Mobile Transaction has tested Square for years, so ratings and opinions are based on real experiences. Our editors tried the service in different countries and photographed the products in the UK and France.

Looking for the review of Square Ireland or Square Australia?

What is Square and how does it work?

Originating in the US, Square’s payment system was one of the first truly affordable card processing solutions for small businesses. Not only does it offer face-to-face, remote and online payment tools, it also saves the merchant from committing to a contract, which is the norm for traditional merchant service providers.

Square (trading name of Block, Inc., or Squareup in Europe) was also the first company in the world to release a card reader to be used with a mobile app. In 2017, this so-called Square Reader for chip and contactless cards arrived in the UK.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

A Square Reader with its charging cable and decals, received and tested by us.

Over the years, the freestanding Square Terminal and other Square-branded register hardware have also been launched to great success, along with many other cloud-based business tools. The free POS app works as a complete till system that helps you run any type of business from just your mobile device.

Accepted cards

The card machines accept the most popular debit and credit cards, Apple, Google and Samsungs mobile wallets and Clearpay (buy now, pay later solution). Funds arrive in your bank account in 1-2 days, or instantly for an extra fee.

Our opinion of Square: extremely versatile

If value for money is important, Square is one of the leading payment systems in the UK. It has the most free features for the price of a cheap card reader and fixed transaction rate – or like some users do: just use the app or online payments without buying a card reader.

“I’m always impressed by Square’s never-ending improvements and how much of it is free to use. As the software has matured, though, it has got more complicated to find my way around in the back-end Dashboard.”

– Emily Sorensen, Senior Editor, Mobile Transaction

A big advantage of Square is the many online payment tools available without a monthly fee, which we think makes any merchant more resilient in the face of unpredictable business conditions. Instant transfers to a bank account have also become popular, despite their extra charge.

We also like that growing businesses can use it with external software for e.g. inventory and delivery apps, so it isn’t a closed platform where you are stuck with Square’s own tools, like SumUp is to a large degree.

Pros

Cons

| Criteria | Verdict |

|---|---|

| Product Payments: Good Hardware: Good / Excellent Software: Good / Excellent |

Good |

| Cost and fees | Good / Excellent |

| Value-added services | Good / Excellent |

| Contract | Excellent |

| Sign-up and transparency | Excellent |

| Customer service | Passable / Good |

| FINAL RATING | [4.3/5] |

Square fees are simple and transparent

Square card processing fees are just a fixed rate of 1.75% per chip and PIN and contactless payment regardless of the card brand or whether it is premium or from abroad. Cash payments are free to process through the app. No additional or monthly fees are charged on top of that.

| Square Payments | Fees |

|---|---|

| Monthly fee | None |

| Chip, contactless payments | 1.75% |

| Online store, payment links | UK cards: 1.4% + 25p Non-UK cards: 2.5% + 25p |

| Keyed, invoice, virtual terminal | 2.5% |

| Instant Transfers | 1.5% in addition to card fee |

| Refunds | Original transaction is retained by Square |

| Chargebacks | Free |

Remote or online payments have a higher rate. That is, keyed, virtual terminal and invoice payments cost 2.5% of the transaction amount (the keyed rate applies to both when the customer is and is not present).

Online payments through the online store, payment links and eGift Cards are 1.4% + 25p for UK-issued cards and 2.5% + 25p for all non-domestic cards.

“Square’s online rates are similar to Stripe’s so you can say they are competitive, but the fixed fee of 25p makes low transaction values (e.g. £5) considerably pricier than higher amounts (£15+).”

– Emily Sorensen, Senior Editor, Mobile Transaction

With Square, you don’t commit to a contract period, nor do you need to sell every month or have certain sales volumes to qualify for the card rates.

Nothing is charged for chargebacks, which are dealt with by a dedicated support team for payment disputes. Refunds used to be free, but now cost the transaction fee originally paid for the transaction that is refunded.

