Absolutely No Nonsense Admin Ltd (in short: ANNA) is a private limited company that provides business current accounts to freelancers and small businesses in the UK.

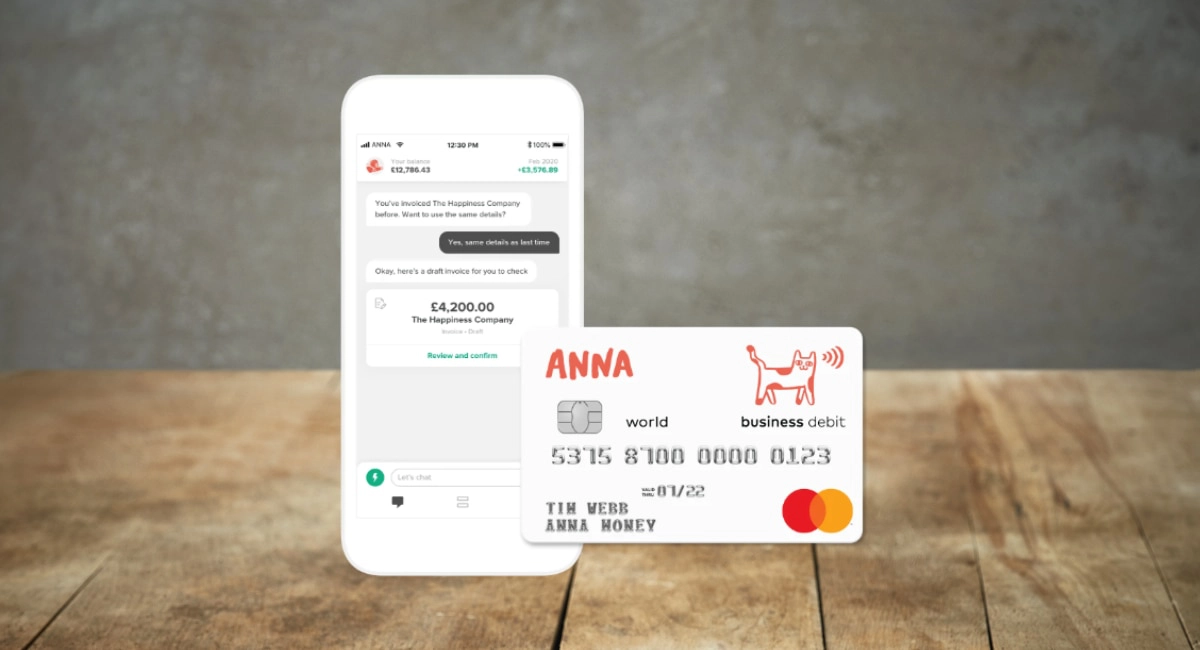

ANNA – sometimes called ‘Anna Money’ – is not a bank, but nonetheless gives you a current account with a sort code, account number and IBAN. With the business account comes a Debit Mastercard, money tracking features, invoicing and bookkeeping tools.

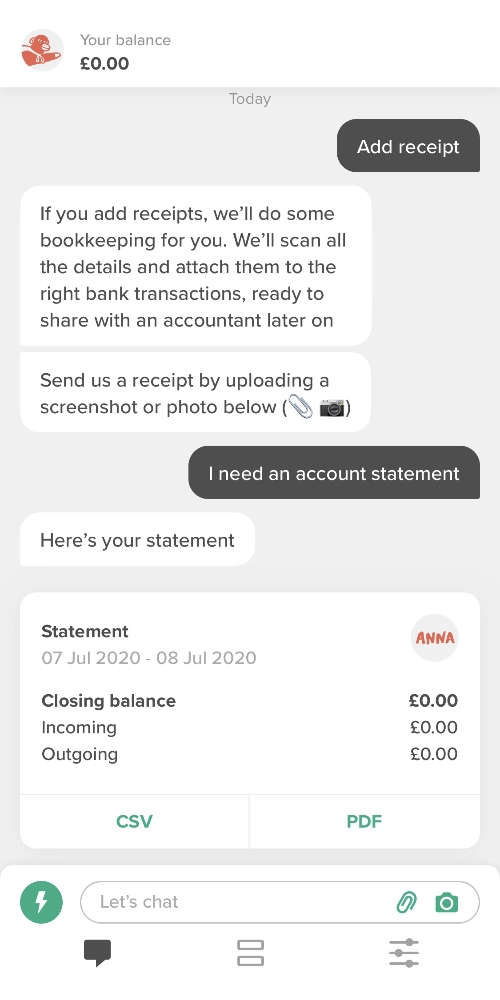

The account is managed entirely through a mobile app within an AI-powered chat and simple menu sections. You can message the chatbot 24/7 and it will ask further questions, post information or present appropriate options for your needs.

