Zettle (previously iZettle) is popular for its mobile card readers at no monthly cost with free POS software, all run from an app on your mobile device. Square offers these things as well, but has other advantages that Zettle lacks.

How do the two compare? We look at fees, point of sale features, online payments and additional features.

Read complete review Read complete review |

Read complete review Read complete review |

|---|---|

|

|

| Device cost £14.25 through link |

Device cost |

| Transaction fee 1.75% (any card) |

Transaction fee 1.75% (any card) |

| Monthly fee None |

Monthly fee None |

| Payouts in bank account 1-2 working days |

Payouts in bank account 1-2 working days |

| Solution type Chip, contactless, keyed |

Solution type Chip, contactless |

| PIN confirmation On tablet or phone screen |

PIN confirmation On card reader buttons |

| Customer service Email, online support centre Phone 9pm – 5 pm weekdays |

Customer service Email, online support centre Phone 9am – 5pm weekdays |

|

|

|---|---|

| Complete review | Complete review |

|

|

| Device cost | |

| £14.25 through link | |

| Transaction fee | |

| 1.75% (any card) | 1.75% (any card) |

| Monthly fee | |

| None | None |

| Payouts in bank account | |

| 1-2 working days | 1-2 working days |

| Solution type | |

| Chip, contactless, keyed | Chip, contactless |

| PIN entry | |

| On tablet or phone screen | On card reader buttons |

| Customer service | |

| Email, online Phone 9am-5pm weekdays |

Email, online Phone 9am-5pm weekdays |

|

|

Card readers and hardware

Zettle only sells one card reader: Zettle Reader. This is connected to a point of sale (POS) app on iPhone, iPad or Android device, which is compatible with certain cash drawers, receipt printers and barcode scanners.

The Zettle card reader has long been a popular choice among small businesses in the UK. It is pretty, pocket-sized and user-friendly with its PIN pad and display, working anywhere with just a Bluetooth connection to your smartphone or tablet.

Photo: Zettle

Zettle Reader is straightforward for chip and PIN anywhere with a phone and network connection.