Square Reader costs £19 + VAT, and the optional Bosstab Dock for charging and keeping the card reader in place costs £29 + VAT. The Square Stand, with a built-in card reader, is currently £99 + VAT. The all-in-one touchscreen register with attached card machine, Square Register, costs a total of £599 + VAT.

As for the Point of Sale app, features are free except for additional employee permissions costing £20 per month per location (Team Plus subscription). Then there’s a whole selection of add-on features for your business, some of which may require a subscription, including:

- Online store (£0-£75/month)

- Square for Retail POS software (£0-£49/month)

- Square for Restaurants POS software (£0-£69/month)

- Square Appointments POS software (£0-£69/month)

- Invoices (£0-£20/month)

- Email marketing (£9-£29/month)

- Loyalty programme (£25-£65/month)

Any third-party integrations are paid for separately through those other software platforms.

Fast transfers to a bank account

Payments are deposited in your bank account as soon as the next working day, but the general wait is 1-2 working days. This is automatic by default, but you can also set it to manual deposits if that simplifies bookkeeping.

Square also offers Instant Transfers, a setting that enables you to receive transactions within 20 minutes (may take up to two hours) – if your bank is a Direct Participant of Faster Payments. This costs an extra 1.5% of the transaction amount, i.e. a total of 3.25% for face-to-face payments.

We should warn, though, that merchants may not have access to this feature before they have a sufficient sales history in the Square account.

A thing that’s still missing with Square UK is a complimentary business account and debit card, like SumUp has (and to an extent Zettle with its optional PayPal account). Square offers this in the US and Australia, so we wouldn’t be surprised if it eventually arrived in the UK.

Square card reader: small but powerful

The crown jewel of Square’s offering is Square Reader, the pocketable card reader ideal for contactless payments especially, though it accepts chip cards too.

It is one of the smallest card readers in the UK at 66 x 66 x 10 mm and 56 g, but still lasts a whole day of active sales from a full charge. The new second-generation version lasts 20% longer than the original one.

Through Bluetooth, it connects with your iPhone, iPad or Android smartphone or tablet to process payments through a Square app.

Contactless payments just require a tap against the square-shaped card machine, while chip cards are inserted in the reader, followed by PIN entry in the app.

Photo: Emily Sorensen (ES), Mobile Transaction

Square Reader is quite small.

Square Reader differs from other card readers in the UK because customers need to enter their PIN on the touchscreen of the phone or tablet rather than a physical PIN pad. This is referred to as ‘PIN on COTS’ (PIN on commercial off-the-shelf devices), sometimes called ‘PIN on glass’ even though that is different.

Since the reader has no display either, the transaction amount and tipping options are displayed only in the app.

Some have been concerned that inputting their PIN using software on a multi-use commercial device is not safe, but PIN on COTS is officially approved by the PCI Security Standards Council, so we do not see cause for concern for merchants or payers.

That said, we recommend positioning the mobile screen so it’s easy to shield the on-screen keypad during PIN entry, allowing customers to feel safe doing so.

Photo: ES, Mobile Transaction

PIN entry happens in the Square Reader app on the smartphone or tablet screen.

Tap to Pay on a smartphone: an alternative to Square Reader

If you haven’t got the card reader, or it’s not working, Square merchants can add Tap to Pay on iPhone or an Android smartphone. The mobile device must have NFC (near-field technology) enabled. You can then ask customers to tap their contactless card or mobile wallet on your smartphone display to accept a payment.

We’ve seen this feature used more and more across London, and it seems to work really well. But I wouldn’t recommend ditching the card reader for it, because you don’t want to turn away customers who use chip and PIN. There’s also the risk of someone taking your phone after handing it to them for PIN entry.

Square card reader offer

No monthly fees or contract. Free delivery in 3-5 working days.

Mobile Transaction is an independent payments industry resource, trusted by over a million small businesses yearly.