This can be refreshingly straightforward, or tedious if you prefer just a non-communicative app without the human element of a chat.

Who can open an ANNA account?

ANNA is mainly geared towards startups, freelancers and “creative types” as they like to call it.

Specifically, you need to reside in the United Kingdom and be one of the following to open an ANNA account:

- Sole trader

- Director of a limited company that’s listed at Companies House

- Partner in a Limited Liability Partnership (LLP)

Your business should also be located in the UK. Note that only directors and partners of a company can be account owners, i.e. no ‘persons of significant control’ can open an account. Charities are currently not accepted.

Costs and fees

ANNA has three plans: Pay as you go, Business and Big business.

There’s no setup fee or commitment, though the two ‘business’ plans have an annual option requiring a yearly upfront fee that works out cheaper than a monthly subscription. The accounts can be cancelled any time through the app.

Pay as you go has no monthly or annual fee, but then you have charges for nearly all types of transactions except for card payments and Direct Debit transfers. You can also create invoices in the app and send them for free.

| ANNA pricing | Pay as you go | Business | Big business |

|---|---|---|---|

| Monthly fee | Free | £14.90*/mo, or £149*/yr First month free |

£49.90*/mo, or £499*/yr First month free |

| Card payments | Free | Free | Free |

| UK transfers | 20p* each | 50 free/mo, then 20p each | Unlimited free |

| International payments | £5* each | 1 free/mo, then £5 each | 4 free/mo, then £5 each |

| Currency conversion fee | 0.5% | 0.5% | 0.5% |

| Cash withdrawals | £1 each | 3 free/mo, then £1 each | Unlimited free |

| Payment link transactions | 1%* each | Up to £200/mo free, then 1% each | Unlimited free |

| Debit card | First 1 free, then £3* each/mo | First 5 free, then £3 each/mo | Unlimited free |

*VAT is added on top.

| ANNA pricing | Pay as you go | Business | Big business |

|---|---|---|---|

| Monthly fee | Free | £14.90*/mo, or £149*/yr First month free |

£49.90*/mo, or £499*/yr First month free |

| Card payments | Free | Free | Free |

| UK transfers | 20p* each | 50 free/mo, then 20p each | Unlimited free |

| International payments | £5* each | 1 free/mo, then £5 each | 4 free/mo, then £5 each |

| Currency conversion fee | 0.5% | 0.5% | 0.5% |

| Cash withdrawals | £1 each | 3 free/mo, then £1 each | Unlimited free |

| Payment link transactions | 1%* each | Up to £200/mo free, then 1% each | Unlimited free |

| Debit card | First 1 free, then £3* each/mo | First 5 free, then £3 each/mo | Unlimited free |

*VAT is added on top.

The Business subscription includes 50 local transfers, three ATM withdrawals, one international payment, up to £200 worth of payment links transactions per month. You also get five extra debit cards for staff members.

If you upgrade to Big business, you have unlimited UK transfers, cashpoint withdrawals, payment link transactions and employee debit cards. You also get four international payments monthly.

The plans have a 1% cashback offer on selected purchases like train travel and food.

Account, debit card and cash

The ANNA account is not actually provided by ANNA directly. It is an electronic money (e-money) account with a Debit Mastercard, all managed by PayrNet who keeps your funds secure in a ring-fenced bank account. The account is regulated by the Financial Conduct Authority (FCA) in the UK.

The current account comes with a Debit Mastercard (not prepaid) that can be used for free anywhere in the world, whether in card machines or online. Payments in foreign currency will be subject to a currency conversion fee of 0.5%.

The type of domestic transfers allowed are Direct Debits, BACS and Faster Payments. Account limits exist on transactions and cash withdrawals, but they are so high it is unlikely to limit users. You can deposit cash into the account in any PayPoint store, but it is not yet possible to deposit cheques.

