- Highs: Just one transaction fee. No contract. Works independently anywhere with 3G, GPRS or WiFi.

- Lows: No out-of-the-box integration with POS systems. Too simple for some merchants.

- Buy if: You want a friction-free portable card terminal without monthly fees or lock-in.

Looking for the review of SumUp 3G Ireland?

Note: SumUp 3G and SumUp 3G & Printer have been discontinued and replaced with SumUp Solo (with or without a receipt printer).

With this terminal, you enter the transaction value directly on the keypad, put in the chip card or tap the contactless card, and it will process the payment over the mobile network.

It’s a pay-as-you-go system, so you purchase the card machine, then pay only one fixed card rate for all transactions through the reader.

There’s no contract or other fees to commit to, making this an economical solution for price-sensitive businesses, sporadic sales or startups that can’t predict where they’ll be beyond the next few months, or just those who need a mobile terminal to take cards where the customer is.

If you need to print receipts, you can get the SumUp 3G and Printer, which is basically the SumUp 3G reader attached to a printing cradle.

Accepted cards

We’ve tested SumUp 3G + Printer duo, which was SumUp’s first card reader and printer combo:

Fees and settlement

The two things you pay for are the £69 + VAT one-off cost of the card reader and 1.69% transaction fee for all the payments processed through it. There’s no setup fee or extra charges for foreign cards.

Delivery of the card reader is free, and there are no monthly fees or minimum sales volume required, so this is a pay-as-you-go system without hidden costs. SumUp has a 30-day money-back guarantee for the card machine in case you change your mind, and one year’s warranty if you keep it.

Payments go “directly into your bank account”, meaning they automatically reach your bank account 1-3 working days after each transaction, minus the transaction fee. Alternatively, the new SumUp prepaid card gives you access to payouts the day after transactions, even on weekends. That is, if you accept cards on a Saturday, you can spend those takings the next day, Sunday.

There are no fixed transaction limits. Instead, SumUp views transactions on a case-by-case basis (e.g. suspicious-looking or large payments may be flagged).

| Costs | |

|---|---|

| SumUp 3G price | £69 + VAT |

| Shipping | Free |

| Monthly fee | None |

| Contractual commitment | None |

| Card transaction fee | 1.69% |

| Payouts | Free |

| Refunds | Free within 1-3 days, 1.69% after |

| Chargebacks | £10 admin fee |

| Costs | |

|---|---|

| SumUp 3G price | £69 + VAT |

| Shipping | Free |

| Monthly fee | None |

| Contractual commitment | None |

| Card transaction fee | 1.69% |

| Payouts | Free |

| Refunds | Free within 1-3 days, 1.69% after |

| Chargebacks | £10 admin fee |

Refunds are free if done straight after the transaction took place, i.e. before settlement has completed. If payments have already been paid out to your bank account, SumUp keeps the transaction fee for the refund. Chargebacks incur a £10 admin fee.

Those who want to accept remote payments can ask SumUp to activate a virtual terminal (for over-the-phone payments) costing 2.95% + 25p per transaction. You can also just use the mobile payment options (QR codes, payment links, SMS), invoicing and online store accessible for all users in the SumUp App – those transactions cost 2.5% each.

Of the pay-as-you-go solutions, SumUp is known for having the lowest transaction fees. Their other terminal, SumUp Air, also accepts cards at 1.69% per transaction.

The most equivalent card machine, myPOS Go, advertises a 1.75% transaction fee, but this is contingent on the card being used. The rate is indicate of Visa and Mastercard transactions, while premium cards like Amex will likely incur a higher fee.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

We have tested SumUp 3G, which is as small as you get a terminal with built-in SIM card.

Card machine specs

SumUp 3G is a pocket-sized card machine with an inbuilt SIM card. The terminal is very lightweight and easy to carry around compared to a traditional one, but sturdy enough to be reliable.

In contrast to card readers that work in conjunction with a mobile app, there is no SumUp 3G app that the terminal can connect with. Instead, all the software features are hardcoded on the card machine.

Photo: EC, Mobile Transaction

SumUp 3G has a chip card slot at the bottom.

