It’s a no-brainer for face-to-face businesses in the UK to accept cards. In fact, card payments have surpassed cash transactions, so all but a few special cases would suffer as a result of not accepting cards.

But how does one go about card acceptance?

Unless you’re choosing a payment facilitator, it will be necessary to have certain things in place streamlining the legal, efficient and secure payment processing involved in passing money from a customer’s card to your bank account.

An important role in this cycle is the ‘acquirer’ or ‘acquiring bank’ (same thing). Let’s look at where acquirers fit in with your face-to-face business.

How does acquiring work?

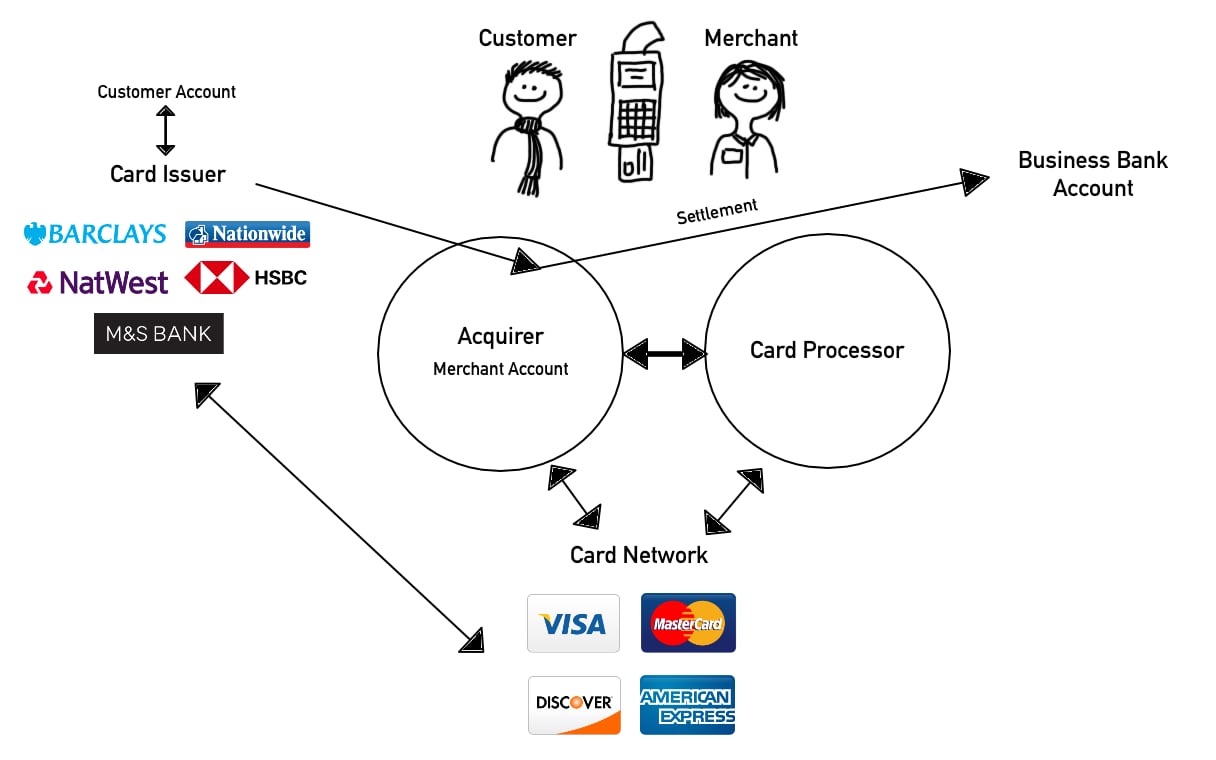

You cannot process cards without an acquirer, but you also need a processor to streamline transactions from the frontend where the customer pays, and card network/scheme membership to even accept the cards.

So where do acquirers fit in to the payment cycle? Acquiring banks provide merchants with a merchant account through which transactions are processed. The account gets a merchant identification number (MID), used to identify the merchant during transactions, similar to how bank account numbers identify where money goes.

Acquirers also have the necessary memberships in place with the different card schemes you want to accept, such as Visa and Mastercard.