The ANNA business account cannot have an overdraft. The lack of bank licence means there are no credit cards or business loans on offer either.

The account integrates with a few ecommerce platforms, Shopify and WooCommerce, with more being added soon. If you’re using card machines, you’ll be pleased to know that it also receives payouts from well-known payment companies like Zettle, SumUp, Elavon, Stripe and Worldpay.

International transfers

The ANNA business account now comes with an IBAN and BIC/SWIFT code for receiving international transfers. This is provided by Payoneer to allow you to receive euro and US dollar payments from abroad into your ANNA account.

This integration requires opening a Payoneer account, where you answer questions about your business, clients and the nature of your international payments. It is then linked with the ANNA account so money can be transferred between the two (they are two different accounts).

Incoming payments in US dollars or euros cost a currency conversion fee of 0.5% on top of the mid-market rate at the time of the transaction. An additional fee of £5 is charged by ANNA, unless it is included on a paid ANNA subscription.

You can also send money internationally. This is facilitated by CurrencyCloud and also costs £5 per transaction (unless included in the ANNA subscription).

ANNA app

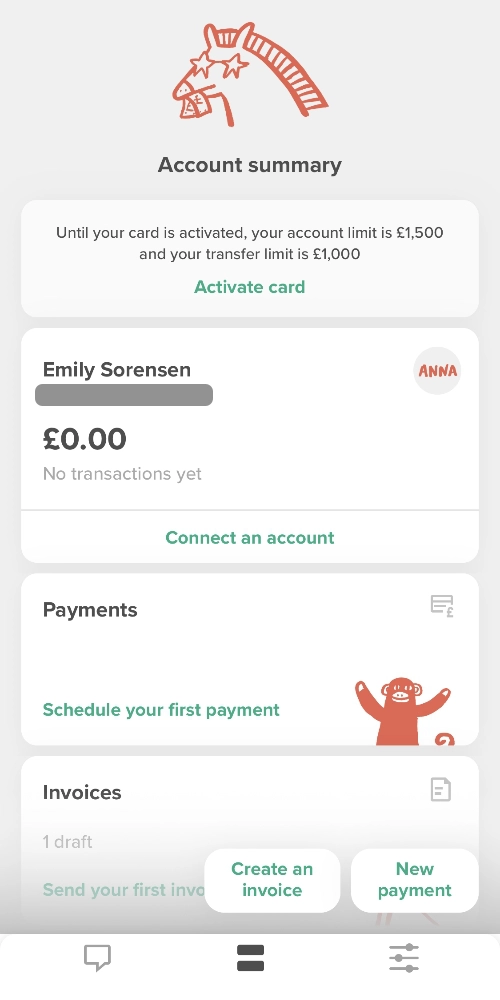

The ANNA app isn’t like all the other business account apps around in the UK. Why? Because the main screen screen is a messaging thread acting as your virtual assistant available to take questions and instructions round-the-clock. Beneath the chat is a simple menu for switching between the chat, account summary and settings, should you prefer to bypass the chat.

Credit: Mobile Transaction (MT)

The in-app ANNA chat.

Credit: MT

Account summary tab.

Credit: MT

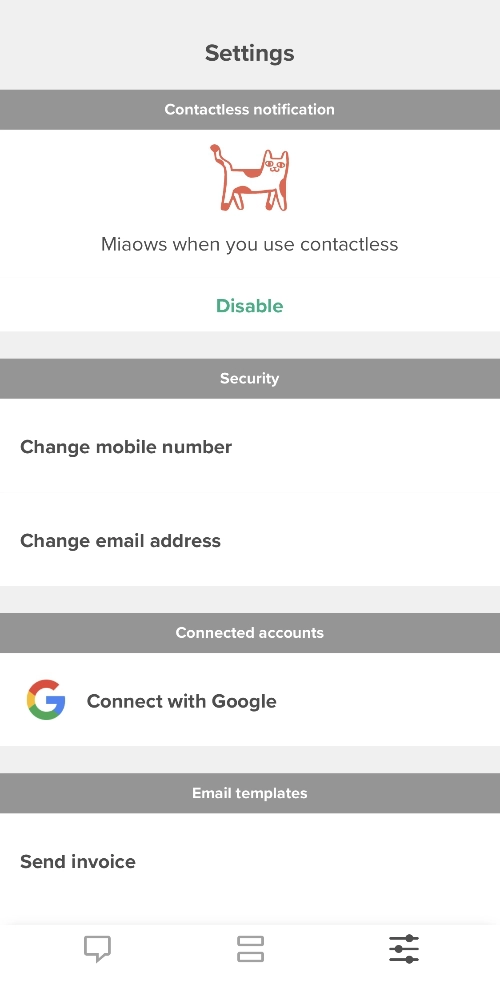

Settings tab in ANNA app.