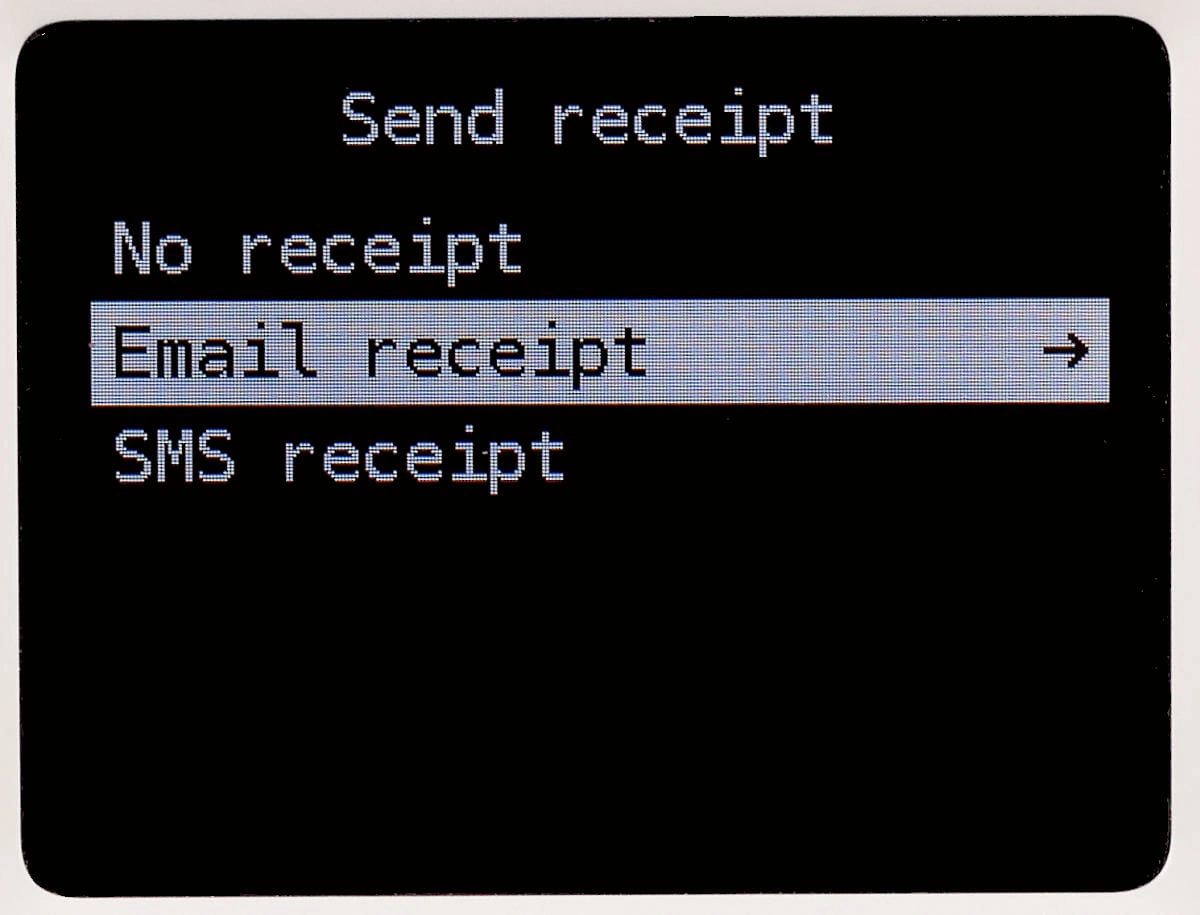

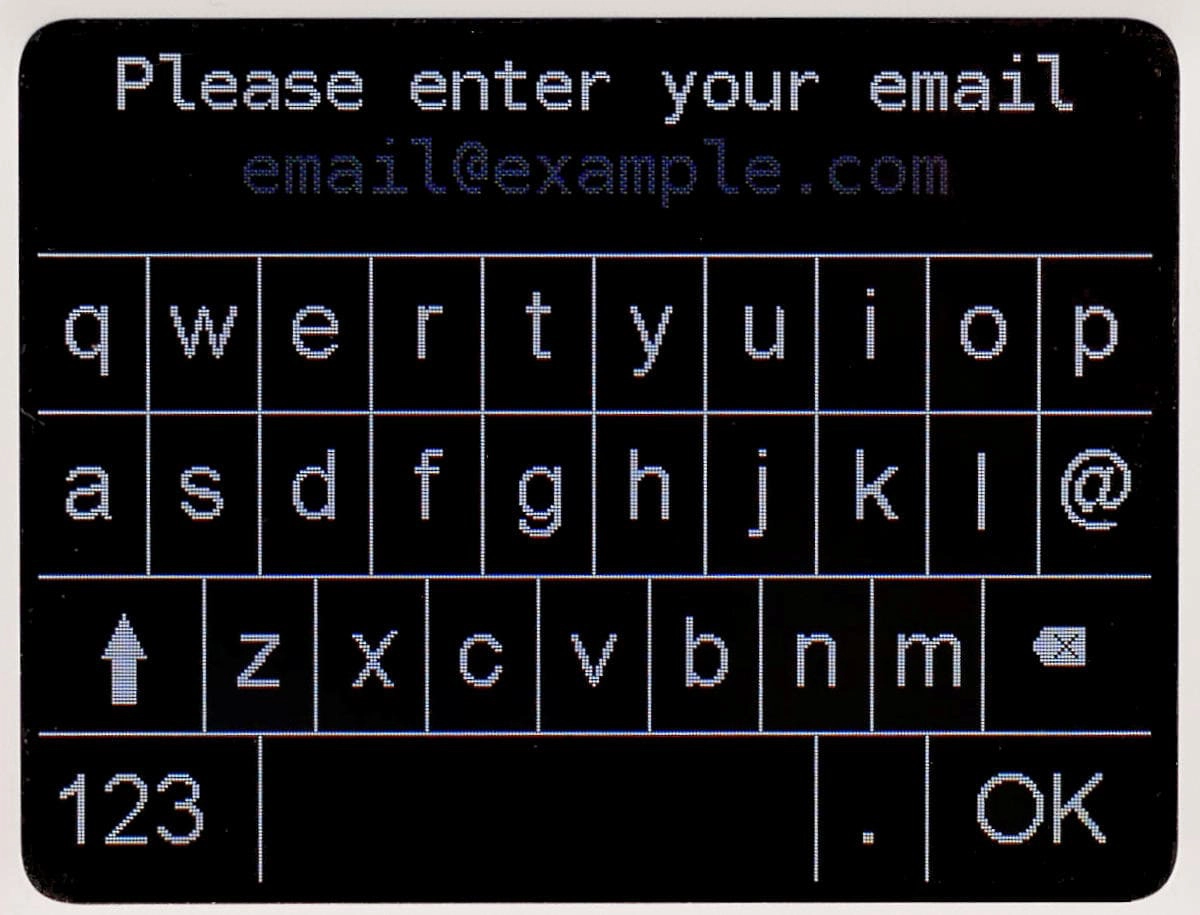

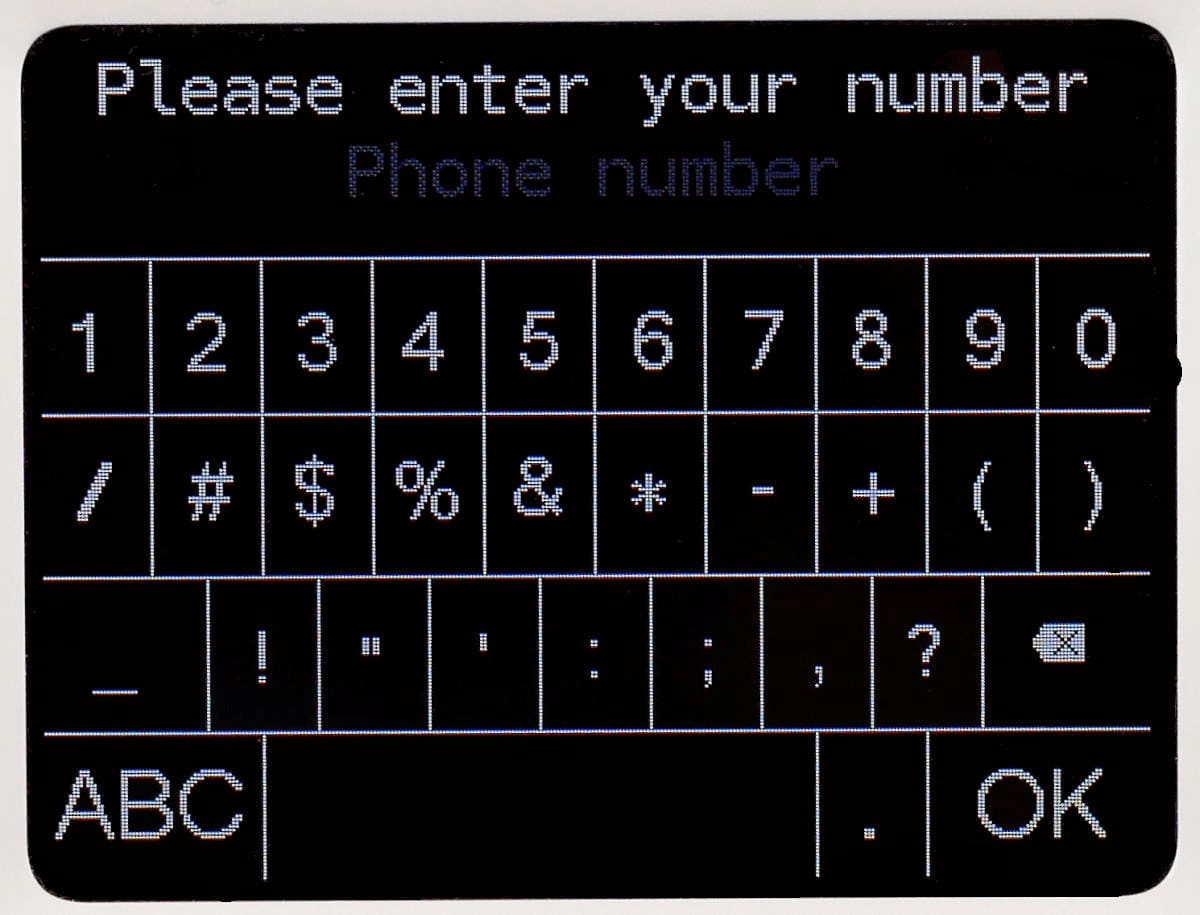

You navigate it through the keypad buttons and view the menu and information on the screen above the keypad. For some functions, you can use the display as a touchscreen. For instance, the screen gives you an option to send a text or email receipt after each transaction. This, of course, requires you to ask the customer for a phone number or email address, or you can ask them to enter it themselves on the touchscreen in this case.

If you need paper receipts, you can get the SumUp 3G and Printer terminal, which comes in two parts: the card reader and a printing-and-charging cradle. When they are attached, the receipt printer is able to print a receipt following each transaction.

It is limited what other more-than-basic functions are hardcoded on the SumUp 3G, but food businesses will like that you can add a tip on the machine before payments.

SumUp 3G displays for sending a digital receipt.

The card machine works with WiFi or/and makes use of the 3G network via the preinstalled SIM card in order to process card transactions. SumUp provides unlimited data on this card, so you don’t need to top it up.