Discounts do not influence our reviews or recommendations. Ratings are based on full retail price. (Full policy)

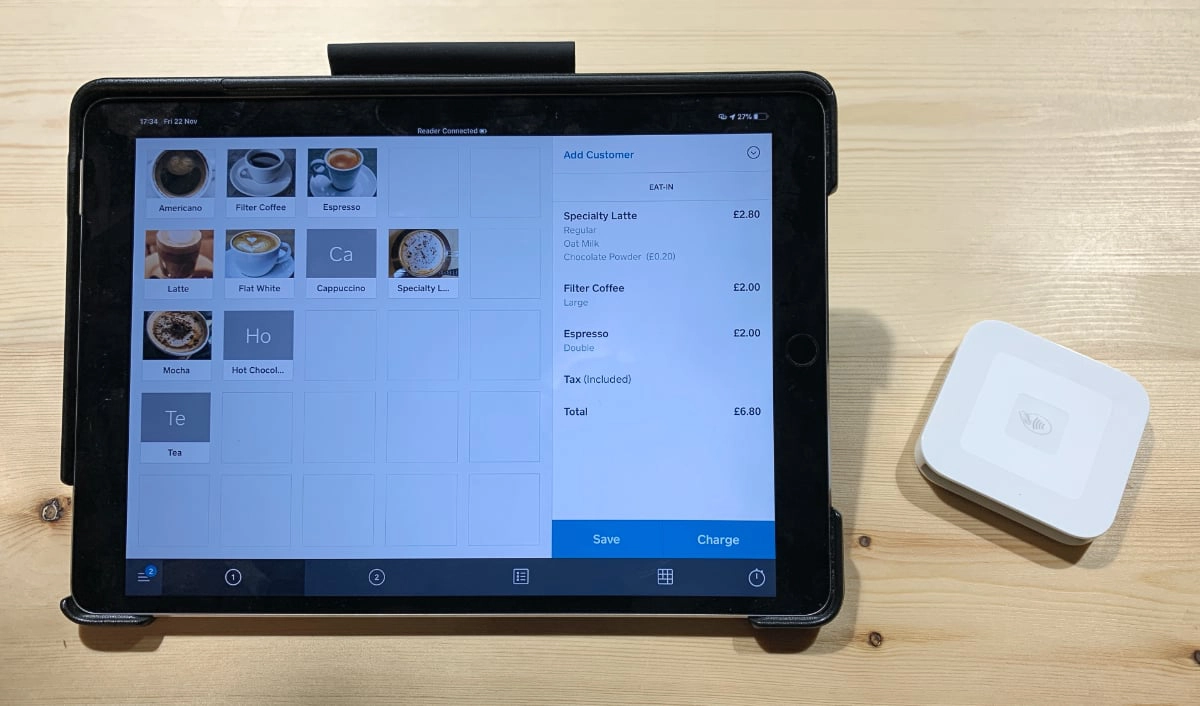

Square app: free POS features, with options to specialise

The free ‘Point of Sale’ app is one of Square’s biggest draws. Out of all POS apps in the UK, it has the widest breadth of free features for managing sales and business operations from any compatible Android or Apple device.

Apart from accepting cards through the contactless and chip reader, you can manually enter card details, send invoices and accept cash, as well as create custom discounts, add tips and split the tender so customers can pay some of the transaction with a card and the rest with cash. You can also sell gift cards sent via email, to be redeemed in your store.

The product inventory is great for tablets especially, as you can view a neat table of products, the layout of which can be customised. Each product can have a picture, description, types (e.g. red, black, pack of 2, pack of 5), different prices for each type, and stock levels.

Photo: ES, Mobile Transaction

Add products, apply discounts, view stock levels, and distinguish between product types.

To get the most out of Square’s tools, we suggest adding all the items you sell to the library before using the app. This enables you to track product popularity and differentiate between items when processing a refund. And of course, it makes it easier at checkout to just tap the product rather than manually entering each item or calculating a sales total, which are both possible as well.

You can also take advantage of the customer library where customer profiles can be added. This allows you to attach people to specific transactions, get customer feedback, track product preferences and manage sales more efficiently.

Businesses can add staff accounts with limited permissions in the app. Creating a user account for each employee enables time sheets so you can track hours and overtime worked.