There’s not a huge amount of features in the app, but that is not a bad thing considering they are all relevant for your business books. The main functions are:

Invoice management: Message ANNA when you want to create an invoice, and the virtual assistant will fill in the details and even send the invoice. If a client hasn’t paid you by the due date, the app can send polite invoice reminders until the client pays. The automatic invoice reconciliation will also match invoices with incoming payments, chasing up outstanding payments where needed.

Credit: ANNA

Template of an ANNA invoice.

Expense management: Take pictures of expense receipts and upload them in the app through the chat. ANNA categorises expenses in your account to make accounting easier. If your employees have an ANNA Debit card each, their payments are automatically grouped into these categories as well.

Tax calculations and reminders: At the right times of the year, you will receive notifications that it’s time to submit your self-assessment form, VAT or corporation tax. You can view your total income, expenses and taxable income in the summary tab and adjust tax settings.

Payment links: Send personal payment links to clients, through which they can make a bank transfer. It is not yet possible for payers to use their card details, only bank account details, but the latter is cheaper to process for merchants (only 1% or no fee).

Schedule payments: If you know when someone needs to get paid, you can schedule payments to take place in the future.

Card management: Copy and paste the card details of the virtual Mastercard for online purchases, set spending limits, freeze or replace the physical card. When you use the contactless card, the app says “miaow” like a cat – but you can disable this setting if it’s too embarrassing!

Open Banking: Add your other bank accounts to ANNA so they can be viewed and managed from within the same app.

View spending limits, change your contact details and ask ANNA anything in the messaging chat. If the artificial intelligence (AI) powered virtual assistant isn’t able to answer, a real person from the support team will take over the chat and answer within minutes. If you prefer talking over typing, switch on your phone’s voice-to-text setting to allow for dictation instead of manual typing.

All transactions in ANNA can be imported to Xero for advanced accounting management. The support in the chat can help set this up.

Accountants can use ANNA to manage your data easily through a special dashboard, or you can use it yourself for your bookkeeping tasks.

Customer service and ANNA reviews

Honestly, the quality of customer support and human element of the in-app virtual assistant are two of the best things about ANNA.

Every day of the year, 24/7, ANNA has a support team on hand to answer any questions and help solve problems through the mobile app or via email. If no one gets back to you within 10 minutes in the chat, your account subscription fee for the month will be refunded.

We put the response time to the test with various questions at different times, and ANNA really did answer them all within minutes with clear answers. If you’re stating an action like “create an invoice”, you get an automatic response to initiate it straight away. An invoice, for example, will prompt questions about what to include on the invoice, due date etc. until it is ready to be sent.

If no one gets back to you within 10 minutes in the chat, your account subscription fee for the month will be refunded.

When it comes to the general commitment of the service, we saw an example of the company’s remarkable ability to handle a crisis in 2020.

To deal with Wirecard’s (ANNA’s previous account and Mastercard provider) financial troubles, the ANNA founders promptly conducted a live Q&A with its users concerned about what will happen to their account and funds.

A crisis communication kit about dealing with concerned payees was published, regular updates were posted and there was complete transparency about what ANNA is doing and who’s doing what.

ANNA even offered to personally confirm to users’ business partners or stakeholders that the account suspension was outside of their control. If there was any doubt about whether users would get their money back, ANNA was prepared to “put our own money into customer’s accounts to prove how committed we are”.

This level of transparency is not so common in financial products, and you see customer reviews on Trustpilot showing appreciation for this.

Does this mean ANNA Money is perfect? It won’t be for everyone.

We have seen some users complain about delayed transfers, account limits being reduced and temporary freezes. These issues are usually related to security protocols and sometimes users who have not provided requested documentation for ANNA to verify certain information.