You just need to keep the machine charged in advance of using it and be somewhere with a stable network connection. That said, it doesn’t take much to have a stable connection since it automatically switches between networks to get the best service. With WiFi switched on, it will use wireless internet primarily as this gives faster processing speeds. – otherwise it will default to the phone network.

| Tech specs | |

|---|---|

| Dimensions | 133 x 71 x 19 mm |

| Connectivity | GPRS, EDGE, 3G, WiFi |

| Data | Unlimited with SumUp SIM card (preinstalled) |

| Included accessories | USB type C cable for charging |

| Battery life | 50+ transactions from full charge |

| Card technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text, paper receipts with 3G Printer |

| Tech specs | |

|---|---|

| Dimensions | 133 x 71 x 19 mm |

| Connectivity | GPRS, EDGE, 3G, WiFi |

| Data | Unlimited with SumUp SIM card (preinstalled) |

| Included accessories | USB type C cable for charging |

| Battery life | 50+ transactions from full charge |

| Card technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text, paper receipts with 3G Printer |

Businesses with multiple staff members can use several SumUp 3G devices under the same SumUp business account. For this to work smoothly, it’s recommended you set up sub-user accounts in the SumUp dashboard, so each individual can log in with their email address and password and take payments simultaneously with the other card readers.

All of such sub-accounts will process payments through the main SumUp account, allowing you a full, real-time overview of all your employees’ transactions in your web dashboard.

Photo: EC, Mobile Transaction

SumUp 3G from the back.

SumUp Air vs 3G – how are they different?

If you’re looking for a cheaper terminal, SumUp sells an app-based card reader called SumUp Air. This does not work on its own – instead, it utilises the internet connection on a mobile phone or tablet that is paired with the Air through Bluetooth.

To accept a payment on SumUp Air, you open the SumUp app on the mobile device, enter an amount or add products to the cart. When you pick the option to accept a card, the Air reader automatically activates with the right transaction amount ready for processing.

