consuming more power).

Both have a built-in receipt printer, but can send digital receipts after each transaction. They also accept tips and can have split billing added if used with certain POS systems.

The Pro Touch model is a premium smart POS terminal that can potentially be adapted with specialised point of sale features. We have tested the model – Ingenico Axium DX8000 – and think it works flawlessly as an EFTPOS machine.

Photo: Emily Sorensen (ES), Mobile Transaction

Tyro Pro is an Ingenico Axium DX8000 model we have tested first-hand.

The card machine comes with a charging base suitable for a countertop, so it’s not just best for mobile use.

“Axium DX8000 is a robust EFTPOS machine for any situation, but Tyro only has a basic payment app installed on it. We would’ve liked to see more checkout features on the terminal, like preauthorisation or itemised sales.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The touchscreen buttons in the transaction app are large enough to navigate easily, and the speed of payments generally fast. I was struck by the quality feel of the plastic casing and can verify it’s a premium screen.

Still, some people prefer physical push-buttons for accessibility. In that case, we recommend Pro Key, which is another good-quality Ingenico terminal. Though it has push-buttons, these take up less space than the touchscreen display above, so the navigation can be mixed.

Overall, Tyro Pro is certainly a step up from Tyro’s previous old-school card machines ill-famed for their technical issues. The new terminals might provide most value when integrated with your favourite POS system, since its payment software is a bit basic as a standalone solution.

Tyro Go card reader – requires an app on a phone

What about Tyro Go, the white and square-shaped terminal that looks like Square Reader? If you’re going for an EFTPOS reader that only works when connected with an app, you have to be able to rely on that app.

Unfortunately, we see that the app is rarely updated to address bugs (to compare, Square updates its app weekly), and users have complained about technical issues and constant logging out when a customer is ready to pay. We wouldn’t recommend this headache to a small business.

Accepted cards

The card machines accept chip and PIN and contactless payments from eftpos, Visa, Mastercard, American Express and JCB. The popular mobile wallets Apple Pay, Google Pay and Samsung Pay are also accepted.

Tyro actually used to accept Alipay, Diners Club and UnionPay too, but these schemes aren’t part of the package any more.

Tap to Pay on your phone

As a backup solution to an EFTPOS machine, Tyro also accepts contactless cards and mobile wallets via Tap to Pay on iPhone and Android phones. These transactions have the same fee as the EFTPOS machines: 1.4%.

Photo: ES, Mobile Transaction

Unlike white card machines, Tyro’s black terminals wouldn’t look dirty in grungy environments.

Pricing and payments

Tyro does not require any commitment and mainly just charges for the EFTPOS machine and transactions. It is free to set up an account, and the contract can be cancelled any time without a termination fee.

Just note that a cancellation has to be submitted within the timeframe stated in your contract to avoid getting charged for the following month.

Tyro pricing:

| Tyro fees | |

|---|---|

| Setup fee | None |

| Contract | Monthly rolling (no lock-in) |

| EFTPOS machine | Tyro Pro: $29*/mo (rental) Tyro Go: $39* upfront (purchase) |

| Terminal delivery | Free |

| Transaction fees | 1.4%* Custom fees for $20k+/mo turnover |

| Refunds | Free |

| Chargebacks | Free |

| Monthly minimum charge | None |

| Exit fee | None |

*Including GST.

The Tyro Pro terminal costs $29 including GST to rent, and the Tyro Go card reader costs $39 including GST to purchase upfront (no monthly fee required). These costs are quite normal for a merchant service provider.

Any of the card machines should be ordered on Tyro’s website when signing up. It used to be possible to but the card reader online from e.g. Australia Post and The Good Guys, but we see they’re no longer for sale there.

Transaction fees

Businesses transaction for less than $20,000 monthly in card sales are charged a fixed rate of 1.4% for Visa, Mastercard, eftpos, JCB and American Express transactions (unless you have a separate Amex agreement).

Merchants with a monthly card turnover above $20k can negotiate custom fees based on the interchange++ pricing structure (variable card scheme fees). This is the closest thing you get to paying the true cost of card transactions, which is often more attractive for bigger businesses.

Alternatively, those who transact for over $10,000 monthly and surcharge too can avoid paying the monthly rental fee of Pro. We recommend looking closely at the terms for that deal, since it applies only when certain circumstances are met.

“Since surcharging will likely be banned from mid-2026, we recommend picking a product with transaction fees you can live with.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Keyed payments (‘card not present’ transactions) incur higher fees disclosed during sign-up.

Payout speeds – nightly in Tyro Bank Account

Transactions can settle into any Australian business bank account within 1-2 business days, or the same day – 7 days a week – in the Tyro Bank Account.

The Tyro bank account has no monthly fees or payout charges, but requires that you don’t transfer all the funds out daily to a different bank account.

Sales overview and bank account

There are two ways to get a sales overview of your EFTPOS transactions:

- Tyro Portal in a web browser

- Tyro App on your phone

You can generate reconciliation reports, cost analysis reports or simply view a list of sales from anywhere you are logged in. Ecommerce transactions may also be shown here if using the Tyro Portal.

If you have a Tyro Bank Account, this is also managed through the web portal and app, similar to other banking apps. This can be used as your primary business bank account where EFTPOS funds are settled, then managed through the app.