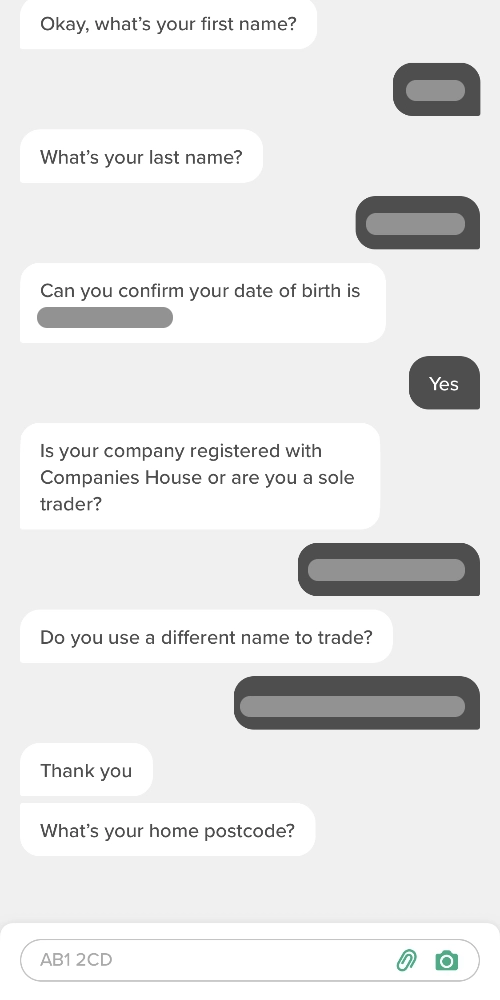

Credit: MT

Signing up in the ANNA app.

If you’re on a computer, enter your mobile number in the ‘Get started’ field on the ANNA Money home page. This will text you a link to the App Store or Google Play where you download the ANNA app.

In the app, you are asked a series of questions about your identity and business in a messaging thread, including whether you are a sole trader or limited company. You will also need to take a picture of your face and photo ID to verify your identity. Sole traders might be asked to upload a copy of a letter from HMRC showing their unique taxpayer reference.

After submitting the information, ANNA will check your details and approve your account. It took about an hour for ANNA to approve our sole trader account, after which we were free to start using it straight away.

A Mastercard is automatically ordered and delivered by post within five working days. In the meantime, you can use the virtual Debit Mastercard accessible in the app.

Our verdict

The ANNA account is ideal for the self-employed, freelancers and entrepreneurs who would appreciate the always-on, friendly support in the app. Most of the customer base are digitally-minded professionals and creatives, whether that’s a sole trader or start-up.

Brick-and-mortar shops will appreciate being able to deposit cash at participating PayPoint locations, though not cheques.

The fact that the account can only be managed through a mobile app – preferably through a messaging chat – means it is essential you are comfortable managing all your finances on a phone.

Features are centred around bookkeeping and invoicing to make life easier for those who might otherwise struggle with accounting on their own. The ANNA business account is made for simplifying your books and connecting them with your payments. In fact, ANNA is working on adding more features like payroll support, self-assessment assistance and compliance with HMRC’s Making Tax Digital requirements.

Features are centred around bookkeeping and invoicing to make life easier for those who might otherwise struggle with accounting on their own.

The recent addition of an IBAN and international payments means it is usable for cross-border business as well, but mostly on a paid plan to avoid the £5 transfer fee. If you need credit, loans or an overdraft, you won’t get that from ANNA.

| ANNA Money criteria | Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 4.5 | Good/Excellent |

| Value-added services | 3.8 | Good |

| Service and reviews | 4.8 | Excellent |

| Contract | 4.2 | Good |

| OVERALL SCORE | 4.1 | Good |

| ANNA Money criteria |

Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 4.5 | Good/Excellent |

| Value-added services | 3.8 | Good |

| Service and reviews | 4.8 | Excellent |

| Contract | 4.2 | Good |

| OVERALL SCORE | 4.1 | Good |

The main strength of ANNA is the committed support team that exceeds the performance we’ve seen with other business accounts. The less-that-10-minutes response guarantee is refreshing, because it is common to wait for ages for help from other providers. With the recent account issues beyond ANNA’s control, it is this kind of service that saves their reputation as a serious business account provider.