What if you want more POS features?

Restaurants can upgrade to Square for Restaurants and retailers to Square for Retail, both with free and monthly subscriptions for features tailored for those industries. Our tests of these have shown they work well in very busy, small venues or shops, but could do with more complex functions and a better user flow.

The Square Appointments scheduling system is also available for hairdressers, personal trainers and other professionals who need a booking system connected to payments. We were impressed with how adaptable this was for both online and in-person bookings, plus it has Square Point of Sale’s features built in.

If none of these suit, you can integrate with a few other POS platforms like Shopwave or TouchBistro.

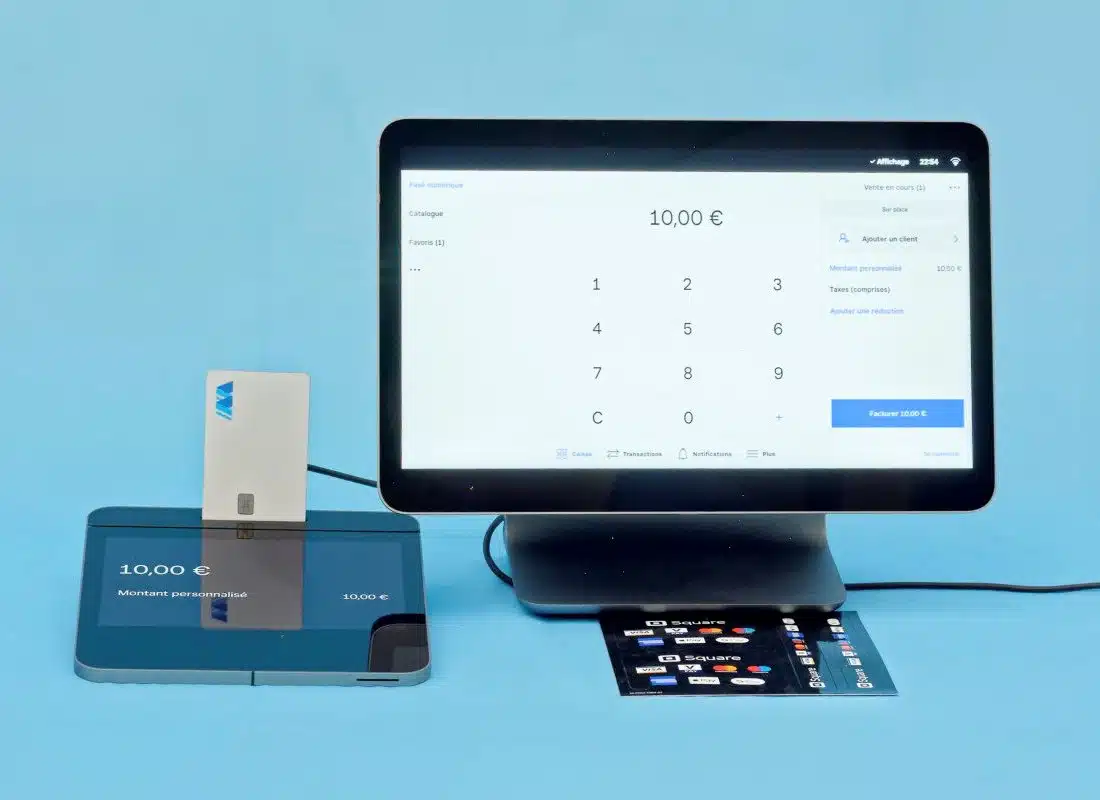

Photo: EC, Mobile Transaction

Square Terminal prints receipts and has the Point of Sale software built in.

Square Reader vs Square Terminal

If a POS app on a mobile device is not for you, the card machine Square Terminal works independently.

This is a touchscreen smart terminal with integrated POS features (similar to Square Point of Sale app) navigated directly on the card machine screen. It takes chip, contactless and swipe cards and accepts PIN codes on its touchscreen PIN pad, similar to how you would use a traditional card machine.