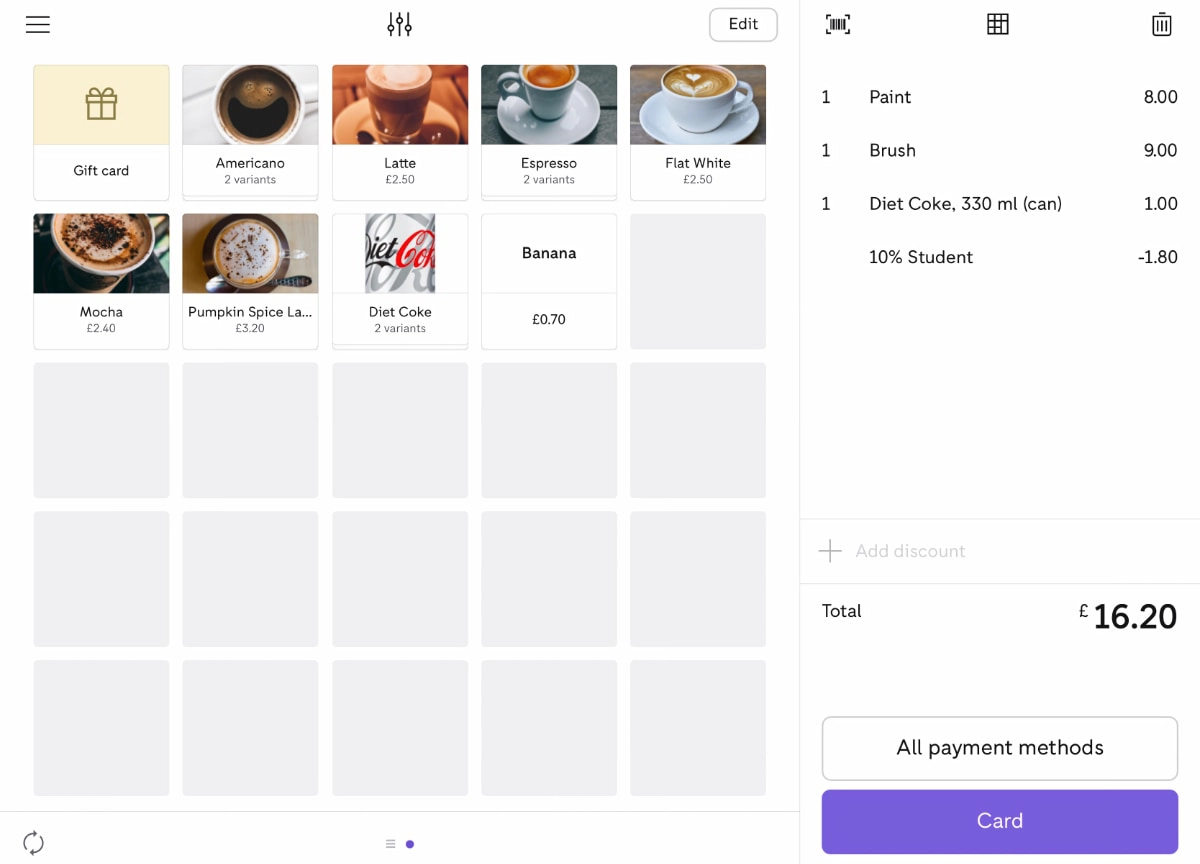

Square has an app-based card reader too: Square Reader. It is even smaller than Zettle Reader, but has no display or PIN pad.

Instead, payment amounts are shown in the app, and the customer enters their PIN (if applicable) in the app on your phone or tablet.

If you sell at a counter, Square’s PIN entry flow may be smoother if you invest in a tablet stand (Square Stand is an obvious choice for iPad) that swivels to face the customer. On the go, you’ll have to hand the customer both the card reader for a tap or card insertion and phone for PIN entry (if prompted).