Card schemes have strict rules around card acceptance, which the acquirer fulfils and passes on to the merchant. In that sense, they act as a mediator to the card schemes, and accepting new merchants therefore involves business checks to see if you fulfil those rules and security requirements yourself.

Acquirers further have the technology in place to integrate card acceptance into the payment processing system merchants use.

How the different parties interact in the card payment cycle. Image: Mobile Transaction

Then there is the business bank account, which is where the transaction money is settled after being processed through the acquirer’s merchant account (this process is referred to as ‘settlement’). Your business bank account is, in other words, separate from your merchant account.

From the payer’s side, there is the card issuer who issues the credit or debit card the customer uses. This is typically the customer’s bank, who during the payment process verifies there’s enough credit or debit to fund the transaction.

The issuer sends its authorisation to the card network who passes it on to the acquirer, after which it goes to the processor to finalise the transaction. It is after the transaction is complete that settlement can start.

How do I get an acquirer?

There’s really no easy way to choose the best acquiring solution. Understanding how card processing works is useful, but when it comes to distinguishing acquirers, there’s a lot of overlap in roles. For example, American Express acts as acquirer, processor and card network all in one, but allows other acquirers to accept Amex through a special agreement.

Acquirers may offer card machines (sometimes even POS systems), a web portal for analytics and the processing part too, any of which may be outsourced or handled internally. Rarely do you see ‘pure’ acquirers that only offer just that.

In any case, acquirers will have the technological setup in place to integrate with card machines for point of sales or a payment gateway for online sales, enabling a processor (either the acquirer is also a processor, or an external processor will take over) to process transactions through the merchant account.

It’s possible to go directly to an acquirer to apply for a new merchant account, or a merchant service provider to look for a complete payment solution where they help with the merchant account, or aggregator for an easy solution that doesn’t require setting up a merchant account. Our overview below covers all these options.

Acquirers

The following acquirers are used by UK businesses trading face to face.

Note that it’s common for acquirers today to also be a processor and offer integrated solutions like card machines and POS software. It means that lines are often blurry between acquirers and merchant service providers (more on that later). Sometimes, you can even manage entirely with the acquirer if they offer end-to-end solutions.

Below, we’ve identified who offers processing as well as card issuing and acquiring.

Another thing to consider is which cards you want to accept. All acquiring banks except for Amex accept Mastercard and Visa, but not always Diners Club, JCB, and so on. That’s because they have to have those card scheme memberships (not simple to obtain) to accept those.

We also look at which acquirers can integrate with e-commerce and mail order/telephone order (MOTO) payments and whether they offer card machines and POS solutions directly through them as well.

As regarding fees, these are harder to come by and best attained by contacting acquirers directly.

AIBMS (Allied Irish Bank Merchant Services/AIB Merchant Services)

Despite the name, AIBMS offers acquiring and processing for both Irish and British businesses for most payment channels. They offer a cloud-based POS solution called Clover (powered by First Data), consisting of a specially-designed touchscreen card machine, countertop POS screen, receipt printer, cash drawer and Clover-branded POS software. You also have the freedom to choose conventional terminals with other software and opt for e-commerce solutions.

American Express

American Express is both a card issuer and acquirer, working in a closed network separate from other card networks. It means you can only accept Amex through American Express (funnily enough) and the paperwork involved is separate from the other acquirers handling other cards you want to accept. Other acquirers can also offer Amex, but its processing is always routed through American Express via a special agreement.

Barclaycard Business

Barclays aspires to have a payment solution for any type of business. They’re not just an acquiring bank – they offer card terminals, card issuing and complete payment solutions for face-to-face, online and phone or mail order businesses.

Borgun

Borgun offers acquiring for face-to-face and e-commerce businesses. Their customers get a B-Online account, a web portal with real-time management and overview of payments, settlements and more. They also provide card machines integrated with the web portal, which you can integrate with a compatible POS system.

Credorax

Credorax specialises in cross-border e-commerce payments, but provides omnichannel “smart acquiring” and processing for European face-to-face business too. They strive to eliminate paperwork, having made merchant onboarding easy, quick and online-based. Your account application is typically completed in a matter of days rather than weeks, after which you can accept payments and access the web portal showing detailed analytics and management tools.