Given the large touchscreen and integrated software, Square Terminal is much bigger than the credit card reader, like a conventional card machine. It also has a built-in receipt printer so you don’t need a separate one. And still, we’ve seen that the battery lasts a whole day from a full charge, like Square Reader.

While Square Reader works with 4G and WiFi through a connected mobile device, Terminal only works with a secured WiFi connection. If you purchase a ‘Hub for Square Terminal’, it can be connected to an Ethernet cable as well.

So we think Reader is more suitable for on-the-go payments and Terminal geared towards a fixed area with a closed WiFi setup.

Photo: ES, Mobile Transaction

Square Terminal and Square Reader next to a pound coin.

Hardware and accessories

You can wirelessly connect Square’s card reader with compatible receipt printers, kitchen printers (for restaurants), cash drawers, barcode scanners and a round countertop Dock for Square Reader to keep it charged all day.

Square Stand for iPad enables you to swivel the tablet screen to face the customer who can then enter their PIN. In addition, the Square Stand has a chip card slot and NFC for contactless payments so you don’t need a separate card reader. However, the stand is only compatible with certain iPads.

Square-branded equipment generally looks very Apple-inspired – sleek and minimalistic – so prioritising iPad compatibility is unsurprising.

Photo: EC, Mobile Transaction

The latest Square Stand accepts contactless taps and chip cards on its side.

Alternatively, you can bypass iPad entirely and get the all-in-one POS device called Square Register. This comes with a purpose-built tablet screen where you can use Square’s POS software only, without the need for an Android tablet or iPad. A small touchscreen card machine is attached to it as well.

Photo: EC, Mobile Transaction

We were impressed with the quality and stylish look of the Square Register bundle.

Quite a few receipt printers work with the Square system, but some only work via Square Stand in which case you need to use iPad, not Android or Square Register.

How does Square compare with other card machines?

So how does Square compare with other card readers and market leaders in the UK? Its closest competitors are SumUp and Zettle that, like Square, have pay-as-you-go fees without a monthly charge or lock-in.

Zettle Reader is arguably the best-known card reader on the market, partly because of its ergonomic design and push-button PIN pad. Popular SumUp Air also has a PIN pad, but it is made of flat, touch-sensitive glass that is easy to wipe. Square Reader is nevertheless the smallest of them all and comes with the most comprehensive POS app.

Photo: EC, Mobile Transaction

Square Reader is smaller than SumUp Air in all dimensions.

As for standalone card machines, Zettle Terminal is the smallest with (simple) POS software built in – but it is pricier than Square Terminal if you opt for the model with a receipt printer or barcode scanner. That said, Square Terminal only works with WiFi so cannot be used on the go through a mobile network. SumUp Solo is cheaper than either of these card machines, but too basic for some merchants.

If you’re planning to sell online or over the phone without a subscription, Square trumps the alternatives. We have simply not seen a better virtual terminal or payment link features more extensive than Square’s at no monthly cost. You also get a free online store, QR codes and keyed card entry in the app.

All Square merchants have free access to:

- Email invoices (with dedicated app)

- Payment links

- QR code payments

- Online ordering page

- Basic website builder

- Virtual terminal for telephone payments

- E-gift cards

Payment links and QR codes (Online Checkout) are accessed in the Point of Sale app or the Dashboard. Invoices can be sent from and managed in the Point of Sale app or through the dedicated Invoices app, which we can testify is the best free invoice app around.

An online ordering web page can be created with a QR code to display in store for contact-free ordering, or for to link to online for click and collect. Or go further: create a complete online store with shipping or collection options at checkout through Square Online.