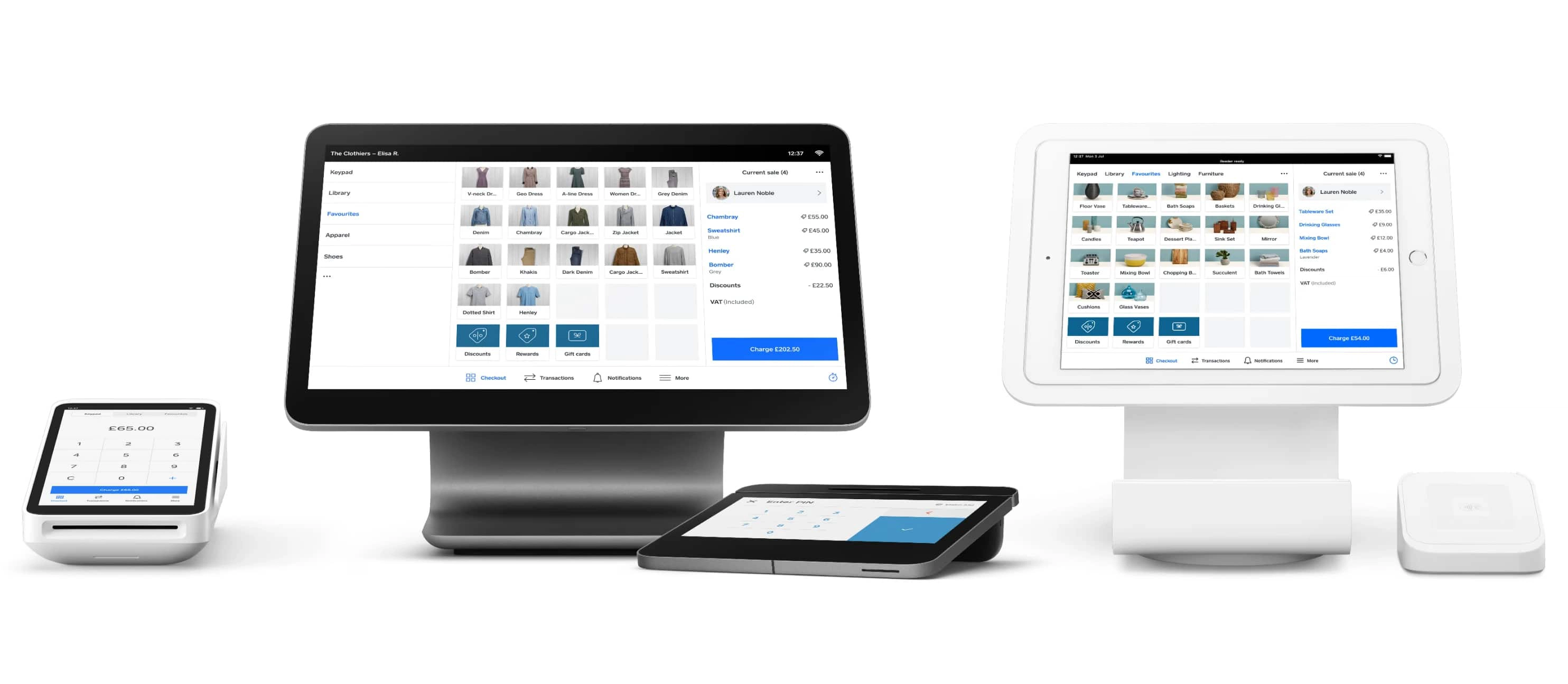

Photo: Square

Square Reader with connected app.

Contactless cards and mobile wallets are always effortless and quick for transactions below £100 that mostly don’t require PIN entry. That’s what Square Reader is best for, making it ideal for cafés, bars and other businesses where customers regularly just tap their cards. Zettle is equally effortless with contactless payments, but the added PIN pad makes it superior for chip payments.

To us, Zettle Reader is more stylish and friendly-looking than standard card machines on the market. Square’s sleek but displayless device might make some customers a little apprehensive, but is very convenient for contactless taps.

Photo: Square

Square has designed a whole range of payment terminals to fit with any point of sale.

Square also offers a portable touchscreen terminal called Square Terminal. This has a large display, works with your WiFi network (not 3G or 4G) and has the Square Point of Sale app built in so you don’t need to connect it with a smartphone or tablet.

A custom-built Square Register with a large touchscreen interface is also available, on which you can use any of Square’s point of sale software. This is attached to a small touchscreen card terminal that can be placed so it faces the customer. This setup is great if you don’t want to use a consumer-grade tablet such as the iPad at your till point.

Square’s hardware works with a larger selection of receipt printers, kitchen printers, cash drawers and barcode scanners than Zettle’s compatible models.

Similar pricing

Both companies charge 1.75% per chip payment, contactless tap and swipe. There are no additional fees for foreign cards, contractual commitment or monthly fees, though subscriptions apply to more specialised POS features.

The card machines available are paid for upfront, after which you own them outright with no obligation to use them continuously. Shipping is free within the UK.

| Pricing |  |

|

|---|---|---|

| Card terminals | Square Reader: £14.25 + VAT Square Terminal: £149 + VAT Square Register: £599 + VAT |

Zettle Reader: £29 + VAT |

| Monthly fee | None | None |

| Chip, tap payments | 1.75% | 1.75% |

| Invoice payments | 2.5% | 2.5% |

| Keyed, virtual terminal payments | 2.5% | n/a |

| Payment links | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

2.5% |

| Ecommerce payments | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

n/a |

| Keyed, virtual terminal payments | 2.5% | n/a |

| Payouts | Free (1-2 working days) 1% within 2 hours |

Free (1-2 working days) |

| Refunds | Free | Free |

| Chargebacks | Free | Free cover for up to £250/mo |

| Pricing |  |

|

|---|---|---|

| Card terminals | Square Reader: £14.25 + VAT Square Terminal: £149 + VAT Square Register: £599 + VAT |