You can transfer money from the Tyro account to other bank accounts or BPAY billers, even initiate payments over Siri on iPhone.

POS integrations: good in general

Tyro’s card terminals integrate with over 450 different point of sale (POS) and practice management software systems including Bepoz, Clinic to Cloud and Epos Now. The wide range of integrations means that Tyro can fit into almost any kind of business using specialised POS software, whether retail, food and drink or any other service.

Why is this important? To save time and human errors, it is better to integrate an EFTPOS machine with your point of sale system – unless you’re using the terminal as a standalone solution.

When a POS system syncs with an EFTPOS machine, it automatically communicates transactions to the terminal and records them in your sales reports along with relevant details like card types. You also avoid having to manually enter totals on the terminal or confirm successful payments in the POS software afterwards.

For restaurants and hospitality businesses, the EFTPOS machines can adapt to facilitate additional features on their screen, such as split billing and Pay at Table. This only works with certain POS systems, so you’ll need to check with Tyro which ones to use for this.

Remote payments: basic options available

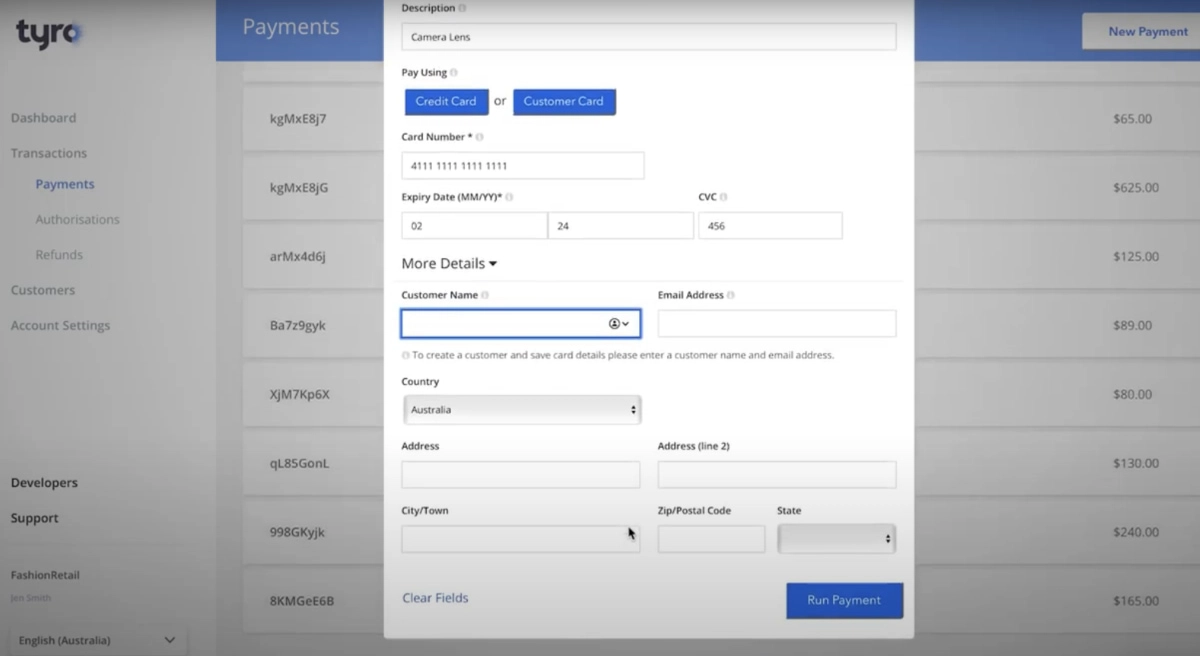

Through the Tyro eCommerce portal in a web browser, you can accept Mail Order and Telephone Order (MOTO) payments. This happens on a virtual terminal page where you enter card and transaction details manually on behalf of the cardholder.

Image: Tyro

Tyro Virtual Terminal in the eCommerce portal.

It’s also possible to key in transactions on the Tyro Pro terminals – handy when you’re away from a computer. Other payment options include electronic invoicing, recurring payments and card-on-file transactions in the web portal.

Access to these remote payments requires that you set it up first. You’ll need to have PCI-DSS compliance in place, which Tyro will help you with, possibly at an additional cost.

Although possible to integrate with ecommerce, Tyro isn’t transparent about which online store platforms it works with. You’ll need to inquire about this during onboarding to be sure it works with your preferred setup.

Customer service and reviews: mixed bag

Tyro provides round-the-clock customer support via telephone or email.

Onboarding is not exactly fast, though. Applications typically take about 2-3 business days to process, after which 5-7 business days go by before you receive the EFTPOS terminal. This means it could take two weeks (10 business days) – and that’s if you’ve submitted all the correct documents.

Tyro reviews are a mixed bag. Several customers complain of Tyro’s poor, slow or even lacking customer service, while others are entirely happy with their experience.

The biggest issue happened in January 2021 when Tyro EFTPOS machines were out of order for up to five weeks. During this time, the thousands of affected merchants received poor communications from Tyro and inadequate compensation when the businesses’ losses were clear. Some of these businesses sued Tyro who only offered rebates on merchant fees rather than compensation for the significant sales losses incurred.

Given the age of the card machines back then, we are not surprised they were prone to technical issues. Fortunately, they have since done away with the old models and introduced the newer Ingenico models which are more future-proof.