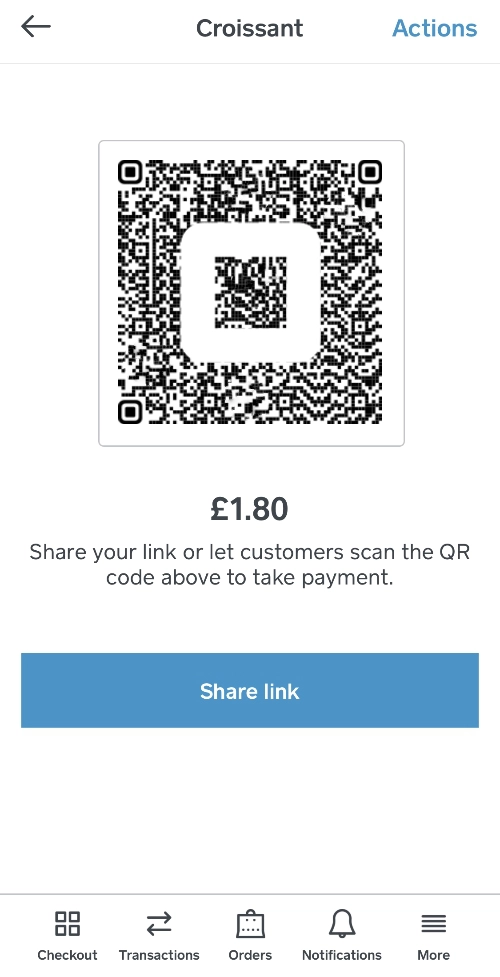

Image: Mobile Transaction

QR code/payment link in Point of Sale app.

Transactions over the phone or by mail order can be completed in the Virtual Terminal. From any desktop browser, you can log in to the Square account and go to the Virtual Terminal section where you key in a customer’s card and transaction details.

All of these features have consistently impressed us with its ongoing improvements and excellent value – except for maybe the online store which is not the most flexible ecommerce platform, to be honest.

Reports and accounting

In any supported internet browser, you can log into your Square account and export data to Excel for accounting purposes. Because the system is cloud-based, the account is synced with shop activities in real time so you can always check in on how sales are going.

The POS app also shows transactions, payouts, amount of cash in the till drawer (if cash management is on) and sales reports you can email from the app.