Zettle Reader: £29 + VAT |

| Monthly fee | None | None |

| Chip, tap payments | 1.75% | 1.75% |

| Invoice payments | 2.5% | 2.5% |

| Keyed, virtual terminal payments | 2.5% | n/a |

| Payment links | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

2.5% |

| Ecommerce payments | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

n/a |

| Keyed, virtual terminal payments | 2.5% | n/a |

| Payouts | Free (1-2 working days) 1% within 2 hours |

Free (1-2 working days) |

| Refunds | Free | Free |

| Chargebacks | Free | Free cover for up to £250/mo |

Square facilitates keyed payments directly in the app for 2.5% per transaction, also applicable to Square’s email invoices and virtual terminal.

Online payments through Square’s ecommerce store, payment links and QR codes are 1.4% + 25p per transaction with a UK or European card and 2.5% + 25p for cards issued outside of Europe.

Keyed-in transactions are not possible with Zettle, but you can send payment links and invoices through the app so customers can pay remotely. These transactions cost 2.5%.

Both companies offer next-day settlement in your bank account, although Zettle sometimes takes 2-3 working days depending on the type of card used.

Square has an Instant Transfers service for payouts within 20 minutes for an extra 1% on top of the usual transaction fee. This is an optional setting that’s only available after you’ve accumulated enough transactions. Also, there has to be at least £50 in the Square balance for it to work, and only a maximum of £2500 per transfer can be deposited, so it’s less straightforward if your sales are irregular or larger in volume.

Zettle offers generous protection of up to £250 worth of chargebacks per month as long as you follow what is considered best practice. A chargeback is when a customer contacts their issuing bank and disputes a purchase – either because they are dissatisfied with the product or service or forgot about making the purchase (it does happen!).

Square goes a step further by eliminating all chargeback fees (i.e. there’s no maximum monthly chargeback protection) while offering free dispute support services.

Refunds are free to process whether you’re with Zettle or Square.

Both offer amazing POS features, free

Through the free point of sale (POS) apps and respective back office dashboards of both platforms, you get a lot of functions free. Their ecosystems are impressive, but Square takes the price for most features by far.