Because SumUp Air only needs battery when the customer uses their card, and not when you enter a payment amount or navigate settings, it lasts for many more transactions than SumUp 3G that works entirely on its own.

| SumUp Air | SumUp 3G | |

|---|---|---|

|

|

|

| Price | £19 + VAT | £69 + VAT |

| Works without mobile app | ||

| Network | WiFi, 3G, 4G | GPRS, EDGE, 3G, WiFi |

| Size | 8.4 x 8.4 x 2.3 cm | 13.3 x 7.1 x 1.9 cm |

| Battery life from full charge | ~500 transactions | ~50 transactions |

| POS system integrations? | Yes, with SumUp app and others | Can connect with SumUp app, but not intended for it |

| Receipt printing | Connects to compatible Bluetooth printers | Requires SumUp 3G Printer cradle |

| SumUp Air | SumUp 3G |

|---|---|

|

|

| £19 + VAT | £69 + VAT |

| Works without mobile app | |

| Network | |

| WiFi, 3G, 4G | GPRS, EDGE, 3G, WiFi |

| Size | |

| 8.4 x 8.4 x 2.3 cm | 13.3 x 7.1 x 1.9 cm |

| Battery life from full charge | |

| ~500 transactions | ~50 transactions |

| POS system integrations? | |

| Yes, with SumUp app and others | Can connect with SumUp app, but not intended for it |

| Receipt printing | |

| Connects to compatible Bluetooth printers | Requires SumUp 3G Printer cradle |

SumUp Air integrates with Bluetooth receipt printers and more advanced POS systems if you need to expand the system. The 3G reader can connect and be synced with the SumUp app, but merely for backup reasons.

SumUp 3G can be purchased with a printer cradle that also acts as a charging stand, called ‘SumUp 3G and Printer’ when purchased together. It is also possible to buy this printer separately if you already have the 3G reader.

There’s a charging stand for the Air reader, but it only keeps the card reader charged and doesn’t print receipts.

Both card readers have no contract, no monthly fees and charge the same card card rate, 1.69%. They also accept exactly the same card brands.