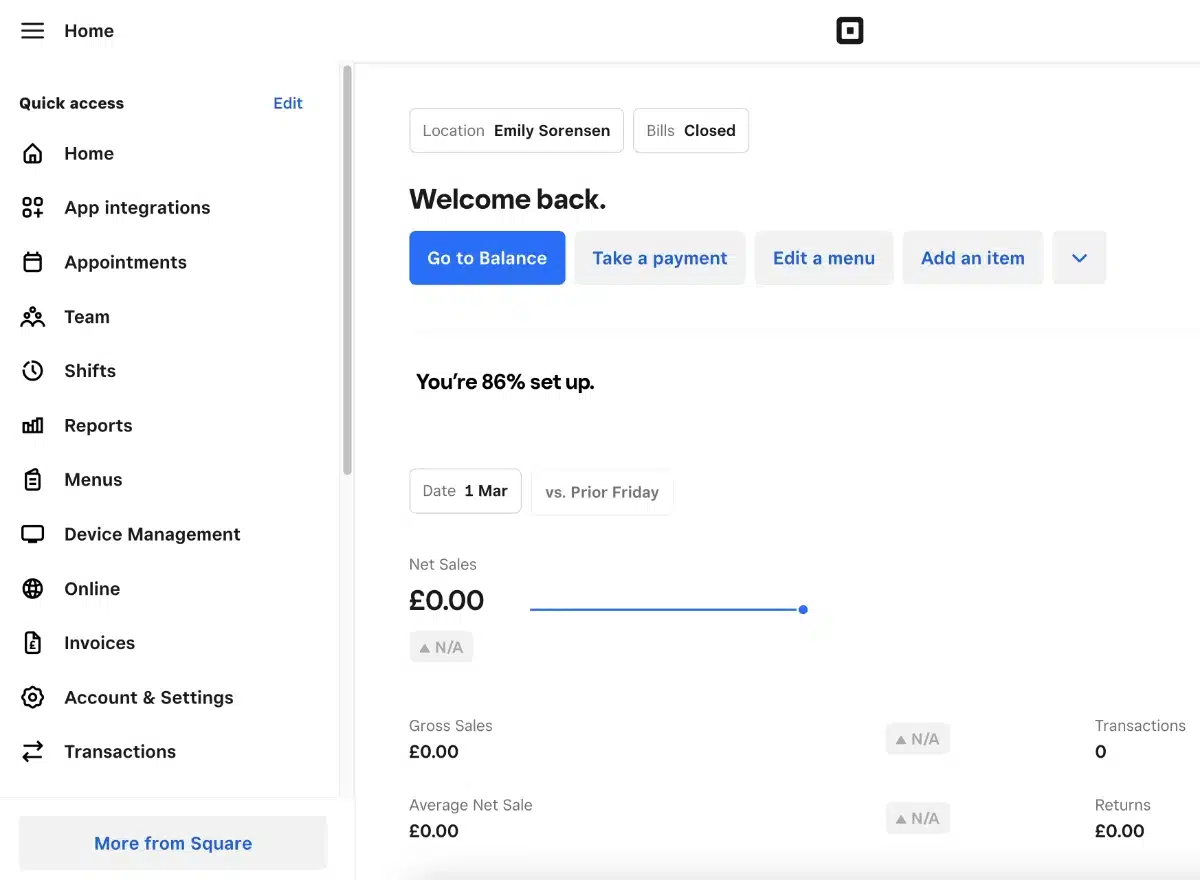

Image: Mobile Transaction

Square Dashboard analytics give you an overview of sales from any web browser.

Square analytics are in-depth compared to similar card reader services. The Dashboard provides an overview of key sales data, but many more analytics are accessed in the reports section. We could, among other things, analyse employee sales, taxes, product categories and product modifiers applied to sales.

For more complex accounting features, Square integrates with Xero, Zoho Books and other supported software.

Who is it best for?

Square aims to suit every business type. Having tested the POS app, we can verify it’s useful in the retail and hospitality sectors – food-and-drink in particular – due to its comprehensive product library, checkout functions, tipping, analytics and staff management features.

Those selling at multiple locations can distinguish between sales at different locations. And let’s not forget the very small size of the card reader, which makes it the handiest for mobile payments at, for example, market stalls, home visits and conferences.

As with other payment companies, Square has a list of prohibited businesses. Some of these industries include pharmaceuticals, adult products and services, certain marketing services, certain financial services, and illegal or otherwise questionable products and services.