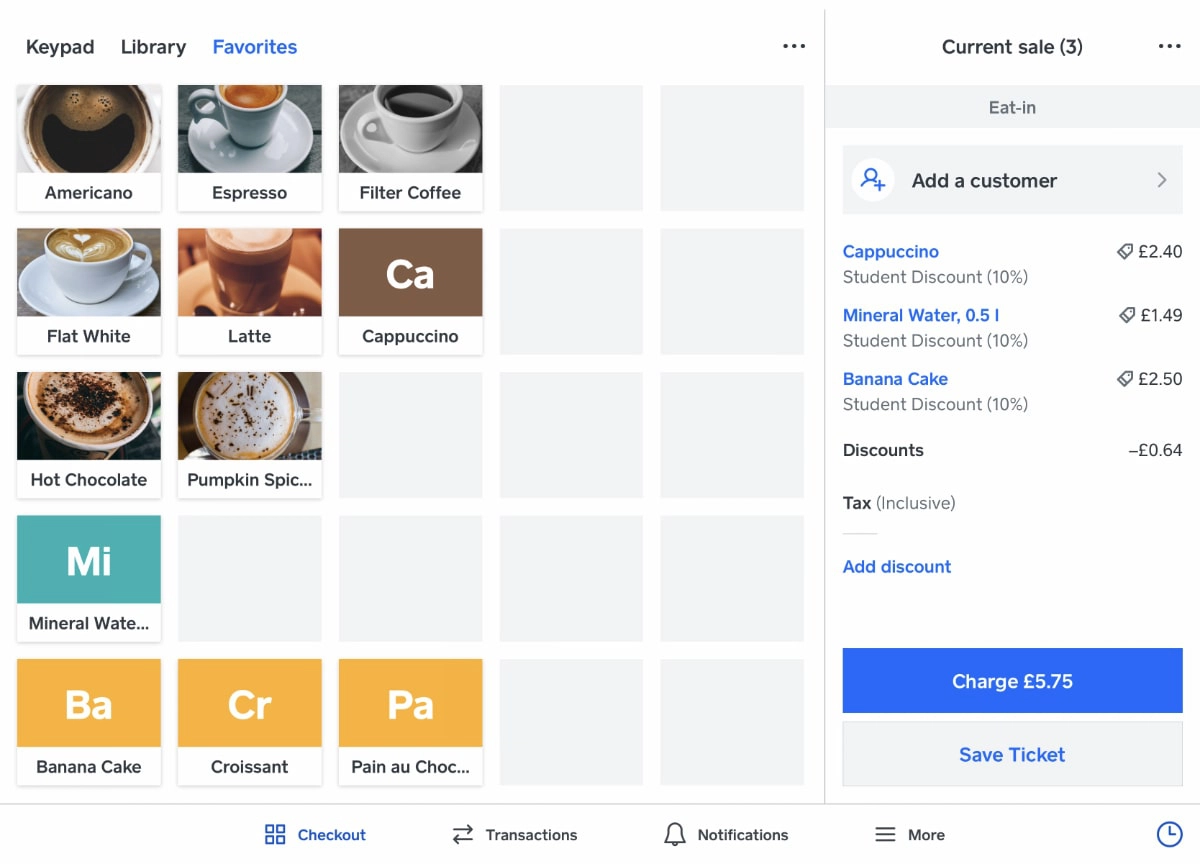

The free point of sale apps (Zettle Go and Square Point of Sale) look similar at a first glance.

In these apps, you can add products and assign different attributes to them. You can add discounts and VAT to items, but only Square allows you to add a customer to a bill, mark a transaction for takeaway, eat-in etc., record stock levels and save an order for later. Zettle Go does let you scan barcodes through your tablet camera, whereas Square Point of Sale doesn’t.

Just beware that a few of the more specialised Square features (e.g. advanced employee timesheet tracking) do come at an extra monthly fee, though.

Square Point of Sale product menu (1) versus Zettle Go product menu (2) on iPad.

If you own a café, restaurant, pub or food truck, the free Square Point of Sale app has more to offer. While Zettle’s free app doesn’t support split tenders or open tickets, Square does. You can add a tip with Square, and split tenders make it easy to split a bill between a table of customers. That said, Zettle does allow customers to add a tip to their transaction as well.

Square has subscription-based till apps for restaurants, retail and services taking bookings. Zettle offers no additional POS systems.

Zettle’s Repeat Payments feature is something Square does not have. You basically set an amount in the app, and the card reader will then be ready for the payment. This is great for processing lots of transactions without entering the amount in the app each time, ideal for street musicians and vendors accepting the same amount of money every time. Zettle does not, however, provide it as a default setting yet – you need to contact support for activation.

Not just for face-to-face payments

Those accepting payments where the customer is not present will find that Square has more to offer. Its Virtual Terminal accepts payments through a desktop browser, while the email invoice app is useful in service sectors. Alternatively, you can use Square app’s keyed entry option for card-not-present transactions where the card details have been given to you. None of these have an added monthly cost, allowing you the flexibility to charge customers the way you need it.

Ecommerce businesses can use the Square Online website builder, which has a free and paid plans. At no monthly cost, you can launch an online ordering page for contact-free ordering through a QR code or online takeaway or pickup orders. Furthermore, payment links can be sent from the Point of Sale app.