Elavon

Elavon is a global acquirer and processor, offering end-to-end solutions for businesses of all sizes. They offer same-day settlements and an umbrella of services customised to your needs. You can either use their own selection of EPOS software and card machines, or integrate Elavon’s card acceptance with your existing payment system.

EVO Payments

EVO Payments is a global payment processor that offers acquiring in the UK. They have integrated solutions for in-person, e-commerce, telephone and mail order businesses as well as ATMs, and offers a range of card terminals too.

First Data/Clover

First Data – or Clover, as they are also called – offers a wide range of flexible solutions to any business size or type. They created their own POS hardware and software with their Clover range, making it possible to use them as a complete end-to-end solution. Their onboarding only takes a few days, subject to your business’ approval.

Global Payments

Global Payments is an omnichannel payment provider, offering acquiring for face-to-face, online and on-the-go businesses. They specialise in international (and local) software solutions and payment technology, with a big partnership network spanning 30 countries around the world.

Lloyds Bank Cardnet

Lloyds Bank Cardnet has payment solutions to most business types, offering a straightforward pricing structure with “no hidden fees”. As both acquirer and processor, Lloyds Bank Cardnet offers complete, custom solutions to each business, including the Clover EPOS system and a range of card machines. You commit to a contract of minimum 6 months with Lloyds Bank Cardnet, and it takes 10-15 working days to set up your own merchant account with them.

Valitor

UK-based Valitor thrives on offering complete end-to-end solutions including acquiring, processing, card issuing, POS and omnichannel services to businesses of any size. They have a wide range of POS components you can use with your merchant account, including card machines and EPOS software.

Worldpay

Worldpay is the UK’s leading payment processor and acquirer. They have an extensive range of packaged solutions for all business types, whether online, remote or in person. Some of their packages can look a bit complicated, but they are trying to simplify pricing and provide end-to-end solutions including EPOS software, POS equipment and mobile payments.

Merchant service providers

Independent sales organisations (ISOs), merchant account providers or merchant service providers – different terms, same thing. These are providers that sell acquiring and card processing to merchants. In the past, acquiring banks were responsible for signing up new merchants themselves, but this job has in part shifted to merchant service providers who are better able to offer packaged solutions to merchants.

There are many of these in the UK. Our list focuses on key ISOs, classed together according to which acquirers they have partnerships with. As they are generally not that transparent, some of them may have more partnerships than what we are aware of. Again, choosing one is not simple, but if you look at acquirers above and pick one that looks ideal, you could look at the ISOs with a relationship to that acquirer.

The merchant service provider will offer prices determined in part by the fees they negotiate with the acquirer. They will also provide card machines and sometimes POS software. If you already have the POS system, you can go for one that just provides card machines.

Contracts are made directly with the ISO, so beware of the fine print (e.g. termination fees, contract length) before you go ahead with a deal, and do look around before settling on one provider.

Acquirer

Merchant service providers

- Bleep – card machines, EPOS

- Bluebird – card machines, EPOS

- Card Cutters – card machines, EPOS

- Card Saver – card machines, EPOS

- Fidelity Payment – card machines, EPOS

- Monek – card machines, EPOS

Acquirer:

- Card Cutters – card machines, EPOS

- Card Saver – card machines, EPOS

- Fidelity Payment – card machines, EPOS

- Opayo – card machines, business software

- Paymentsense – card machines

- Retail Merchant Services – card machines

- United Merchant Services – card machines

Acquirer:

Merchant service providers:

- Card Cutters – card machines, EPOS

- Card Saver – card machines, EPOS

- Fidelity Payment – card machines, EPOS

- Opayo – card machines, business software

- Paymentsense – card machines

- Retail Merchant Services – card machines

- United Merchant Services – card machines

- Bizzon – mPOS

- Monek – card machines, EPOS

- Payment+ (or PaymentPlus) – card machines

- Payzone – card machines

- Universal Transaction Processing (UTC) Merchant Services – card machines

Acquirer:

Merchant service providers:

- Bizzon – mPOS

- Monek – card machines, EPOS

- Payment+ (or PaymentPlus) – card machines

- Payzone – card machines

- Universal Transaction Processing (UTC) Merchant Services – card machines

- Glorydale Merchant Services – card machines

- Card Saver – card machines, EPOS

- Monek – card machines, EPOS

Acquirer:

Merchant service providers:

- Glorydale Merchant Services – card machines

- Card Saver – card machines, EPOS

- Monek – card machines, EPOS

- Dalenys – card machines

Acquirer:

Merchant service providers:

- Dalenys – card machines

- Active Payments – card machines

- Monek – card machines, EPOS

- Opayo – card machines, business software

- Payzone – card machines

- Retail Merchant Services – card machines

Acquirer:

Merchant service providers:

- Active Payments – card machines

- Monek – card machines, EPOS

- Opayo – card machines, business software

- Payzone – card machines

- Retail Merchant Services – card machines

- Card Cutters – card machines, EPOS

- Card Saver – card machines, EPOS

- Handepay – card machines

- Pago Payments – card machines

Acquirer:

Merchant service providers:

- Card Cutters – card machines, EPOS

- Card Saver – card machines, EPOS

- Handepay – card machines

- Pago Payments – card machines

- Active Payments – card machines

- Card Saver – card machines, EPOS

- First Payment Merchant Services – card machines, EPOS

- Monek – card machines, EPOS

- NetPay – card machines

- Paymentsense – card machines

- United Merchant Services – card machines

- Universal Transaction Processing (UTC) Merchant Services – card machines

Acquirer:

Merchant service providers:

- Active Payments – card machines

- Card Saver – card machines, EPOS

- First Payment Merchant Services – card machines, EPOS

- Monek – card machines, EPOS

- NetPay – card machines

- Paymentsense – card machines

- United Merchant Services – card machines

- Universal Transaction Processing (UTC) Merchant Services – card machines

- Annecto – card machines

- Monek – card machines, EPOS

- Retail Merchant Services – card machines

Acquirer:

Merchant service providers:

- Annecto – card machines

- Monek – card machines, EPOS

- Retail Merchant Services – card machines

- Monek – card machines, EPOS

- PayPoint – card machines, EPOS

Acquirer:

Merchant service providers:

- Monek – card machines, EPOS

- PayPoint – card machines, EPOS

- Valitor – card machines, EPOS

Acquirer:

Merchant service providers:

- Valitor – card machines, EPOS

- Payment+ (or PaymentPlus) – card machines

Acquirer:

Merchant service providers:

- Payment+ (or PaymentPlus) – card machines

- Handepay – card machines

- Monek – card machines, EPOS

Acquirer:

Merchant service providers:

- Handepay – card machines

- Monek – card machines, EPOS

Unknown acquirers

- CutPay – card machines, EPOS

- Wireless Terminal Solutions – card machines, EPOS

- XLN – card machines

Unknown acquirers

- CutPay – card machines, EPOS

- Wireless Terminal Solutions – card machines, EPOS

- XLN – card machines

Aggregators

Payment aggregators – also called payment facilitators – offer a different point of entry into card acceptance. Instead of being allocated an individual merchant ID and merchant account, an aggregator uses one “master merchant ID” for all the businesses taking card payments through them.

The aggregator works with one or more acquirers without the need for the merchant to deal with the acquirer directly.

Such a system removes the hassle for merchants to set up contracts and a merchant account, as the aggregator will handle all that for you. However, once you are taking over £100,000 a year, card networks will require you to have an MID, and the contract between you and the aggregator would need to change.

Below the £100k annual revenue, choosing an aggregator can be the most cost-effective way to accept card, although fees and conditions vary between providers.

Aggregators currently available in the UK:

Acquirers: Bambora, Elavon

Acquirer: First Data

Acquirer: First Data

How to proceed

So what’s the best way to proceed from here? You can start by asking yourself what you need in your business. Do you want the lowest fees? Best customer support? Flexibility? Simplicity? Expertise? A need for different sales channels such as e-commerce? A combination of things?

The things you prioritise here should be the focus when you sift through the options. Then consider which type of provider is best for you:

Acquirer and ISO costs can be hard to compare, as most of them encourage you to contact them about this. This is partly because fees depends on your turnover, business area and complex fee structures – so do pick some providers and approach them individually with your questions.

You’ll also need to consider PCI-DSS compliance costs, which each provider will have recommendations for.

If you’re a small business who want to start easy, choosing an aggregator is often best.