Reports and dashboard functions

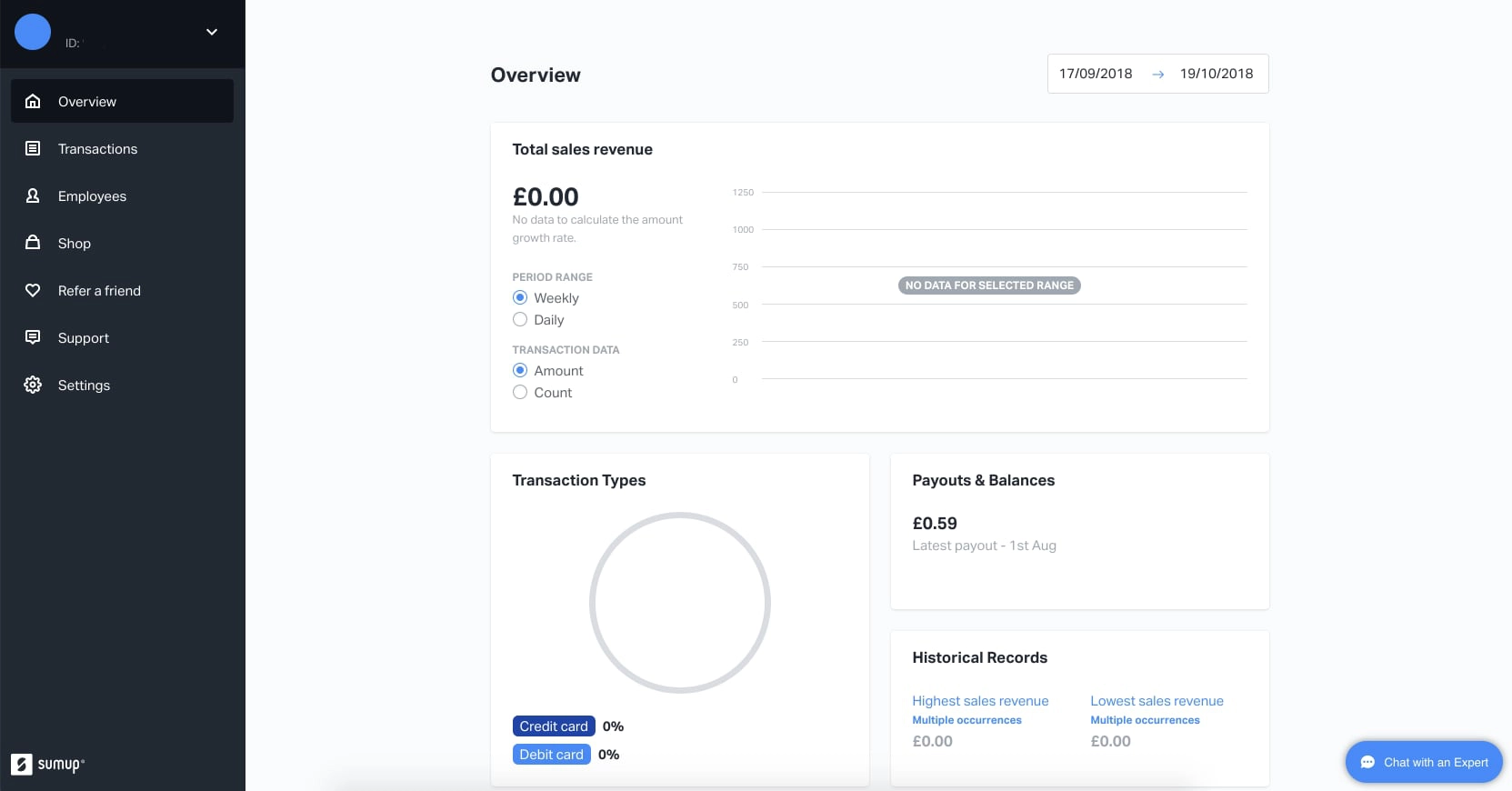

So where do you get a record of all your transactions? As a SumUp customer, you can log in to an online dashboard accessible in any internet browser. Here, you see details like payment history, sales categorised into card types, where payments were made and payout history. If you’ve created multiple user accounts, you can filter sales to focus on individual employees.

SumUp emails you payout PDF reports automatically, and you can export transaction data to a CSV or XLS file from your SumUp dashboard. Furthermore, transaction history is available on the card machine display.

Credit: Mobile Transaction

SumUp dashboard analytics, employee management and payout settings.

What is SumUp 3G best for?

The compact size and light weight make SumUp 3G perfect for use in market stalls or rural areas where connectivity is basic, but it is a bit faster with a good WiFi connection.

The tipping feature makes it particularly interesting for cafés and restaurants taking orders at the table, since many food-and-drink places don’t require all terminals to be synced with a POS system anyway.

It cannot register individual products, but only works with payment amounts (other terminals on the market, like SumUp Air, are made to integrate with product libraries). If such kinds of POS functions are needed, you might want to consider app-based card readers.

Since there’s no contract, monthly fees or minimal sales volume required, the terminal is ideal for seasonal sales. Just beware that if something happens to the card machine beyond the first year, you may have to purchase a new one, although SumUp claims they usually offer free replacements even after the 1-year warranty period has passed. However, SumUp’s machines should last a while provided you treat it well.

Travelling businesses could benefit from the option to use it in countries where SumUp’s service is available, which is most European countries.

SumUp does not accept businesses taking payments for products or services provided over a week after the transaction. Other restricted businesses include certain non-profit organisations, door-to-door sales, airlines and a range of other businesses, some of which are dubious or high-risk in nature.

Customer service

SumUp’s customer support is available over telephone and email every day of the week: weekdays from 8am to 7pm and weekends from 8am to 5pm. They have a Support Centre section online too, where most user questions have been answered. We recommend checking answers there first, since SumUp can occasionally take some days to respond over email. If you need an immediate answer or prefer talking, it’s better just to call them during opening hours.

SumUp 3G is an economical solution for price-sensitive businesses, sporadic sales or startups wanting to take card payments without the hassle of complicated contracts.

SumUp is a streamlined service that, because their products are so simple, usually only require minimal contact with their customer support.

That said, if you’re having problems with the card machine in the evening, you won’t get help until the next day during working hours.

SumUp is generally rated highly online, with many saying how valuable the service has been for them. Some users have had connectivity issues, which there could be a number of reasons for, but SumUp puts in the effort to resolve any issues flagged to them.

Photo: SumUp

SumUp 3G is a convenient choice for small cafés and restaurants with table service.

Sign-up process

Lastly, signing up and getting an account is completely online-based. It takes maybe 5-10 minutes to fill in the sign-up pages and order the card machine. Delivery is free and takes up to a week to arrive.

When you sign up, SumUp will perform some basic identity and business checks to make sure your details are legitimate and that your bank account is used by your company.

Verdict

The SumUp 3G setup is one of the simplest – and cheapest – solutions for small-business card payments. You get an affordable card machine with built-in data and software, so all you’re paying for onward is a fixed rate for the transactions, barring potential reasonable fees for chargebacks and refunds.

If all you want is to take cards anywhere and with minimal fuss, SumUp 3G could well be your best choice in the UK.