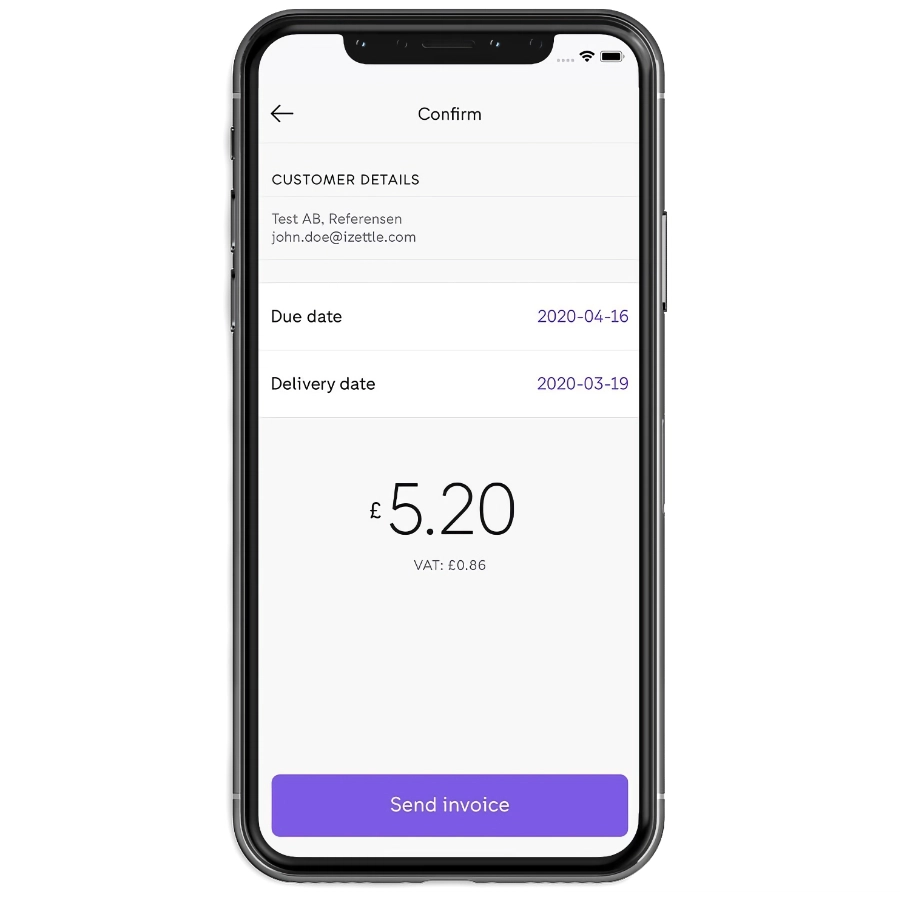

Photo: Zettle

Zettle invoices are basic, but accessible in the Go app.

Photo: Square

Square QR codes are good for table-side ordering.

Zettle also offers email invoicing and payment links as a payment method in the app. The latter can be sent via text, email and social media apps and is basically just a link through which a customer can pay for one bill. As with Square, none of these incur a monthly cost, but Zettle does not have a virtual terminal for phone payments, an online store builder or keyed payments in the app.

Integrations with external software

For bookkeeping beyond the free sales, transactions and payout reports, Square and Zettle can both sync with popular accounting and ecommerce platforms, but Square has many more integration options.

Whereas Zettle focuses on integrations with ecommerce (e.g. Shopify, WooCommerce), accounting (e.g. Xero, QuickBooks) and POS software (e.g. Vend, Lightspeed), Square has many other integrations for things like inventory management, marketing and form builders.

All integrations with external software are paid for separately through the chosen partner platforms.

Zettle offers financing to some merchants

Some Zettle customers qualify for a small business cash advance paid off through future sales. This is called Zettle Advance. That said, you only get such an offer after ongoing sales through Zettle, as the company needs to determine your ability to pay off the advance.

Square offers a similar loan option in the US, but this is not yet available in the UK. We would not be surprised if it were introduced in the next few years, but nothing is clear yet on that point.

Our verdict

Square started out with just an app-based card reader, but it is now a world-class payments platform for small businesses. Similarly, Zettle has been a forefront innovator of easy POS payments in Europe, but is slower to introduce new features.

Overall, Square has more to offer, whether it’s free online payment tools, ecommerce or paid POS systems designed for retail, hospitality and services. Zettle, on the other hand, has the most popular card reader that works with a user-friendly app.