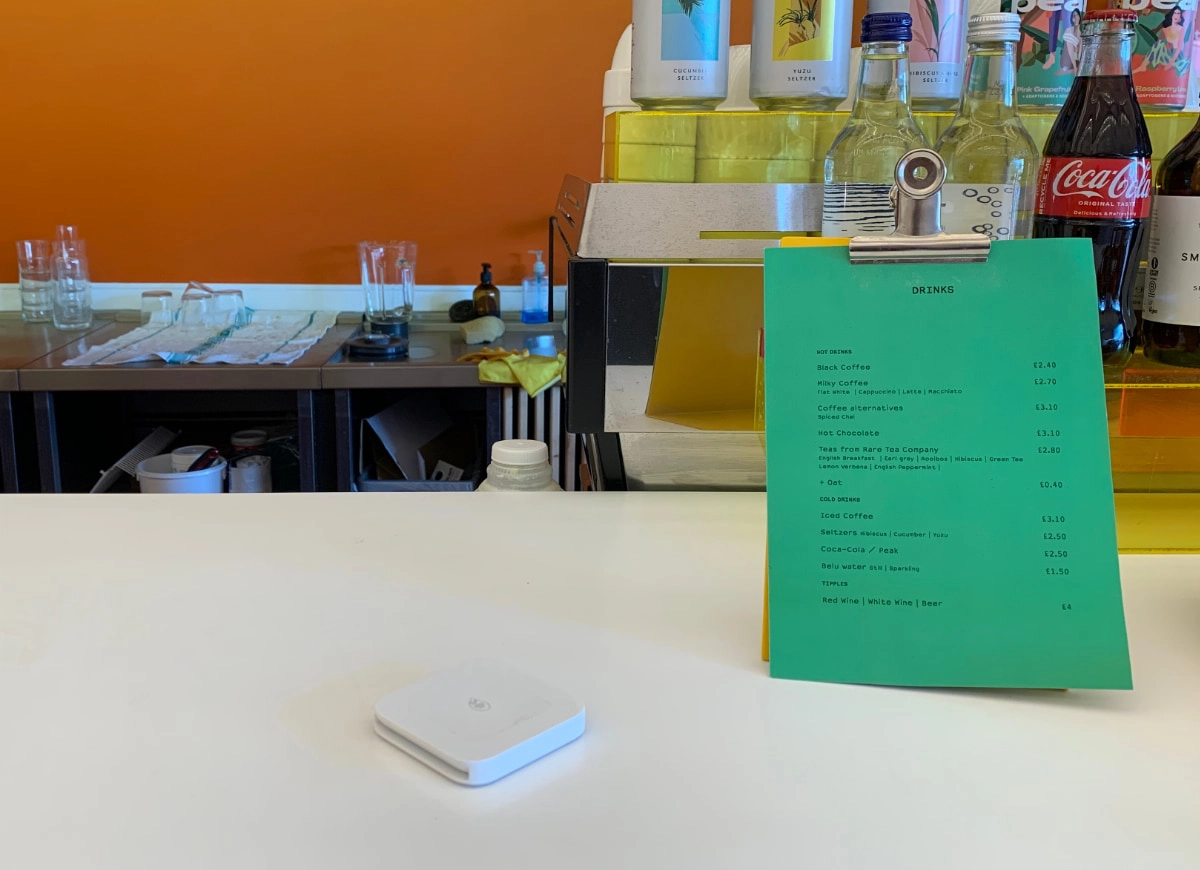

Photo: ES, Mobile Transaction

Square blends in completely with white surroundings. Here seen at La Despensa café, London.

Customer support, reviews and complaints

Square is available to phone or email between 9am and 5pm Monday to Friday. There is no weekend or evening support, which is fine if the system works, but not so good if you need support at night in a bar, for example.

The majority of Square reviews are positive, but there is also a thread of negative user reviews in the UK. The main complaints are about unresponsive customer service, account verification issues and in some rare cases, withheld payments.

It appears that if you do get an issue to resolve, it can be difficult to get through to customer support on the phone and even online. Email replies are slow, and urgent issues are not always dealt with promptly.

That said, the online resource section is comprehensive, with guides and articles covering many aspects of the products and features. Most merchants will be able to find an answer there, so you may not need to contact support.

“We strongly recommend reading the fine print of what trades Square does not allow to avoid having payments suddenly rejected.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Some users report having their account rejected out of the blue (even after they’ve started selling), but it appears many of them are types of businesses deemed as high risk.

Getting started

Before purchasing a card machine, you need to sign up for a Square account and connect your bank account. It typically takes four days to have a bank account verified, but you can still take payments before the verification is finalised. After completing the straightforward sign-up form, you can order the card reader.

If not buying the card reader on Square’s website where it is cheapest at £19 + VAT with free delivery, you can purchase it from Argos, Currys or Amazon. EE and BT sometimes offer a free Square card reader to their business customers. In any case, sign up online via Square first as you won’t be able to use it without an approved account.

Our editor’s experience of registration and setting up

I connected a personal bank account with a history of receiving sole trader income, and this was verified after four days.

To be accepted, Square requires that the bank account allows for both deposits and withdrawals to support the refund and chargeback system. Online-only accounts like PayPal are not supported, nor are prepaid card accounts. Your bank account also must operate in GBP.

Photo: ES, Mobile Transaction

Emily’s card reader arrived two days after ordering it online.

Ordering the Square Reader went smoothly and postage was free. I received it two days after purchase via DPD. Prior to delivery, I received text notifications stating when it’ll arrive, to pick a specific time (from a selection of hours) with the option to request leaving it at the neighbour’s if needed. The parcel was wrapped up well – all in all a positive experience.